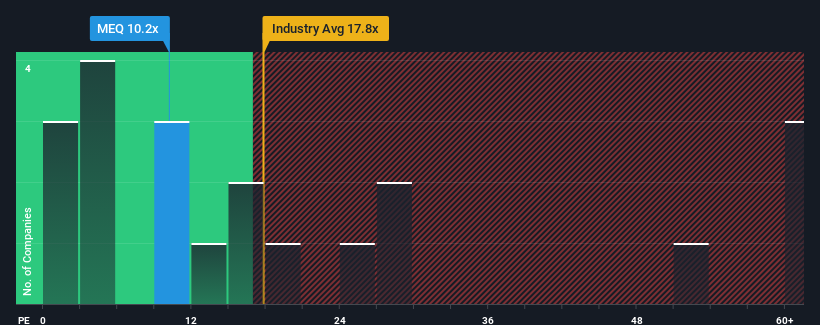

Mainstreet Equity Corp.'s (TSE:MEQ) price-to-earnings (or "P/E") ratio of 10.2x might make it look like a buy right now compared to the market in Canada, where around half of the companies have P/E ratios above 14x and even P/E's above 27x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Mainstreet Equity has been doing quite well of late. One possibility is that the P/E is low because investors think the company's earnings are going to fall away like everyone else's soon. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Mainstreet Equity

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Mainstreet Equity would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered an exceptional 33% gain to the company's bottom line. The strong recent performance means it was also able to grow EPS by 184% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 36% during the coming year according to the dual analysts following the company. With the market predicted to deliver 19% growth , that's a disappointing outcome.

With this information, we are not surprised that Mainstreet Equity is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Mainstreet Equity's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Mainstreet Equity maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Plus, you should also learn about these 4 warning signs we've spotted with Mainstreet Equity (including 2 which are a bit unpleasant).

Of course, you might also be able to find a better stock than Mainstreet Equity. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:MEQ

Mainstreet Equity

Engages in the acquisition, redevelopment, repositioning, and management of mid-market residential rental apartment buildings in Western Canada.

Proven track record with low risk.

Market Insights

Community Narratives