- Canada

- /

- Real Estate

- /

- TSX:GDC

TSX Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

The Canadian stock market has been experiencing a robust year, with the TSX showing impressive gains of over 17% amid a backdrop of economic growth, favorable central bank policies, and rising corporate profits. As investors navigate this positive climate, attention often shifts to smaller or newer companies that can offer unique opportunities. While the term "penny stocks" might seem outdated, these stocks continue to intrigue investors with their potential for affordability and growth when supported by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.41 | CA$11.75M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.29 | CA$119.71M | ★★★★★★ |

| Winshear Gold (TSXV:WINS) | CA$0.165 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.24 | CA$297.04M | ★★★★★★ |

| Foraco International (TSX:FAR) | CA$2.40 | CA$221.84M | ★★★★★☆ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Enterprise Group (TSX:E) | CA$2.26 | CA$138.39M | ★★★★☆☆ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Genesis Land Development (TSX:GDC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Genesis Land Development Corp. is an integrated land developer and residential home builder focusing on residential lands and serviced lots in the Calgary Metropolitan Area, with a market cap of CA$220.90 million.

Operations: Genesis Land Development's revenue primarily comes from Home Building, which generated CA$216.55 million, and Land Development - Genesis, contributing CA$94.55 million.

Market Cap: CA$220.9M

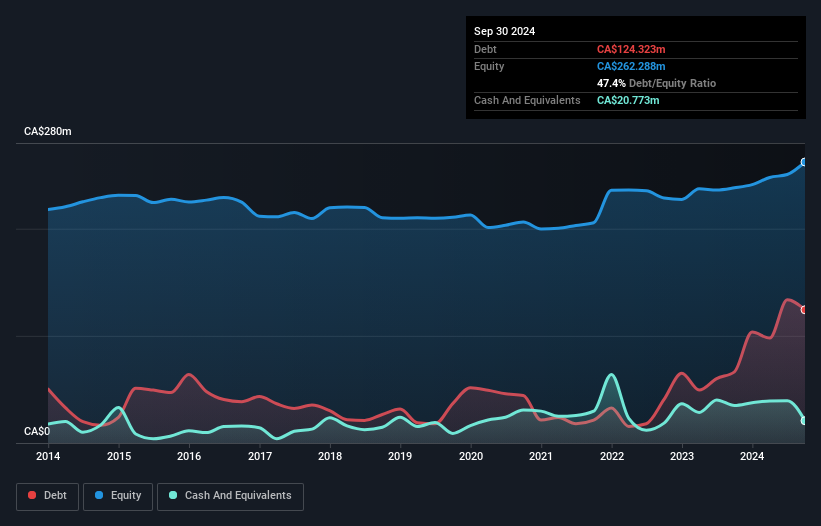

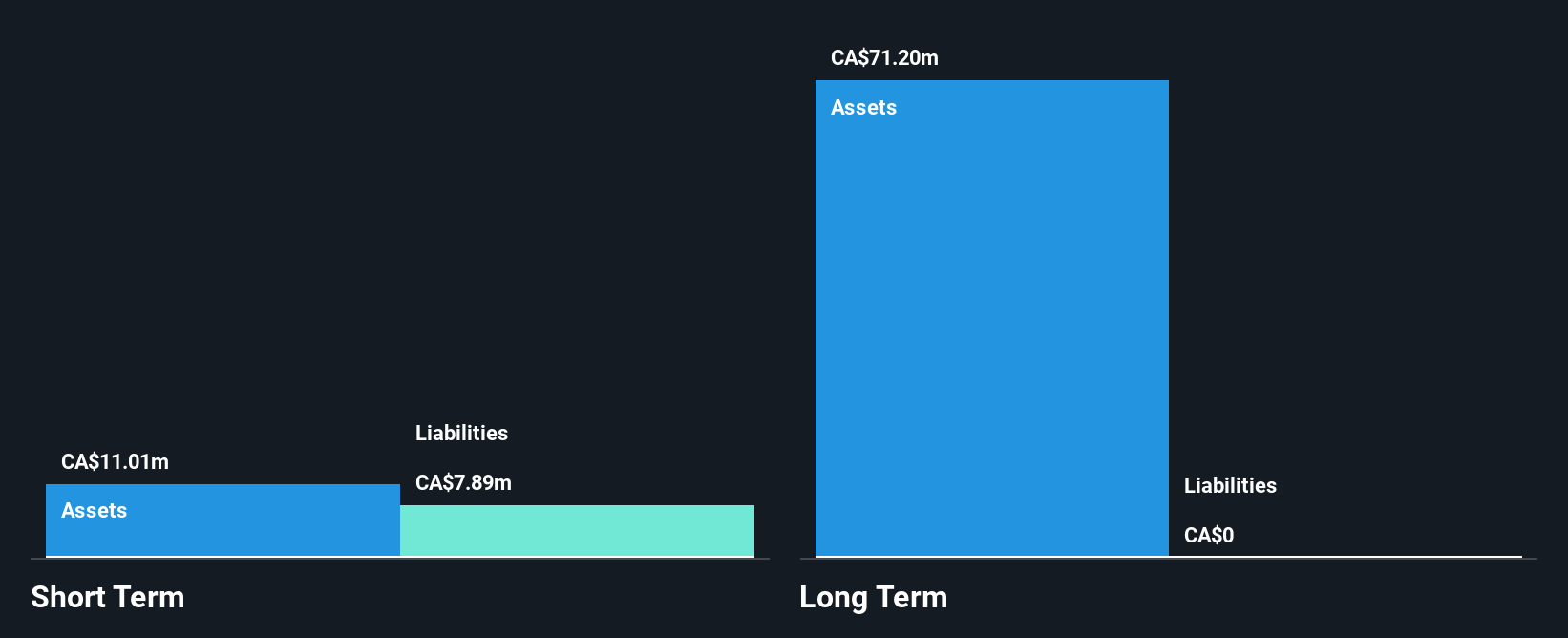

Genesis Land Development Corp. has shown robust financial performance, with earnings growth of 175.1% over the past year and a significant increase in net income for the second quarter of 2024 compared to the previous year. Despite a low Return on Equity of 9.9%, its Price-To-Earnings ratio of 9x suggests it might be undervalued relative to the Canadian market average. The company's short-term assets significantly exceed both its short and long-term liabilities, indicating strong liquidity. Recent executive appointments aim to bolster operational efficiency and growth, particularly in land development activities within Calgary.

- Navigate through the intricacies of Genesis Land Development with our comprehensive balance sheet health report here.

- Learn about Genesis Land Development's historical performance here.

Neptune Digital Assets (TSXV:NDA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Neptune Digital Assets Corp. builds, owns, and operates digital currency infrastructure assets in Canada with a market cap of CA$50.26 million.

Operations: The company generates revenue from data processing, amounting to CA$2.01 million.

