Imagine Holding StageZero Life Sciences (TSE:SZLS) Shares While The Price Zoomed 465% Higher

Buying shares in the best businesses can build meaningful wealth for you and your family. And we've seen some truly amazing gains over the years. Don't believe it? Then look at the StageZero Life Sciences Ltd. (TSE:SZLS) share price. It's 465% higher than it was five years ago. This just goes to show the value creation that some businesses can achieve. And in the last month, the share price has gained 22%.

View our latest analysis for StageZero Life Sciences

StageZero Life Sciences recorded just US$1,608,949 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. It seems likely some shareholders believe that StageZero Life Sciences has the funding to invent a new product before too long.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies go on to make revenue, profits, and generate value, others get hyped up by hopeful naifs before eventually going bankrupt. Of course, if you time it right, high risk investments like this can really pay off, as StageZero Life Sciences investors might know.

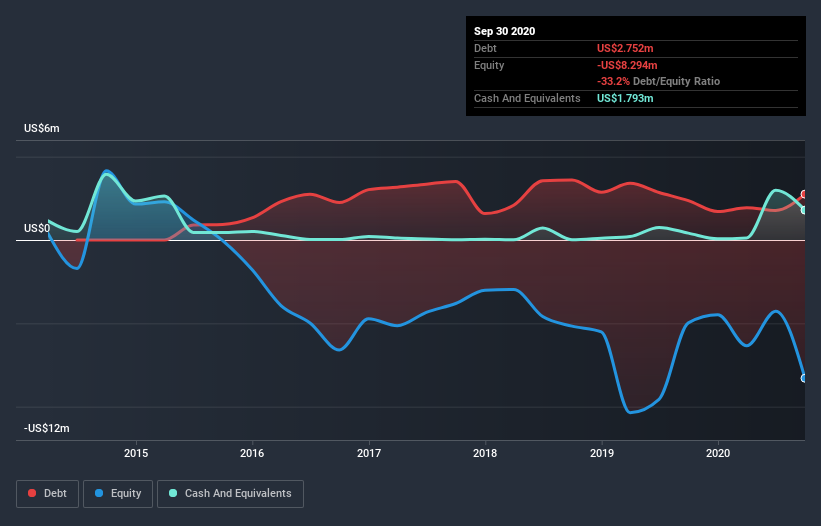

Our data indicates that StageZero Life Sciences had US$11m more in total liabilities than it had cash, when it last reported in September 2020. That puts it in the highest risk category, according to our analysis. So we're surprised to see the stock up 45% per year, over 5 years , but we're happy for holders. It's clear more than a few people believe in the potential. You can see in the image below, how StageZero Life Sciences' cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's nice to see that StageZero Life Sciences shareholders have received a total shareholder return of 253% over the last year. That gain is better than the annual TSR over five years, which is 41%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. It's always interesting to track share price performance over the longer term. But to understand StageZero Life Sciences better, we need to consider many other factors. Even so, be aware that StageZero Life Sciences is showing 6 warning signs in our investment analysis , and 3 of those are potentially serious...

StageZero Life Sciences is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you decide to trade StageZero Life Sciences, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:SZLS

StageZero Life Sciences

A vertically integrated healthcare company, develops and commercializes proprietary molecular diagnostic tests for the early detection of diseases and personalized health management with a primary focus on cancer-related indications in North America and Western Europe.

Moderate and slightly overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026