With A 29% Price Drop For TerrAscend Corp. (TSE:TSND) You'll Still Get What You Pay For

To the annoyance of some shareholders, TerrAscend Corp. (TSE:TSND) shares are down a considerable 29% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

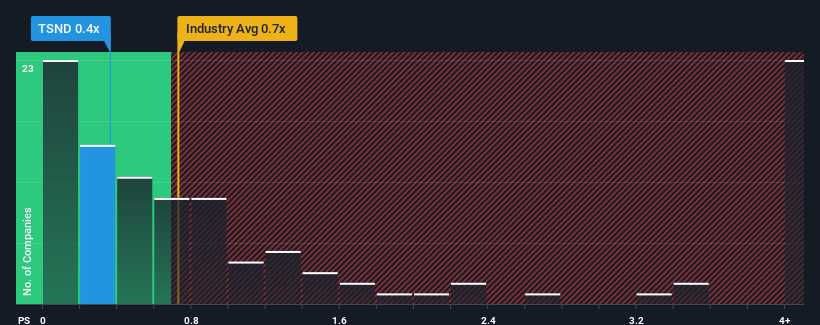

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about TerrAscend's P/S ratio of 0.4x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in Canada is also close to 0.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for TerrAscend

How TerrAscend Has Been Performing

TerrAscend could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on TerrAscend will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, TerrAscend would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 6.4%. Pleasingly, revenue has also lifted 51% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 7.2% each year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 8.2% each year, which is not materially different.

With this in mind, it makes sense that TerrAscend's P/S is closely matching its industry peers. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On TerrAscend's P/S

With its share price dropping off a cliff, the P/S for TerrAscend looks to be in line with the rest of the Pharmaceuticals industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at TerrAscend's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for TerrAscend that you should be aware of.

If you're unsure about the strength of TerrAscend's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if TerrAscend might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TSND

TerrAscend

TerrAscend Corp. cultivates, produces, and sells cannabis products in Canada and the United States.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives