Entourage Health Corp. (CVE:ENTG) Soars 50% But It's A Story Of Risk Vs Reward

Entourage Health Corp. (CVE:ENTG) shareholders would be excited to see that the share price has had a great month, posting a 50% gain and recovering from prior weakness. But the last month did very little to improve the 50% share price decline over the last year.

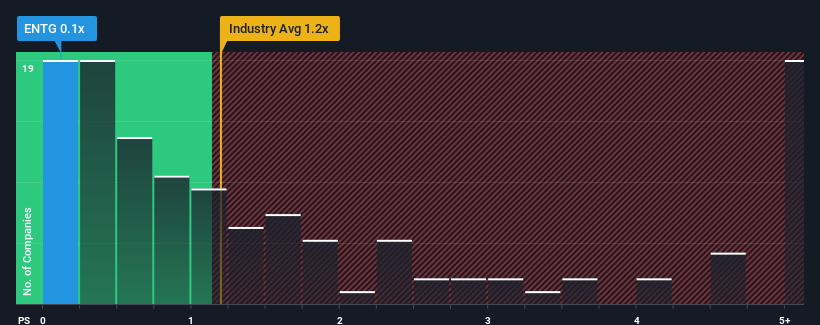

In spite of the firm bounce in price, given about half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.2x, you may still consider Entourage Health as an attractive investment with its 0.1x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Entourage Health

How Has Entourage Health Performed Recently?

For instance, Entourage Health's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Entourage Health will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Entourage Health, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Entourage Health?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Entourage Health's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.8%. Still, the latest three year period has seen an excellent 45% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 4.2%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in mind, we find it intriguing that Entourage Health's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Entourage Health's P/S

The latest share price surge wasn't enough to lift Entourage Health's P/S close to the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We're very surprised to see Entourage Health currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. It appears many are indeed anticipating revenue instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 5 warning signs with Entourage Health, and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Entourage Health might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:ENTG

Entourage Health

Processes, produces, and distributes cannabis products for medical, adult-use, and bulk sales markets in Canada.

Moderate and slightly overvalued.

Market Insights

Community Narratives