- Canada

- /

- Real Estate

- /

- TSX:CIGI

Colliers (TSX:CIGI): Evaluating Valuation After Q3 Earnings Beat and Steady 2025 Growth Guidance

Reviewed by Simply Wall St

Colliers International Group (TSX:CIGI) just posted its third quarter earnings, highlighting higher revenue and net income compared to a year ago. The company also maintained its revenue growth guidance for 2025.

See our latest analysis for Colliers International Group.

Colliers' steady revenue growth, robust net income this quarter, and the strategic appointment of Brian Rosen to lead U.S. Northeast brokerage have kept the company in the spotlight. Despite a recent dip in short-term momentum, including a 4.9% 7-day share price return, the stock is still up 9.7% year-to-date. Its three-year total shareholder return of nearly 69% highlights solid long-term progress. Momentum may be mixed in the near term, but the ongoing focus on expansion and operational execution suggests potential for future gains.

If you’re curious about other companies charting strong long-term growth stories, now is a great time to broaden your investing lens and discover fast growing stocks with high insider ownership

With Colliers shares still trading below analyst targets and its intrinsic value, the question remains: is there still value left to unlock for investors, or has the recent growth already been fully priced in?

Most Popular Narrative: 13.6% Undervalued

With Colliers International Group's fair value pegged at CA$245.77 in the most widely followed narrative, the current share price lags behind. This hints at potential for further upside if future projections hold true. This valuation brings key company strategies and long-term drivers into focus.

The growing interest from institutional and private wealth channels in alternative asset classes such as data centers, student housing, infrastructure, and credit solutions is driving segment diversification and AUM growth in the investment management business, supporting future recurring fee revenue and higher net margins.

What fuels this narrative's bullish outlook? One daring forecast dominates: a radical leap in earnings paired with margin improvements usually reserved for tech giants. Eager to see what financial leaps Colliers is expected to make, and why analysts believe growth will outpace industry standards? Unpack this story behind the numbers for the rationale behind its premium valuation.

Result: Fair Value of $245.77 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if industrial leasing revenues weaken or fundraising momentum in Investment Management stalls, Colliers’ path to sustained outperformance could quickly come under pressure.

Find out about the key risks to this Colliers International Group narrative.

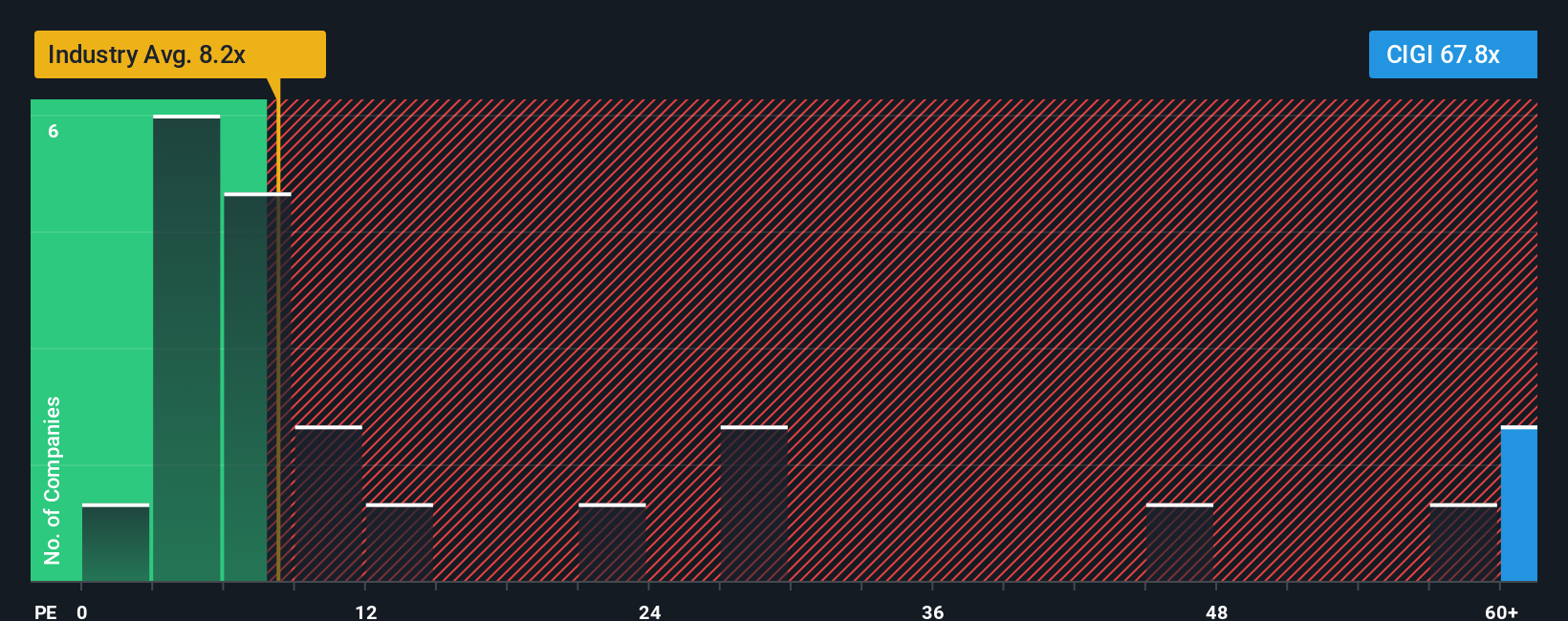

Another View: Market Versus Model

While Colliers appears undervalued based on fair value estimates, the current price-to-earnings ratio tells a different story. At 65.7x, it is sharply higher than the Canadian real estate average of 7.1x, the peer average of 40.6x, and also above its own fair ratio of 61.8x. This kind of premium valuation often signals greater risk of volatility ahead. Is there enough long-term growth to justify these elevated multiples, or could market sentiment swing the other way?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Colliers International Group Narrative

If you see things differently or want to dig deeper into the numbers yourself, crafting your own perspective takes less than three minutes. So why not Do it your way

A great starting point for your Colliers International Group research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart moves start with the right stock picks. Don’t let these opportunities pass you by. Simply Wall Street’s unique screeners can help you spot breakout trends and strong fundamentals before the crowd.

- Jump on breakthrough technology by checking out these 25 AI penny stocks and see which AI-driven companies are set to transform entire industries.

- Get ahead of the curve by tapping into these 864 undervalued stocks based on cash flows, highlighting shares with solid fundamentals that the market may be overlooking.

- Capture steady income opportunities with these 16 dividend stocks with yields > 3% showcasing high-yield stocks that could boost your long-term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CIGI

Colliers International Group

Provides commercial real estate to corporate and institutional clients in the United States, Canada, Europe, Australia, the United Kingdom, Poland, China, India, and internationally.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives