TSX Growth Companies With Strong Insider Ownership In November 2025

Reviewed by Simply Wall St

As November unfolds, the Canadian market is experiencing a moment of reflection amid global equity pullbacks, largely driven by recalibrations in AI valuations. Despite these fluctuations, Canada's economy shows resilience with unexpected job growth and strong corporate earnings, underscoring the importance of balanced portfolios that can navigate both innovation-driven opportunities and valuation concerns. In this environment, stocks with high insider ownership often signal confidence in the company's long-term prospects and alignment between management and shareholders—an appealing trait for investors seeking stability amidst market volatility.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.2% | 78% |

| Robex Resources (TSXV:RBX) | 22.5% | 90.3% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.4% |

| NTG Clarity Networks (TSXV:NCI) | 36.4% | 29.9% |

| goeasy (TSX:GSY) | 21.9% | 27.3% |

| Enterprise Group (TSX:E) | 32.2% | 30.4% |

| Colliers International Group (TSX:CIGI) | 14.0% | 42.4% |

| California Nanotechnologies (TSXV:CNO) | 19% | 153% |

| Almonty Industries (TSX:AII) | 12.2% | 64.5% |

| Allied Gold (TSX:AAUC) | 15% | 95.7% |

Here's a peek at a few of the choices from the screener.

