- Canada

- /

- Real Estate

- /

- TSX:SVI

StorageVault Canada (TSX:SVI): Assessing Valuation Following New Hybrid Debenture Offering

Reviewed by Simply Wall St

StorageVault Canada (TSX:SVI) has launched a CAD 50 million fixed-income offering with 5.60% senior subordinated unsecured hybrid debentures due at the end of 2030. This financing move could influence both its capital structure and liquidity strategy.

See our latest analysis for StorageVault Canada.

Fresh off announcing its new CAD 50 million debenture offering, StorageVault Canada has notched a nearly 20% year-to-date share price return. Momentum is clearly building as investors weigh growth opportunities against balance sheet moves. Over the longer run, its 1-year total shareholder return stands at 18.8%. However, the three-year total return still lags, reminding long-term holders to track both market sentiment and fundamentals.

If the latest financing piqued your interest, it could be the right time to broaden your investing search and discover fast growing stocks with high insider ownership

With shares trading at a notable discount to some analyst targets and the company delivering steady annual revenue growth, investors must ask whether StorageVault Canada is undervalued or if the current price already takes future expansion prospects into account.

Price-to-Sales of 5.3x: Is it justified?

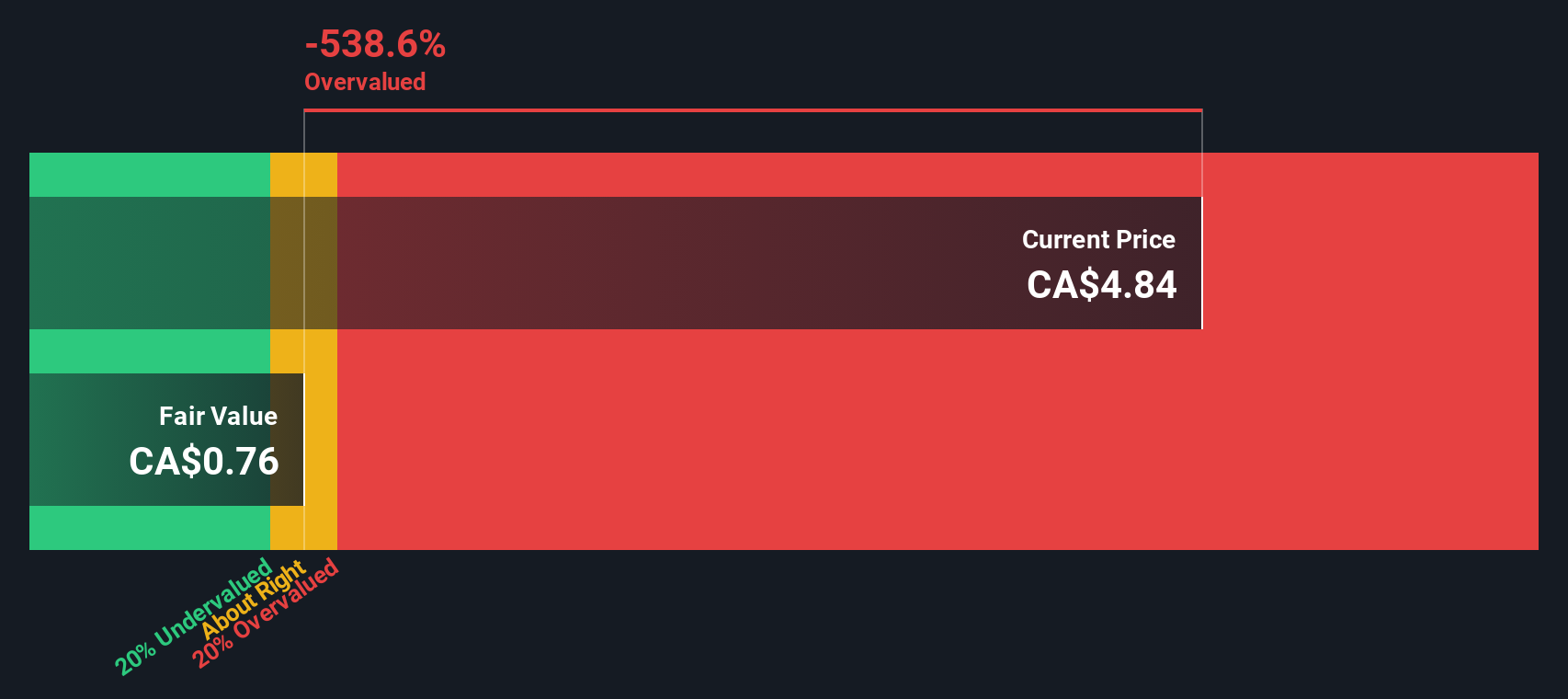

With StorageVault Canada trading at a price-to-sales ratio of 5.3x, the stock sits well above its Canadian real estate peers as well as its estimated fair value ratio. At CA$4.75 per share, investors are clearly paying a premium. This raises the question of whether this valuation can be supported by business fundamentals going forward.

The price-to-sales ratio tells us how much investors are willing to pay for each dollar of revenue and is widely used for companies with inconsistent or negative earnings. A higher ratio usually implies confidence in future growth or unique competitive strengths, but it can also signal over-optimism if underlying performance does not justify the premium. For StorageVault Canada, the current P/S far outpaces the industry average, suggesting the market is expecting above-average expansion or profitability over time.

Compared to the Canadian real estate industry's average price-to-sales ratio of 2.6x and a regression-based fair price-to-sales ratio of 4.1x, StorageVault Canada’s 5.3x is markedly higher. This valuation gap puts pressure on performance to beat not just market but also sector benchmarks if the premium is to be sustained.

Explore the SWS fair ratio for StorageVault Canada

Result: Price-to-Sales of 5.3x (OVERVALUED)

However, persistent negative net income and lagging multi-year returns could dampen momentum if revenue growth alone does not drive sustainable profitability.

Find out about the key risks to this StorageVault Canada narrative.

Another View: The SWS DCF Model

Turning to our DCF model, StorageVault Canada looks even more stretched. The SWS DCF model places fair value near CA$0.75, while the stock trades above CA$4.75. This signals substantial downside risk if the market changes its growth assumptions or if sentiment shifts. Which valuation best defines reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StorageVault Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StorageVault Canada Narrative

If you view these figures differently or want to dig into the numbers on your own, you can quickly build a custom narrative in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding StorageVault Canada.

Looking for more investment ideas?

Set yourself up for smarter investing. Don’t limit your options; there are exciting sectors and opportunities waiting for you right now on Simply Wall Street’s screeners.

- Capitalize on fast-growing trends by jumping into these 26 AI penny stocks, powered by artificial intelligence and automation breakthroughs.

- Boost your portfolio’s income potential as you tap into these 16 dividend stocks with yields > 3%, packed with strong yields and stable payers.

- Take the lead on disruptive technologies with these 26 quantum computing stocks, spearheading innovation in tomorrow’s computing power.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVI

StorageVault Canada

Owns, manages, and rents self-storage and portable storage space to individual and commercial customers in Canada.

Mediocre balance sheet and overvalued.

Market Insights

Community Narratives