- Canada

- /

- Retail REITs

- /

- TSX:CRR.UN

Sustainable Montreal Development Anchored by IGA Could Be a Game Changer for Crombie REIT (TSX:CRR.UN)

Reviewed by Simply Wall St

- Harden, in partnership with Crombie Real Estate Investment Trust, recently celebrated the official ground-breaking of the Faubourg Contrecoeur commercial development in Montreal, a project featuring over 52,000 square feet of leasable space and a $30 million investment anchored by a forthcoming IGA extra supermarket.

- This initiative stands out for its integration of sustainable features, such as solar-powered roofs and green spaces, alongside broadening retail options for the expanding local community.

- We'll now explore how the project's sustainable design and new anchor tenant shape Crombie's investment narrative going forward.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Crombie Real Estate Investment Trust's Investment Narrative?

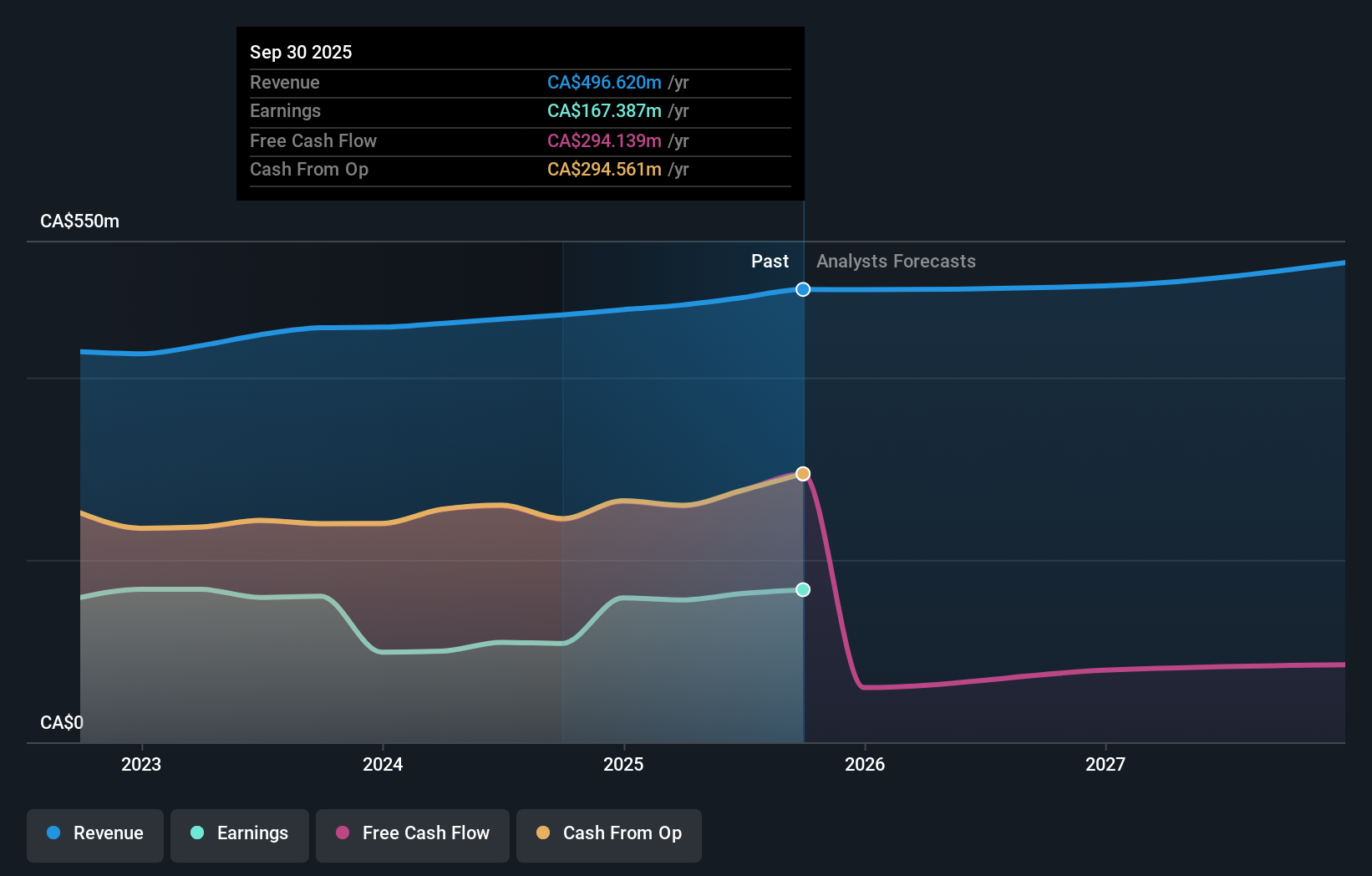

To be a shareholder in Crombie Real Estate Investment Trust, you need conviction in the power of resilient retail, stable income, and thoughtful expansion even as the REIT sector contends with modest growth expectations and management transitions. The recent Faubourg Contrecoeur ground-breaking signals Crombie’s continued focus on long-term value by backing sustainable, community-driven developments and high-traffic anchors like IGA extra. Although this project does not immediately tilt the needle for short-term catalysts, its impact unfolds further out, the news could meaningfully strengthen Crombie's narrative around future cash flows, urban relevance, and retail tenant diversity. Investors must still weigh risks including Crombie's relatively inexperienced leadership, uneven board tenure, modest revenue growth forecasts, and reliance on one-off gains to support recent financial results. The Faubourg project adds strategic promise, though patience and risk-awareness remain essential for shareholders watching for near-term outcomes. On the other hand, board-level turnover could bring challenges investors should not overlook.

Crombie Real Estate Investment Trust's shares have been on the rise but are still potentially undervalued by 34%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Crombie Real Estate Investment Trust - why the stock might be worth as much as 7% more than the current price!

Build Your Own Crombie Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Crombie Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Crombie Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Crombie Real Estate Investment Trust's overall financial health at a glance.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 28 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 23 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CRR.UN

Crombie Real Estate Investment Trust

Crombie invests in real estate with a vision of enriching communities together by building spaces and value today that leave a positive impact on tomorrow.

6 star dividend payer with proven track record.

Market Insights

Community Narratives