- Canada

- /

- Real Estate

- /

- TSX:CIGI

Colliers (TSX:CIGI) Reaffirms 2025 Growth Targets and Expands U.S. Leadership Could Be a Game Changer

Reviewed by Sasha Jovanovic

- Colliers International Group reported third quarter 2025 earnings showing increased sales to US$1.46 billion and reaffirmed its full-year revenue guidance, anticipating low-teens percentage growth.

- The company also announced that Brian Rosen will assume leadership of its U.S. Northeast Region Brokerage while retaining his CEO role in Canada, emphasizing a focus on accelerating growth in key markets.

- We'll explore how Colliers' reaffirmed 2025 outlook and leadership expansion in the U.S. Northeast may influence its investment thesis.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Colliers International Group Investment Narrative Recap

To be a Colliers International Group shareholder today, you need to believe in the company's ability to grow through both leadership depth and robust segment diversification, even as segments like industrial leasing face macroeconomic risks. The latest quarterly results and the appointment of Brian Rosen to lead the U.S. Northeast Region Brokerage are unlikely to materially change the biggest short-term catalyst, continued expansion of recurring, high-margin advisory and outsourcing services, nor do they significantly shift exposure to cyclical revenue swings, which remain the key risk for earnings resilience.

Among recent updates, the reaffirmation of management’s 2025 revenue guidance following Q3 results stands out. By maintaining low-teens percentage revenue growth expectations, Colliers is signaling stability despite a volatile industry backdrop, though investors should watch whether that forecast proves durable as global real estate cycles shift.

However, despite this progress, it’s important to keep in mind how ongoing weakness in industrial leasing revenue could...

Read the full narrative on Colliers International Group (it's free!)

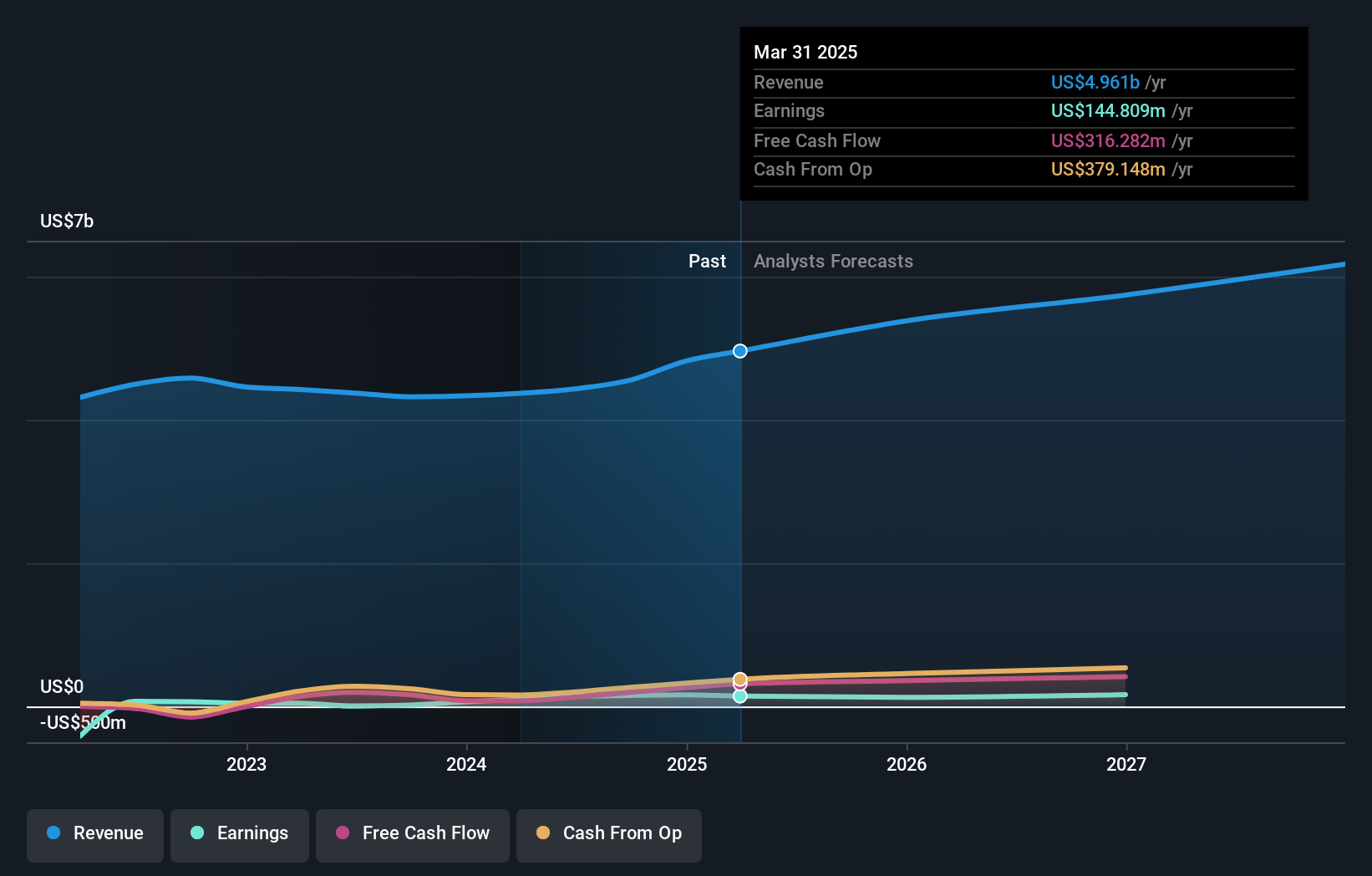

Colliers International Group's narrative projects $6.5 billion revenue and $242.1 million earnings by 2028. This requires 8.2% yearly revenue growth and a $130 million earnings increase from $112.1 million today.

Uncover how Colliers International Group's forecasts yield a CA$245.77 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have posted fair value estimates ranging from CA$245.77 to CA$258.04, based on two separate analyses. While these views can differ, the reliance on cyclical leasing income remains a key performance driver worth considering as you compare viewpoints.

Explore 2 other fair value estimates on Colliers International Group - why the stock might be worth just CA$245.77!

Build Your Own Colliers International Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Colliers International Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Colliers International Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Colliers International Group's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives