- Canada

- /

- Office REITs

- /

- TSX:AP.UN

Allied Properties REIT (TSX:AP.UN): Examining Valuation After Major Office Leasing Win at The Well

Reviewed by Simply Wall St

Allied Properties Real Estate Investment Trust (TSX:AP.UN) just announced a major office leasing deal at The Well in Toronto, securing over 124,000 square feet and reducing sublease availability to 10%. This move highlights demand for quality downtown workspace.

See our latest analysis for Allied Properties Real Estate Investment Trust.

The latest leasing win provides Allied a bright spot, but momentum has been challenging. Despite strong downtown demand, the share price has seen a 31% slide this past month. The total shareholder return is down over 22% in the past year and nearly 54% lower over five years. Investors are watching to see if confidence returns as Allied deepens its roots in Toronto’s office landscape.

If this deal caught your attention, it could be a great time to broaden your search and discover fast growing stocks with high insider ownership

With shares trading at a significant discount to analyst targets and the stock down sharply in recent months, is Allied Properties REIT an undervalued play ready for recovery? Or is the market right to be cautious about its future growth?

Price-to-Sales Ratio of 2.9x: Is it justified?

Allied Properties REIT trades at a price-to-sales ratio of 2.9x, standing out above both its peer group and the North American Office REIT industry. The last close price was CA$12.64, which reflects investors’ willingness to pay a premium relative to sales revenues in this sector.

The price-to-sales ratio measures how much investors are paying for each dollar of revenue generated. For property companies, this can suggest whether the market expects robust revenue streams or harbors skepticism about sustained performance due to sector headwinds or company-specific risks.

AP.UN’s multiple is high. The North American Office REITs average is just 2.1x, and the peer group average is even lower at 1.4x. Compared to the estimated fair price-to-sales ratio of 2.7x, Allied still looks expensive. This could imply the share price may need to adjust to reach equilibrium, especially if expectations around profitability do not materialize.

Explore the SWS fair ratio for Allied Properties Real Estate Investment Trust

Result: Price-to-Sales Ratio of 2.9x (OVERVALUED)

However, Allied’s steep net losses and ongoing share price weakness remain key risks that could undermine hopes for a swift recovery.

Find out about the key risks to this Allied Properties Real Estate Investment Trust narrative.

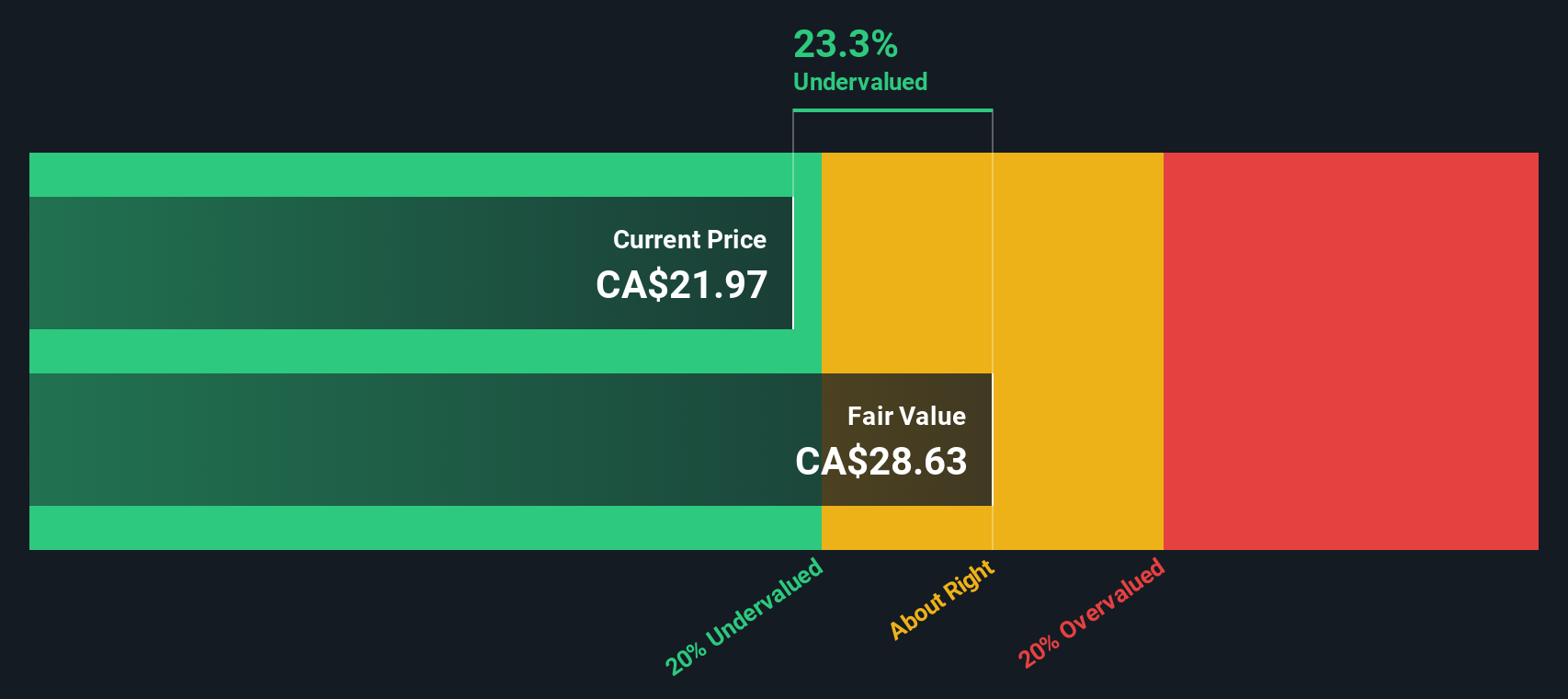

Another View: Discounted Cash Flow Points to Undervaluation

While the price-to-sales ratio suggests Allied Properties REIT is expensive relative to its industry and peers, our DCF model offers a strikingly different perspective. According to this approach, the shares trade about 45% below their estimated fair value. Could the market be offering a recovery opportunity, or is caution still warranted?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Allied Properties Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 924 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Allied Properties Real Estate Investment Trust Narrative

If you want a different perspective or simply prefer hands-on research, you can easily craft your own take in just a few minutes. Do it your way

A great starting point for your Allied Properties Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let fresh opportunities get away. Use the Simply Wall Street Screener to uncover hidden gems and turbocharge your investing strategy today.

- Supercharge your growth strategy by reviewing these 924 undervalued stocks based on cash flows that are trading below their intrinsic value and may be positioned for potential upside.

- Benefit from consistent income potential by checking out these 16 dividend stocks with yields > 3% that offer robust yields above 3% in various sectors.

- Advance your portfolio with these 25 AI penny stocks that are driving breakthroughs in artificial intelligence and shaping tomorrow’s technology landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AP.UN

Allied Properties Real Estate Investment Trust

Allied is a leading owner-operator of distinctive urban workspace in Canada’s major cities.

Established dividend payer with reasonable growth potential.

Market Insights

Community Narratives