Market Might Still Lack Some Conviction On MediPharm Labs Corp. (TSE:LABS) Even After 31% Share Price Boost

Despite an already strong run, MediPharm Labs Corp. (TSE:LABS) shares have been powering on, with a gain of 31% in the last thirty days. Looking further back, the 13% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

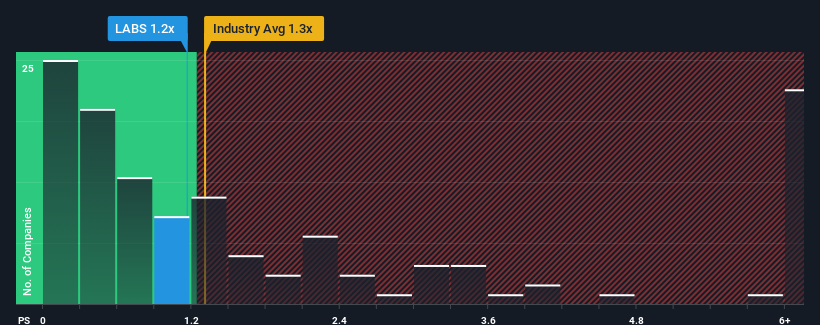

Even after such a large jump in price, you could still be forgiven for feeling indifferent about MediPharm Labs' P/S ratio of 1.2x, since the median price-to-sales (or "P/S") ratio for the Pharmaceuticals industry in Canada is also close to 1.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for MediPharm Labs

What Does MediPharm Labs' Recent Performance Look Like?

Recent times have been advantageous for MediPharm Labs as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on MediPharm Labs will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For MediPharm Labs?

In order to justify its P/S ratio, MediPharm Labs would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 53% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 34% as estimated by the dual analysts watching the company. That's shaping up to be materially higher than the 5.4% growth forecast for the broader industry.

With this in consideration, we find it intriguing that MediPharm Labs' P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From MediPharm Labs' P/S?

MediPharm Labs appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that MediPharm Labs currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

There are also other vital risk factors to consider and we've discovered 5 warning signs for MediPharm Labs (1 is significant!) that you should be aware of before investing here.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:LABS

MediPharm Labs

Operates as a pharmaceutical company that produces and sells purified, pharmaceutical-quality cannabis extracts, concentrates, active pharmaceutical ingredients, and advanced derivative products in Canada, Australia, Germany, and internationally.

Excellent balance sheet and fair value.

Market Insights

Community Narratives