Global's Top Undervalued Small Caps With Insider Buys In November 2025

Reviewed by Simply Wall St

As global markets navigate the aftermath of the longest U.S. government shutdown in history, small-cap stocks have faced headwinds, with the Russell 2000 Index dropping 1.83% amid concerns over elevated valuations and interest rate sensitivities. Despite these challenges, opportunities may arise for investors who focus on identifying companies with strong fundamentals and insider confidence, particularly in sectors poised to benefit from current economic conditions and market shifts.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Eurocell | 16.1x | 0.3x | 41.20% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 26.73% | ★★★★★☆ |

| Morguard North American Residential Real Estate Investment Trust | 4.8x | 1.7x | 28.54% | ★★★★★☆ |

| Senior | 24.0x | 0.8x | 28.25% | ★★★★★☆ |

| Hung Hing Printing Group | NA | 0.4x | 44.01% | ★★★★☆☆ |

| GDI Integrated Facility Services | 15.7x | 0.3x | -10.39% | ★★★★☆☆ |

| Coveo Solutions | NA | 2.8x | 13.44% | ★★★★☆☆ |

| Ever Sunshine Services Group | 6.8x | 0.4x | -447.75% | ★★★☆☆☆ |

| PSC | 9.9x | 0.4x | 19.49% | ★★★☆☆☆ |

| Chinasoft International | 24.2x | 0.7x | -1310.11% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