Market Cap: CA$50.26M

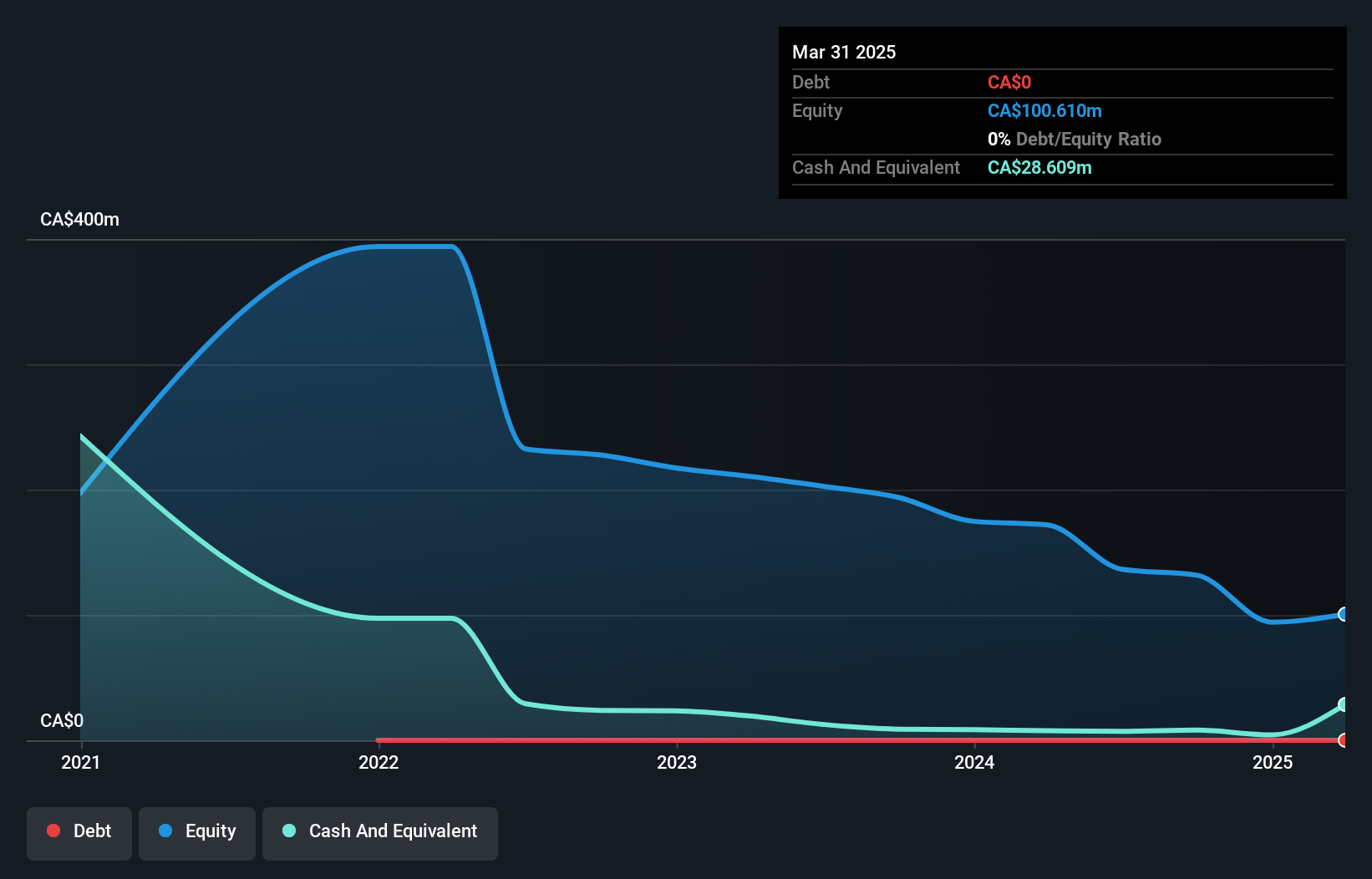

Neptune Digital Assets Corp. operates with a market cap of CA$50.26 million, generating revenue of CA$2.01 million from data processing, though it remains unprofitable and is not expected to achieve profitability in the near term. The company has no debt and a strong cash position, providing a runway exceeding three years even with declining free cash flow trends. Recent earnings reports show net income growth despite lower revenues compared to the previous year, indicating some operational efficiency improvements. Neptune's management and board are experienced, which may support strategic decisions amidst its financial challenges.

- Get an in-depth perspective on Neptune Digital Assets' performance by reading our balance sheet health report here.

- Examine Neptune Digital Assets' earnings growth report to understand how analysts expect it to perform.

Palisades Goldcorp (TSXV:PALI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Palisades Goldcorp Ltd. is a resource investment company and merchant bank that invests in junior companies within the resource and mining sector, with a market cap of CA$86.71 million.

Operations: The company's revenue segment is focused on Metals & Mining, specifically Gold & Other Precious Metals, with a reported revenue of -CA$2.65 million.

Market Cap: CA$86.71M

Palisades Goldcorp Ltd., with a market cap of CA$86.71 million, is pre-revenue and unprofitable, reporting a net loss of CA$35.29 million for the second quarter of 2024. Despite no debt and sufficient cash runway exceeding three years due to positive free cash flow growth, its short-term assets do not cover long-term liabilities (CA$38.1M). The company recently experienced significant changes, including being dropped from the S&P/TSX Venture Composite Index and board member William Hayden's resignation. Although it has completed some share buybacks, financial challenges persist with increasing losses over five years at a rate of 29.8% annually.

- Take a closer look at Palisades Goldcorp's potential here in our financial health report.

- Understand Palisades Goldcorp's track record by examining our performance history report.

Taking Advantage

- Gain an insight into the universe of 947 TSX Penny Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GDC

Genesis Land Development

An integrated land developer and residential home builder, owns and develops residential lands and serviced lots in the Calgary Metropolitan Area, Canada.

Solid track record with adequate balance sheet.