- Canada

- /

- Real Estate

- /

- TSX:SVI

StorageVault Canada (TSX:SVI): Assessing Valuation After Q3 Profit Turnaround and Revenue Growth

Reviewed by Simply Wall St

StorageVault Canada (TSX:SVI) just posted third quarter results that show a clear turnaround. Revenue is up from last year, and net income has swung back into the black after previous losses. This stronger performance is drawing investors’ attention.

See our latest analysis for StorageVault Canada.

After months of steady recovery, StorageVault Canada’s share price has climbed 25.0% so far this year, reflecting renewed confidence among investors following its latest earnings beat and a minor dividend increase. While momentum has picked up in the short term, the 1-year total shareholder return stands at 14.6%, suggesting improving sentiment around the company’s long-term prospects.

If StorageVault's recent surge has you exploring broader opportunities, this could be the perfect moment to discover fast growing stocks with high insider ownership.

With shares rebounding and fundamentals improving, investors are left to wonder if StorageVault Canada is still undervalued, or if the recent strength is a sign that the market has already priced in its future growth.

Price-to-Sales Ratio of 5.5x: Is it justified?

StorageVault Canada is currently trading at a price-to-sales ratio of 5.5x. This places the company well above Canadian real estate peers and raises questions about whether recent outperformance justifies this premium.

The price-to-sales (P/S) ratio compares a company’s market capitalization to its revenues. For storage and real estate management firms, investors use the P/S ratio to measure how much they are willing to pay for each dollar of sales. This can be especially relevant when profits are inconsistent or negative, as is the case for StorageVault.

At present, StorageVault is valued higher than both the Canadian real estate industry average, which sits at 2.6x, and the peer average of 5.3x. It also exceeds the estimated fair price-to-sales ratio of 4.1x, suggesting the stock may be stretched compared to sector norms. If the market pivots toward fundamentals, there could be downward pressure on the valuation to realign with peers and fair value estimates.

Explore the SWS fair ratio for StorageVault Canada

Result: Price-to-Sales of 5.5x (OVERVALUED)

However, weak long-term returns and recent profit volatility remain potential risks that could disrupt the stock's renewed upward momentum.

Find out about the key risks to this StorageVault Canada narrative.

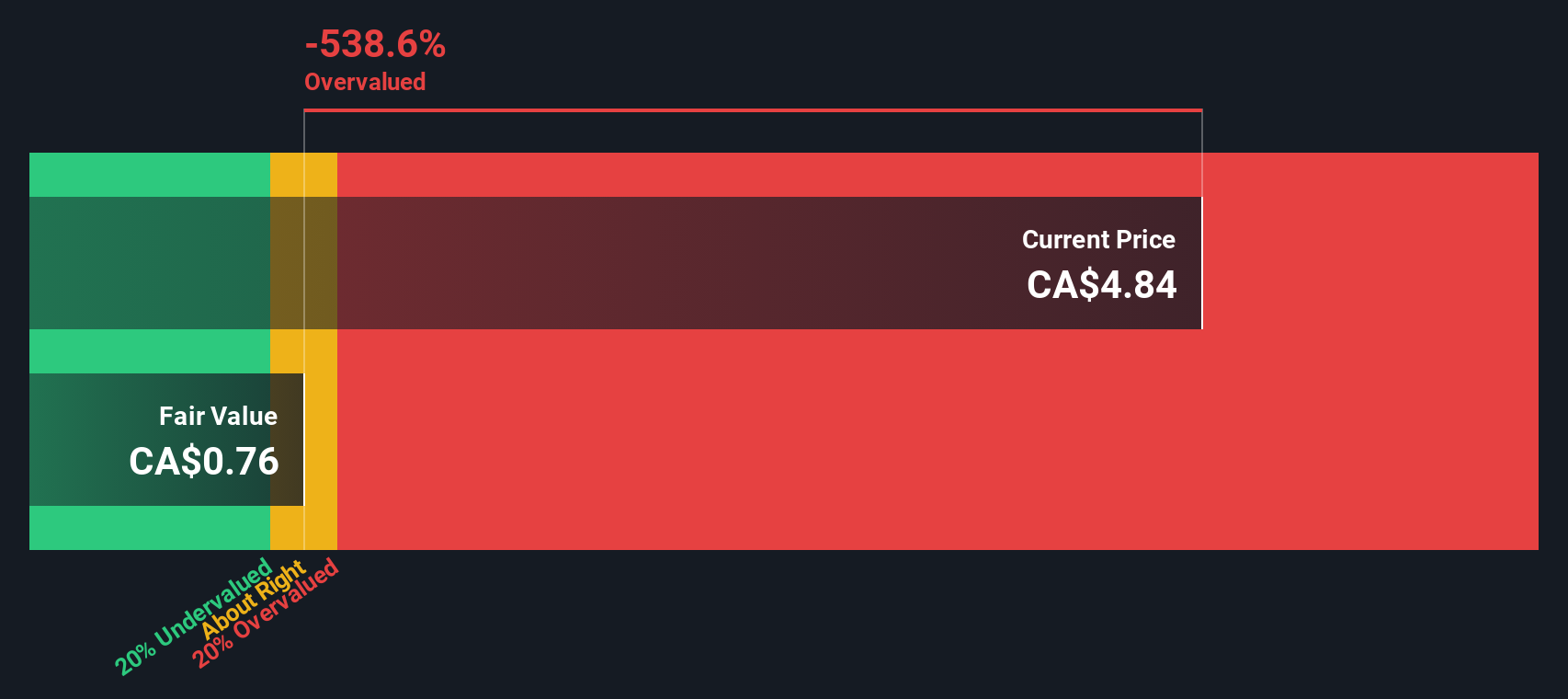

Another View: Discounted Cash Flow Tells a Different Story

Taking a step back from revenue multiples, the SWS DCF model offers a different perspective on StorageVault Canada. According to this approach, the company's shares are trading well above the estimated fair value, which suggests the recent rally could be outpacing fundamentals. Is the market too optimistic, or does it see something the model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out StorageVault Canada for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own StorageVault Canada Narrative

If you have a different perspective or want to follow your own approach, you can dive into the numbers and build your view in just a few minutes with Do it your way.

A great starting point for your StorageVault Canada research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let a great opportunity slip by while others seize the market’s next big winners. Actively seek out stocks that fit your goals with these top ideas:

- Capture high yields and build your income stream by reviewing these 22 dividend stocks with yields > 3%, which features payouts above 3%.

- Target rapid growth in a transforming sector when you spot these 27 AI penny stocks that are reshaping industries with cutting-edge technology.

- Find potential bargains poised for a comeback by checking out these 840 undervalued stocks based on cash flows, identified based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SVI

StorageVault Canada

Owns, manages, and rents self-storage and portable storage space to individual and commercial customers in Canada.

Mediocre balance sheet with concerning outlook.

Market Insights

Community Narratives