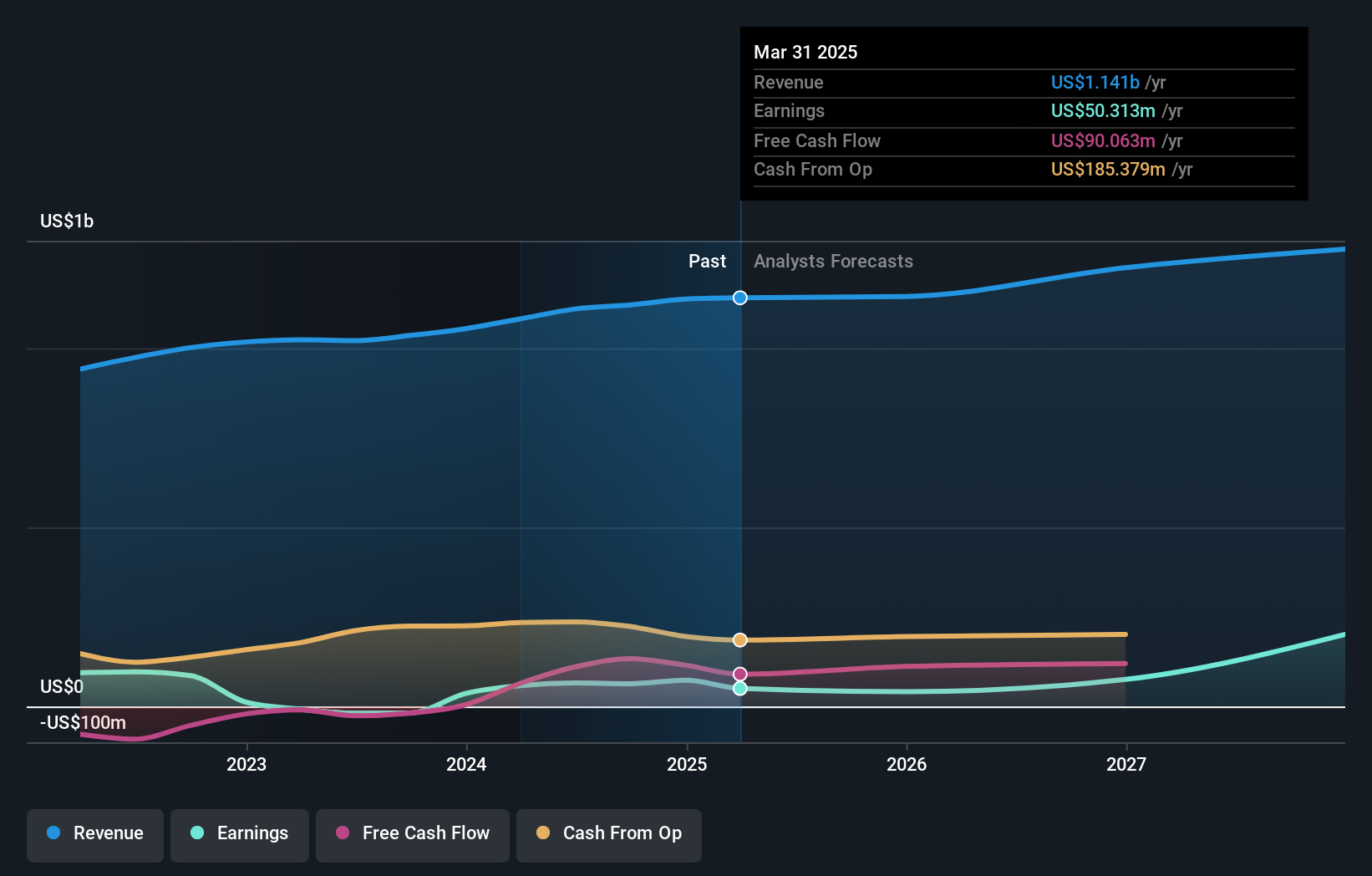

Green Thumb Industries (CNSX:GTII)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Green Thumb Industries Inc. is involved in the manufacturing, distribution, marketing, and sale of cannabis products for both medical and adult-use markets in the United States, with a market cap of CA$2.28 billion.

Operations: Green Thumb Industries generates revenue through the production, distribution, and sale of cannabis products catering to both medical and adult-use markets across the United States.

Insider Ownership: 10.1%

Earnings Growth Forecast: 31.9% p.a.

Green Thumb Industries, a growth company with substantial insider ownership, is trading at 47.1% below its estimated fair value. While its Return on Equity is forecast to be low at 6.9%, earnings are expected to grow significantly by 31.9% annually, outpacing the Canadian market's growth rate of 11.9%. Recent earnings reports show improved net income for Q3 despite flat revenue growth expectations for Q4. The company also announced a US$50 million share buyback program expiring in September 2026.

- Dive into the specifics of Green Thumb Industries here with our thorough growth forecast report.

- Our expertly prepared valuation report Green Thumb Industries implies its share price may be lower than expected.

