- Canada

- /

- Retail REITs

- /

- TSX:CRT.UN

CT Real Estate Investment Trust (TSX:CRT.UN): Assessing Valuation After Strong Q3 and Nine-Month Financial Results

Reviewed by Simply Wall St

CT Real Estate Investment Trust (TSX:CRT.UN) caught investors’ attention this week after announcing higher sales and net income for the third quarter and nine months ended September 30, 2025. This signals solid operational momentum.

See our latest analysis for CT Real Estate Investment Trust.

CT Real Estate Investment Trust’s consistent operational growth and recent earnings beat have kept it on investors’ radar, even as management presented at a major real estate forum in Calgary late last month. The share price has climbed over 10% year-to-date, and the trust’s total shareholder return clocks in at an impressive 45% over five years. This highlights momentum that has been sustained rather than faded lately.

If CT REIT’s performance has sparked your curiosity, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

But with the share price up and analyst targets rising, is there still hidden value in CT REIT for new investors? Or has the market already accounted for the trust’s growth and future gains?

Price-to-Earnings of 17.9x: Is it justified?

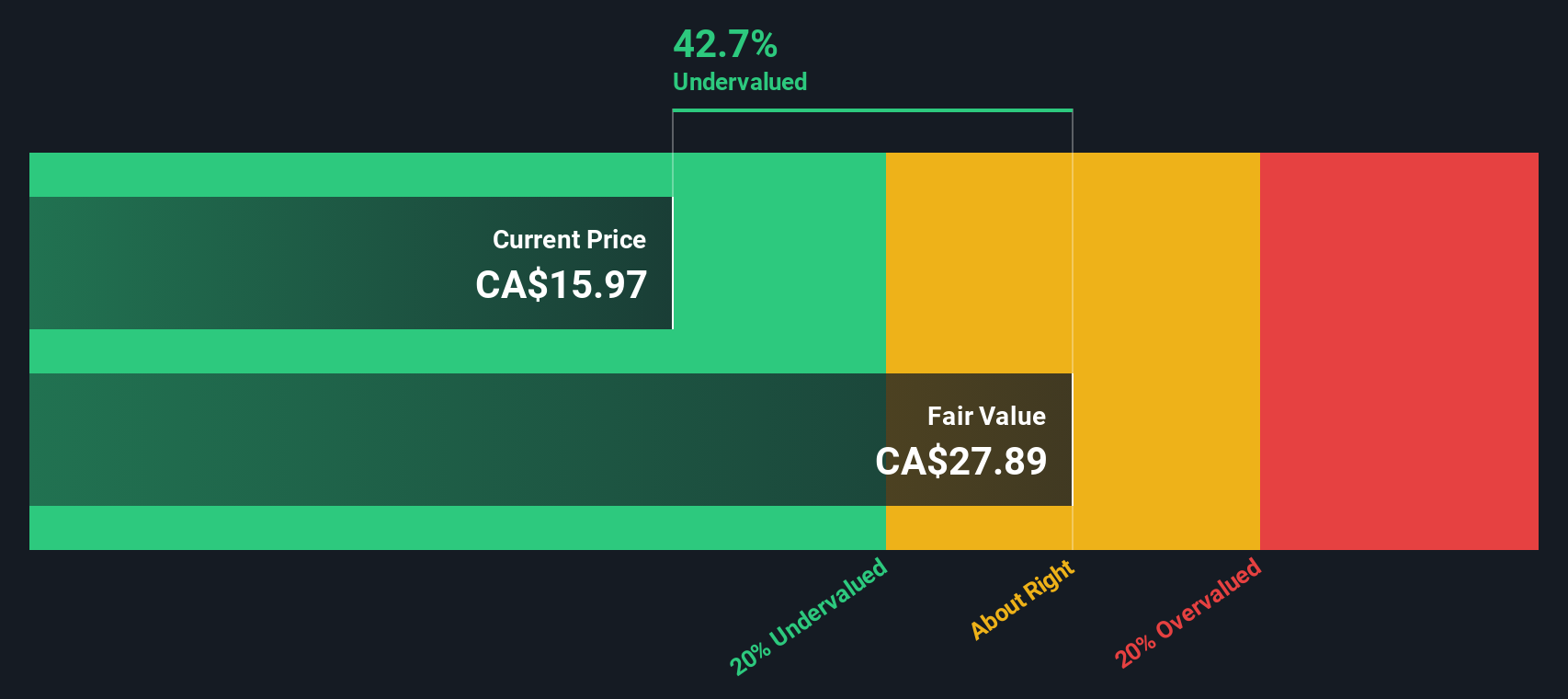

CT Real Estate Investment Trust is trading at a price-to-earnings (P/E) ratio of 17.9x, notably below both its peer group and the broader industry, despite recent strong share price gains. At CA$15.97, the stock appears undervalued on this metric versus direct competitors.

The price-to-earnings ratio measures how much investors are willing to pay per dollar of earnings. For real estate investment trusts, this ratio helps signal if the market expects steady growth or sees future challenges.

In CRT.UN's case, the current P/E is well below the peer average of 33.2x and the North American Retail REITs average of 24.7x. This suggests the market could be underestimating the trust’s ability to continue generating profits, given its track record of reliable earnings growth and recent profit acceleration.

While the market may eventually reprice the stock closer to the peer or industry multiples, investors should consider whether movements toward these higher levels are justified as CRT.UN maintains its consistent growth and dividend record.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 17.9x (UNDERVALUED)

However, continued sector volatility and slowing revenue growth could present headwinds for CT REIT, which may impact its future valuation and returns.

Find out about the key risks to this CT Real Estate Investment Trust narrative.

Another View: Is the Discount Deeper Than It Appears?

Looking at CT REIT from another angle, our DCF model estimates a fair value of CA$27.55, which is well above today’s price of CA$15.97. This could signal an even greater undervaluation than price-to-earnings suggests if the underlying cash flows are correct. However, how reliable is this estimate for the current market?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CT Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CT Real Estate Investment Trust Narrative

If you want to check the numbers yourself or form your own perspective, you can build a personalized view in just a few minutes with Do it your way.

A great starting point for your CT Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take control of your investment journey and uncover hidden gems with screeners that spotlight growth, value, and future trends you don’t want to miss.

- Boost your long-term income by reviewing these 16 dividend stocks with yields > 3%, which is packed with stocks offering yields above 3% and a track record of financial strength.

- Get ahead of big breakthroughs by tapping into these 25 AI penny stocks, a tool for spotting companies making waves in artificial intelligence and next-generation automation.

- Spot stocks trading below their true worth with these 874 undervalued stocks based on cash flows to find undervalued opportunities before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRT.UN

CT Real Estate Investment Trust

CT REIT is an unincorporated, closed-end real estate investment trust established on July 15, 2013 pursuant to a declaration of trust as amended and restated as of October 22, 2013 and as further amended and restated as of April 5, 2020 and as may be further amended from time to time ("Declaration of Trust").

6 star dividend payer and good value.

Market Insights

Community Narratives