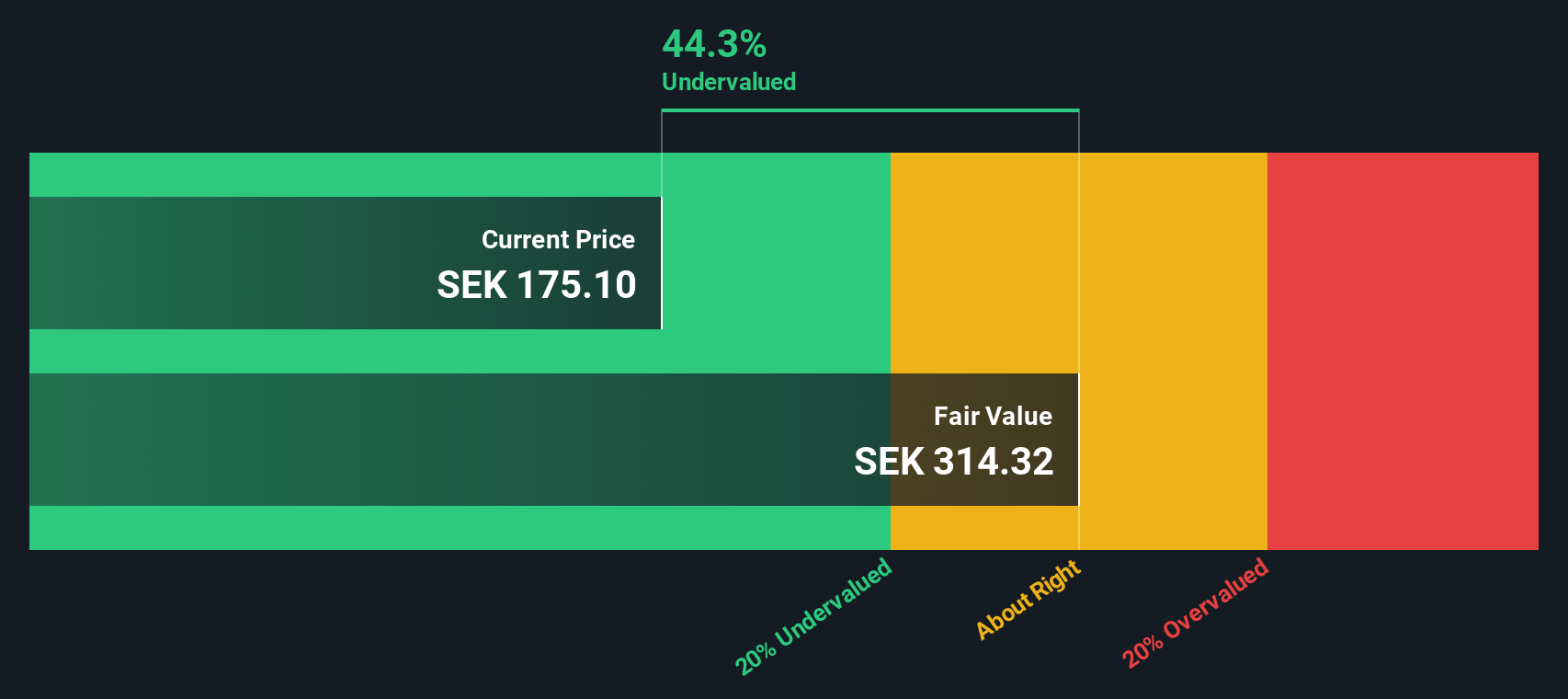

Hemnet Group (OM:HEM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hemnet Group operates as a leading online real estate platform in Sweden, providing digital services for property listings and information, with a market capitalization of approximately SEK 11.81 billion.

Operations: Hemnet Group generates its revenue primarily from internet information services, with the latest reported revenue at SEK 1.54 billion. The company achieved a gross profit margin of 86.96% as of September 2025, indicating efficient management of production costs relative to sales. Operating expenses, including significant general and administrative costs, impact overall profitability but are managed alongside non-operating expenses to support net income growth over time.

PE: 30.9x

Hemnet Group, a player in the real estate sector, shows potential for growth with forecasted earnings expected to rise by 22.01% annually. Despite relying on higher-risk external borrowing for funding, insider confidence is evident as Anders Nilsson acquired 5,000 shares valued at approximately SEK 1.16 million in October 2025. The company completed a share buyback of 812,500 shares worth SEK 223.2 million by September end. Recent earnings reveal stable performance with nine-month revenue reaching SEK 1.18 billion compared to last year's SEK 1.03 billion and net income increasing to SEK 420 million from SEK 362 million previously, indicating resilience amidst market fluctuations.