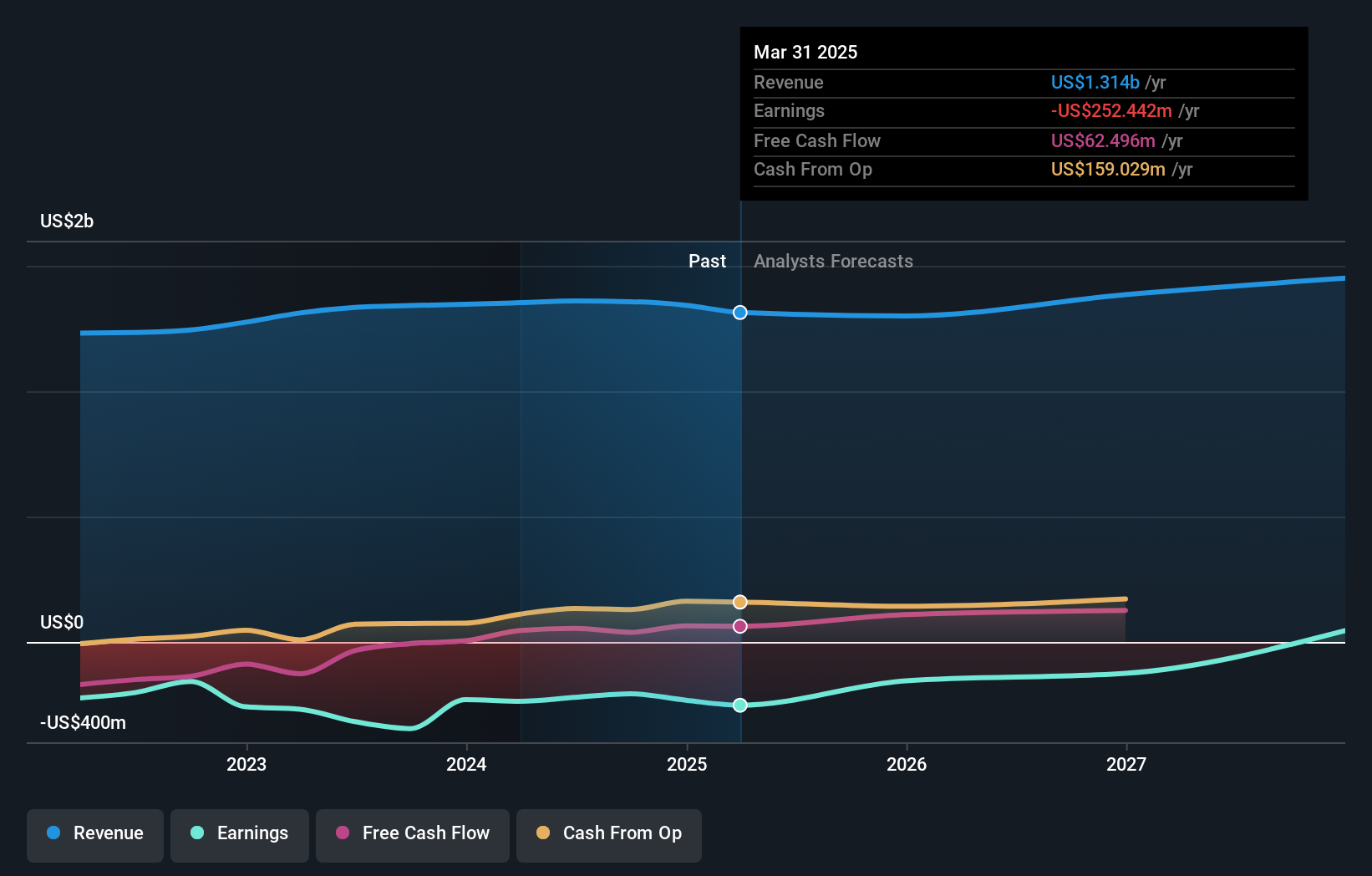

Curaleaf Holdings (TSX:CURA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Curaleaf Holdings, Inc. is involved in the production and distribution of cannabis products both in the United States and internationally, with a market capitalization of approximately CA$2.87 billion.

Operations: The company generates revenue primarily from the cultivation, production, distribution, and sale of cannabis, amounting to $1.28 billion.

Insider Ownership: 18.5%

Earnings Growth Forecast: 72.4% p.a.

Curaleaf Holdings, with a volatile share price, is trading at 72.4% below its estimated fair value. Despite recent earnings revealing a net loss of US$57.03 million for Q3 2025, the company is forecast to achieve profitability within three years, surpassing average market growth expectations. Curaleaf's revenue growth rate of 5.7% per year exceeds the Canadian market's 4.8%. The company recently expanded its credit facility to US$100 million and opened a new dispensary in Ohio.

- Click here to discover the nuances of Curaleaf Holdings with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Curaleaf Holdings' current price could be quite moderate.

Propel Holdings (TSX:PRL)

Simply Wall St Growth Rating: ★★★★★★

Overview: Propel Holdings Inc., along with its subsidiaries, operates as a financial technology company and has a market cap of CA$837.46 million.

Operations: Propel Holdings Inc. generates its revenue through various segments, although specific figures for each segment are not provided in the available text.

Insider Ownership: 30.6%

Earnings Growth Forecast: 32.4% p.a.

Propel Holdings exhibits strong growth potential with earnings expected to increase significantly, outpacing the Canadian market. Despite debt not being well covered by operating cash flow, the stock trades at a substantial discount to its estimated fair value. Recent insider activity shows more buying than selling over three months. Propel's partnership with Column N.A. aims to expand its reach in underserved U.S. markets, enhancing its established presence and supporting revenue growth projections of 24.2% annually.

- Get an in-depth perspective on Propel Holdings' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Propel Holdings shares in the market.

Key Takeaways

- Explore the 41 names from our Fast Growing TSX Companies With High Insider Ownership screener here.

- Interested In Other Possibilities? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives