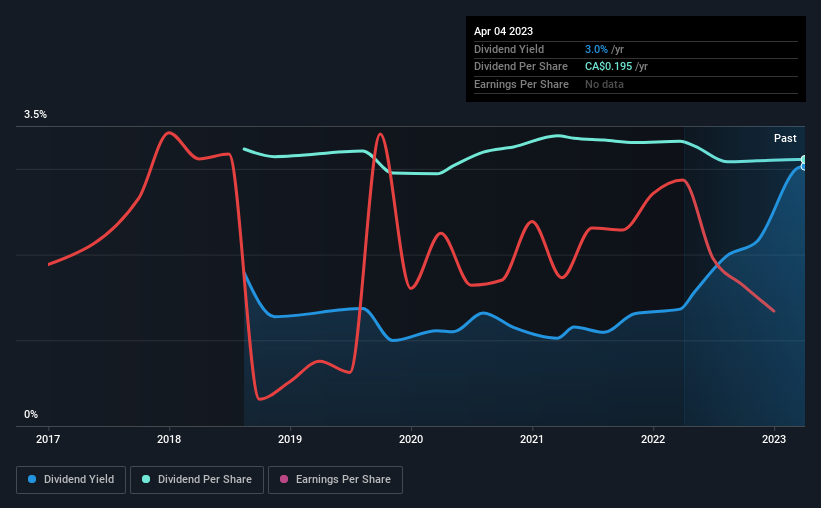

The board of HLS Therapeutics Inc. (TSE:HLS) has announced that it will pay a dividend on the 15th of June, with investors receiving $0.05 per share. This makes the dividend yield 3.0%, which will augment investor returns quite nicely.

While the dividend yield is important for income investors, it is also important to consider any large share price moves, as this will generally outweigh any gains from distributions. HLS Therapeutics' stock price has reduced by 36% in the last 3 months, which is not ideal for investors and can explain a sharp increase in the dividend yield.

See our latest analysis for HLS Therapeutics

HLS Therapeutics' Distributions May Be Difficult To Sustain

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Even though HLS Therapeutics isn't generating a profit, it is generating healthy free cash flows that easily cover the dividend. We generally think that cash flow is more important than accounting measures of profit, so we are fairly comfortable with the dividend at this level.

Analysts are expecting EPS to grow by 71.4% over the next 12 months. We like to see the company moving towards profitability, but this probably won't be enough for it to post positive net income this year. The positive free cash flows give us some comfort, however, that the dividend could continue to be sustained.

HLS Therapeutics Is Still Building Its Track Record

HLS Therapeutics' dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. Since 2018, the dividend has gone from $0.151 total annually to $0.145. Payments have been decreasing at a very slow pace in this time period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

HLS Therapeutics May Find It Hard To Grow The Dividend

Investors could be attracted to the stock based on the quality of its payment history. Unfortunately things aren't as good as they seem. Although it's important to note that HLS Therapeutics' earnings per share has basically not grown from where it was five years ago, which could erode the purchasing power of the dividend over time.

The Dividend Could Prove To Be Unreliable

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. For instance, we've picked out 1 warning sign for HLS Therapeutics that investors should take into consideration. Is HLS Therapeutics not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if HLS Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HLS

HLS Therapeutics

A specialty pharmaceutical company, acquires and commercializes pharmaceutical products for the treatment of psychiatric disorders, central nervous system, and cardiovascular disease in Canada, the United States, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives