- Canada

- /

- Retail REITs

- /

- TSX:CHP.UN

The Bull Case For Choice Properties (TSX:CHP.UN) Could Change Following Return to Profitability in Q3

Reviewed by Sasha Jovanovic

- On November 5, 2025, Choice Properties Real Estate Investment Trust reported third quarter results, highlighting sales of C$362.49 million and a net income of C$242.65 million, reversing a net loss from the previous year.

- The turnaround to profitability in the recent quarter is a significant shift after the very large net loss experienced a year earlier.

- We'll explore how returning to profitability in the third quarter helps shape Choice Properties REIT's broader investment narrative.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Choice Properties Real Estate Investment Trust's Investment Narrative?

To own a piece of Choice Properties REIT, you have to believe in the enduring value of its real estate portfolio, the stability of its income from long-term leases, and management’s ongoing efforts to balance growth with prudent finances. The recent return to profitability in the third quarter, after last year’s very large net loss, shifts the short-term focus toward whether this positive momentum can be sustained given ongoing debt costs and the effects of one-off gains on reported earnings. This earnings surprise may temper the previous risk narrative that fixated on weak interest coverage and persistent losses, possibly elevating catalysts like future asset redevelopments or increased leasing activity as more meaningful near-term drivers. However, potential challenges remain, especially if underlying operating performance does not match the headline profit improvement, so investors will need to look closely at the quality and sources of earnings as these numbers begin to flow through refreshed analysis and market expectations. But beneath these improved numbers, cost pressures and past debt decisions may tell a different story for investors.

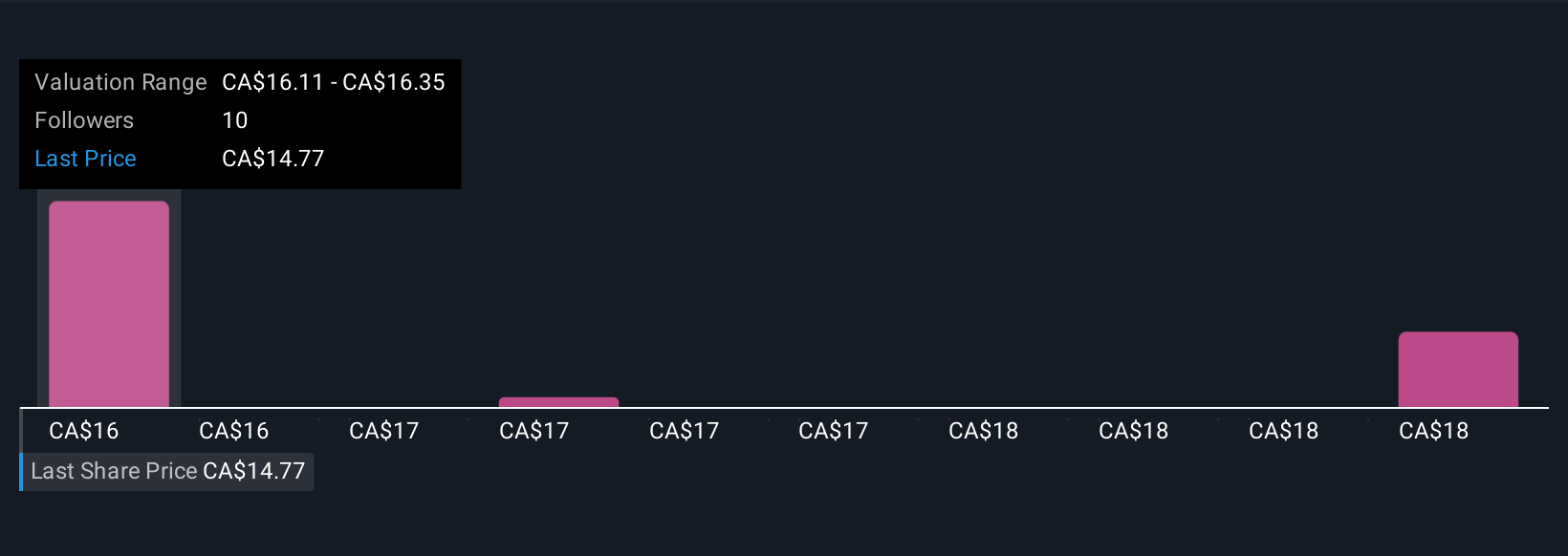

Despite retreating, Choice Properties Real Estate Investment Trust's shares might still be trading 20% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 3 other fair value estimates on Choice Properties Real Estate Investment Trust - why the stock might be worth as much as 26% more than the current price!

Build Your Own Choice Properties Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Choice Properties Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Choice Properties Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Choice Properties Real Estate Investment Trust's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CHP.UN

Choice Properties Real Estate Investment Trust

Choice Properties is a leading Real Estate Investment Trust that creates enduring value through places where people thrive.

Established dividend payer and good value.

Market Insights

Community Narratives