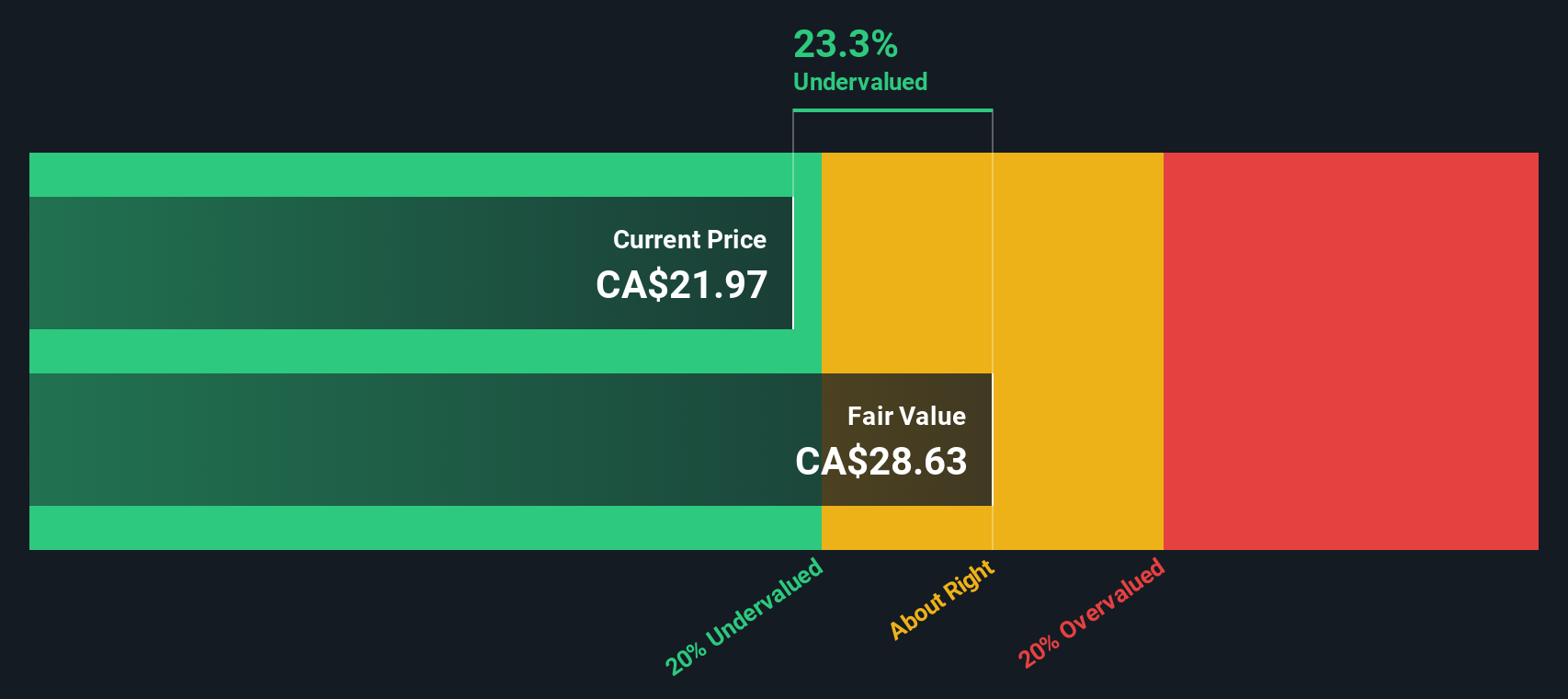

Allied Properties Real Estate Investment Trust (TSX:AP.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Allied Properties Real Estate Investment Trust is a Canadian company focused on owning, managing, and developing urban office environments with operations primarily in Toronto & Kitchener, Montréal & Ottawa, Vancouver, and Calgary & Edmonton.

Operations: The company generates revenue primarily from its properties in Toronto & Kitchener and Montréal & Ottawa, with these regions contributing significantly to its total income. Over recent periods, the gross profit margin has shown a declining trend, reaching 49.05% in the latest quarter. The company incurs operating expenses and significant non-operating expenses that impact net income margins, which have turned negative recently.

PE: -3.2x

Allied Properties Real Estate Investment Trust, a Canadian company with a significant presence in Toronto's King West Village, has recently announced leasing updates and dividend affirmations. They secured a lease for 124,235 square feet at The Well until 2037, reducing available sublease space to 10%. Despite reporting a net loss of CAD 113.39 million in Q3 2025 and relying on higher risk external borrowing for funding, insider confidence remains evident through share purchases. Their recent acquisition of full interest in Vancouver's Main Alley Campus reflects strategic growth initiatives.

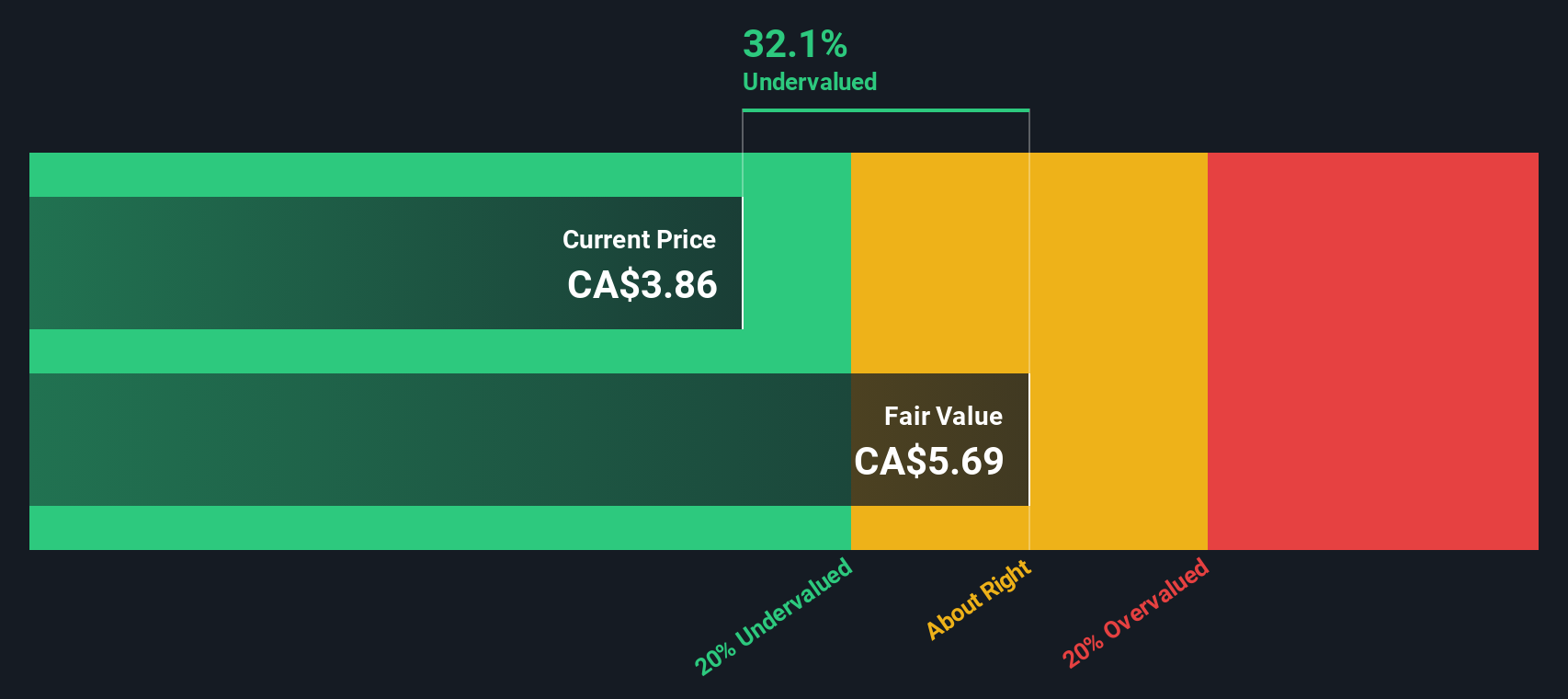

BTB Real Estate Investment Trust (TSX:BTB.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BTB Real Estate Investment Trust focuses on owning and managing a diversified portfolio of industrial, suburban office, and necessity-based retail properties, with a market capitalization of CA$0.16 billion.

Operations: BTB Real Estate Investment Trust generates revenue primarily from its suburban office, industrial, and necessity-based retail segments. Over recent periods, the company has experienced a gross profit margin ranging between 53.12% to 59.35%. The most recent gross profit margin stands at 58.17%, reflecting its ability to manage costs effectively relative to revenue growth. Operating expenses have been consistently above CA$9 million in the latest quarters, impacting net income margins which have fluctuated between approximately 16.73% and 32.31%.

PE: 8.3x

BTB Real Estate Investment Trust, a smaller player in the real estate sector, has shown promising financial performance with net income rising to C$9.5 million for Q3 2025 from C$5.47 million a year earlier. Despite relying solely on external borrowing for funding, insider confidence is evident as insiders have been purchasing shares recently. Consistent monthly dividends of C$0.025 per share further enhance its appeal to investors seeking stable returns, while recent earnings growth highlights potential value opportunities within this stock category.

Next Steps

- Click through to start exploring the rest of the 125 Undervalued Global Small Caps With Insider Buying now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BTB Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BTB.UN

BTB Real Estate Investment Trust

BTB is a real estate investment trust listed on the Toronto Stock Exchange.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives