A Piece Of The Puzzle Missing From Auxly Cannabis Group Inc.'s (TSE:XLY) 33% Share Price Climb

The Auxly Cannabis Group Inc. (TSE:XLY) share price has done very well over the last month, posting an excellent gain of 33%. The last 30 days bring the annual gain to a very sharp 33%.

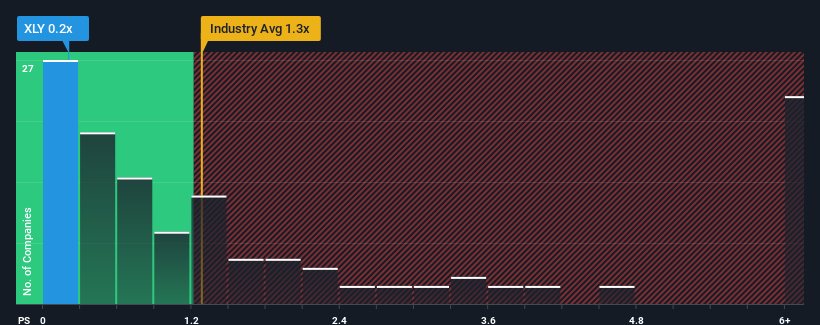

Although its price has surged higher, considering around half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Auxly Cannabis Group as an solid investment opportunity with its 0.2x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Auxly Cannabis Group

How Has Auxly Cannabis Group Performed Recently?

For example, consider that Auxly Cannabis Group's financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many expect the uninspiring revenue performance to worsen, which has repressed the P/S. Those who are bullish on Auxly Cannabis Group will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Auxly Cannabis Group's earnings, revenue and cash flow.How Is Auxly Cannabis Group's Revenue Growth Trending?

In order to justify its P/S ratio, Auxly Cannabis Group would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. However, a few strong years before that means that it was still able to grow revenue by an impressive 213% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 5.8% shows it's noticeably more attractive.

With this in mind, we find it intriguing that Auxly Cannabis Group's P/S isn't as high compared to that of its industry peers. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Bottom Line On Auxly Cannabis Group's P/S

Despite Auxly Cannabis Group's share price climbing recently, its P/S still lags most other companies. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We're very surprised to see Auxly Cannabis Group currently trading on a much lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. When we see strong revenue with faster-than-industry growth, we assume there are some significant underlying risks to the company's ability to make money which is applying downwards pressure on the P/S ratio. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

Having said that, be aware Auxly Cannabis Group is showing 3 warning signs in our investment analysis, and 2 of those are a bit concerning.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:XLY

Auxly Cannabis Group

Operates as a consumer packaged goods company in the cannabis products market in Canada.

Flawless balance sheet and fair value.

Market Insights

Community Narratives