- Canada

- /

- Office REITs

- /

- TSX:AP.UN

Will Allied Properties REIT’s (TSX:AP.UN) Major Lease at The Well Redefine Its Competitive Edge?

Reviewed by Sasha Jovanovic

- Allied Properties Real Estate Investment Trust and RioCan recently announced a major office leasing update for The Well in Toronto, with a Canadian company securing a long-term lease for over 124,000 square feet and exclusive rooftop signage rights at 460 Front Street West.

- This significant transaction, accompanied by a marked reduction in available sublease office space to just 10%, highlights heightened demand and renewed momentum in Allied's core office portfolio.

- We'll explore how the strengthening office leasing activity at The Well shapes Allied Properties REIT's investment narrative.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Allied Properties Real Estate Investment Trust's Investment Narrative?

To believe in Allied Properties REIT as a shareholder right now, you need conviction in a long-term rebound of demand for quality urban office and mixed-use properties, especially in core Toronto markets. The new lease at The Well is a positive sign, with over 124,000 square feet taken and sublease availability falling to 10%, suggesting renewed tenant interest. This could help offset earlier risk concerns about soft office leasing, potentially boosting short-term sentiment and reducing headline vacancy risks. However, Allied remains unprofitable with growing net losses, an uncovered high dividend, and a share price well below analyst targets. The business still faces industry-wide pressures including slow revenue growth, high debt costs, and a weak recent return profile. The recent news brings a catalyst, but key financial risks remain and may only be partially mitigated in the near term. Still, coverage of the dividend from cash flows remains an issue every investor should weigh.

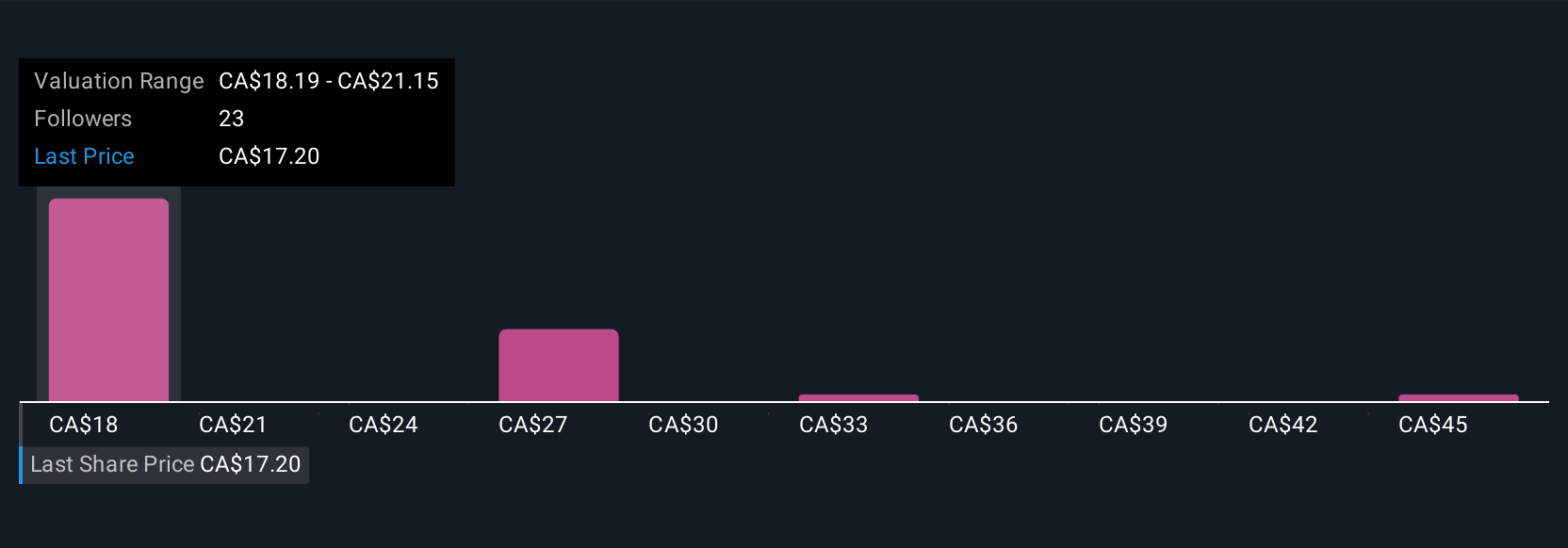

Despite retreating, Allied Properties Real Estate Investment Trust's shares might still be trading 45% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 10 other fair value estimates on Allied Properties Real Estate Investment Trust - why the stock might be worth over 3x more than the current price!

Build Your Own Allied Properties Real Estate Investment Trust Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Allied Properties Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Allied Properties Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Allied Properties Real Estate Investment Trust's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AP.UN

Allied Properties Real Estate Investment Trust

Allied is a leading owner-operator of distinctive urban workspace in Canada’s major cities.

Established dividend payer with reasonable growth potential.

Market Insights

Community Narratives