Jonathan Goodman has been the CEO of Dundee Corporation (TSE:DC.A) since 2018, and this article will examine the executive's compensation with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for Dundee

How Does Total Compensation For Jonathan Goodman Compare With Other Companies In The Industry?

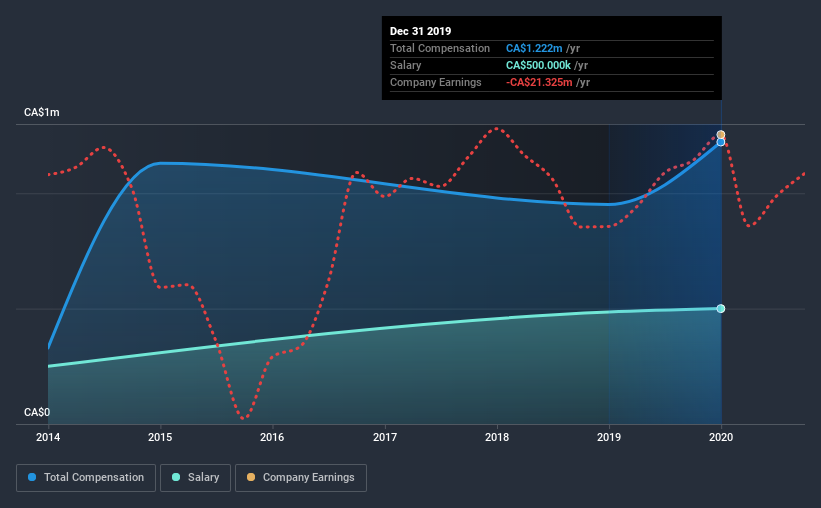

According to our data, Dundee Corporation has a market capitalization of CA$144m, and paid its CEO total annual compensation worth CA$1.2m over the year to December 2019. Notably, that's an increase of 28% over the year before. While we always look at total compensation first, our analysis shows that the salary component is less, at CA$500k.

On comparing similar-sized companies in the industry with market capitalizations below CA$257m, we found that the median total CEO compensation was CA$258k. This suggests that Jonathan Goodman is paid more than the median for the industry. What's more, Jonathan Goodman holds CA$3.3m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$500k | CA$485k | 41% |

| Other | CA$722k | CA$467k | 59% |

| Total Compensation | CA$1.2m | CA$951k | 100% |

Speaking on an industry level, nearly 46% of total compensation represents salary, while the remainder of 54% is other remuneration. In Dundee's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Dundee Corporation's Growth

Dundee Corporation's earnings per share (EPS) grew 3.6% per year over the last three years. Its revenue is down 14% over the previous year.

We generally like to see a little revenue growth, but it is good to see a modest EPS growth at least. It's hard to reach a conclusion about business performance right now. This may be one to watch. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Dundee Corporation Been A Good Investment?

With a three year total loss of 43% for the shareholders, Dundee Corporation would certainly have some dissatisfied shareholders. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

As previously discussed, Jonathan is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Over the last three years, shareholder returns have been downright disappointing for Dundee, and although EPS growth is steady, it hasn't set the world on fire. And the situation doesn't look all that good when you see Jonathan is remunerated higher than the industry average. With such poor returns, we would understand if shareholders had concerns related to the CEO's pay.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Dundee that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Dundee or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:DC.A

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives