- Canada

- /

- Residential REITs

- /

- TSX:BEI.UN

Boardwalk REIT (TSX:BEI.UN) Profit Margin Decline Raises Sustainability Concerns Despite One-Off Gain

Reviewed by Simply Wall St

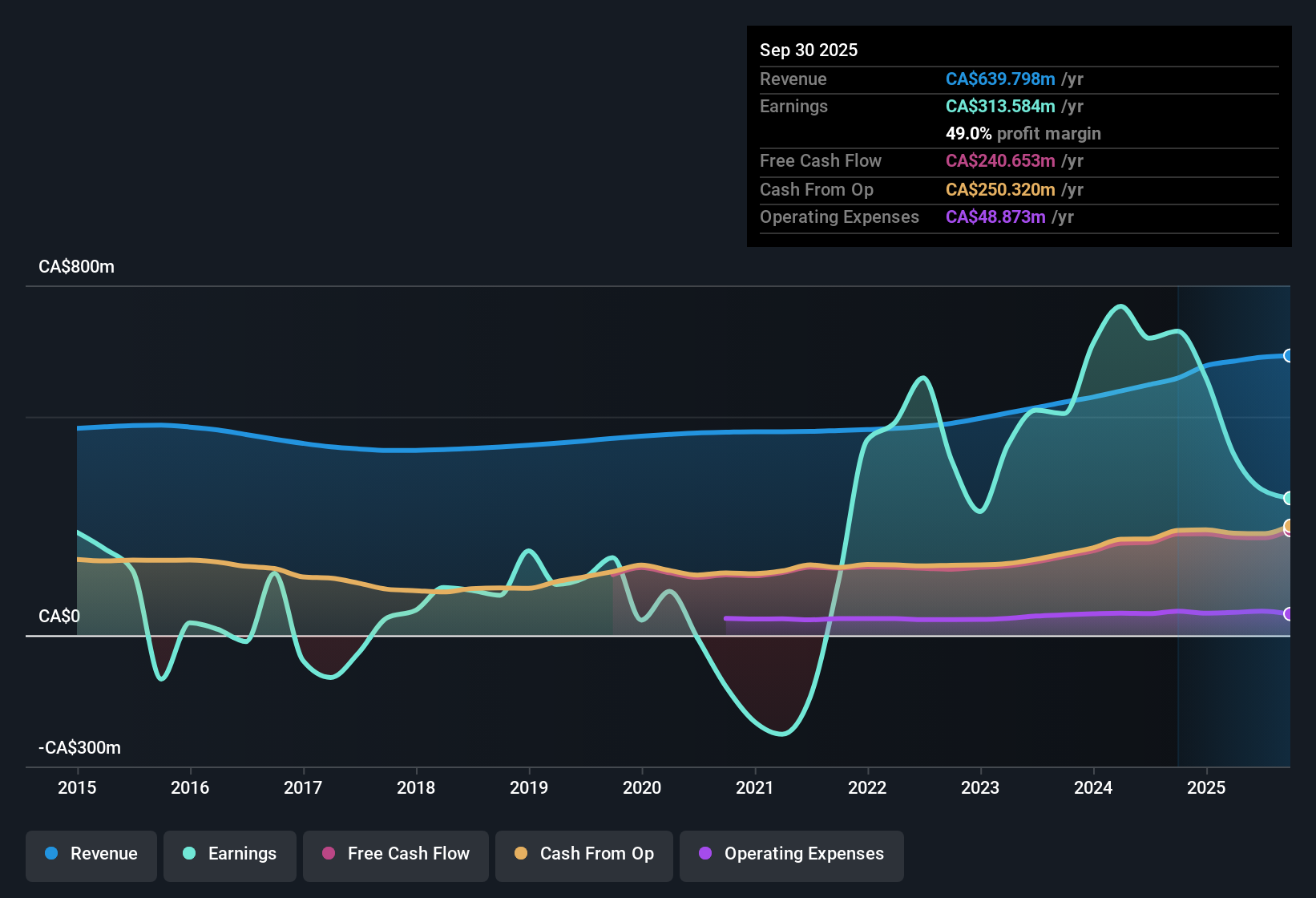

Boardwalk Real Estate Investment Trust (TSX:BEI.UN) reported revenue growth forecasted at 4.4% per year, trailing the Canadian market average of 5.1% per year. Net profit margins now stand at 52.1%, a drop from the previous year, with the most recent results reflecting a sizable one-off gain of CA$96.8 million that clouds direct comparisons. While earnings have climbed by an average of 36.5% per year over the past five years, investors will want to look past headline numbers due to one-off impacts and recent margin compression.

See our full analysis for Boardwalk Real Estate Investment Trust.The next section examines how these reported results compare with the dominant narratives around Boardwalk. Some expectations are likely supported, while others will need a closer look.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Slide to 52.1% Despite One-Off Boost

- Net profit margins are now 52.1%, a noticeable drop from last year even though the latest period includes a one-off gain of CA$96.8 million. Without this gain, margins would have been even lower.

- While the recent gain inflates the headline figure, the prevailing market analysis notes that operational fundamentals such as strong occupancy and rent collection rates continue to support cash flows. However, downside risks remain:

- Sector-wide demand for rentals continues to cushion against margin pressure, which is reflected in the sustained profitability rate over the past five years.

- Concerns about further margin declines persist as higher borrowing costs continue to impact the broader real estate sector.

Share Price at CA$64.16 Well Below Peers' Valuations

- Boardwalk trades at a Price-to-Earnings multiple of 9.5x, compared to its peer group average of 22.2x and a broader sector average of 27.3x. This places the current share price of CA$64.16 at a significant discount relative to analyst estimates and comparable REITs.

- The prevailing market perspective indicates that such a low valuation supports the view that Boardwalk is attractively priced at present:

- The share price is well below the DCF fair value of CA$96.25, suggesting potential upside for patient investors.

- This discount suggests that investors may be overlooking Boardwalk’s operational stability and relative resilience, in addition to sector pressures.

Dividend and Earnings Quality Face Sustainability Questions

- With a notable one-off gain of CA$96.8 million affecting recent figures, investors are scrutinizing whether Boardwalk can maintain its current dividend and earnings run rate if core profitability trends continue down.

- Critics note that, despite headline profitability, recent margin compression and reliance on a non-recurring gain raise valid concerns about underlying sustainability:

- If margin trends do not reverse and further one-off gains do not occur, payout ratios and future dividend reliability could come under pressure.

- Recent performance should be considered alongside broader industry risks such as higher interest expenses, which may reduce future income growth.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Boardwalk Real Estate Investment Trust's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite operational strengths, Boardwalk’s profit margins are slipping and recent earnings were heavily boosted by a one-off gain. This raises concerns about sustainable dividend payouts.

If you’re looking for more dependable income potential, check out these 1980 dividend stocks with yields > 3% that highlights companies delivering reliable dividends with stronger underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boardwalk Real Estate Investment Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BEI.UN

Boardwalk Real Estate Investment Trust

Boardwalk REIT strives to be Canada's friendliest community provider and the first choice in multi-family communities to work, invest, and call home with our Boardwalk Family Forever.

Undervalued with moderate risk.

Market Insights

Community Narratives