Aurora Cannabis (TSX:ACB): Revenue Forecasted to Outpace Market as Losses Narrow Ahead of Earnings

Reviewed by Simply Wall St

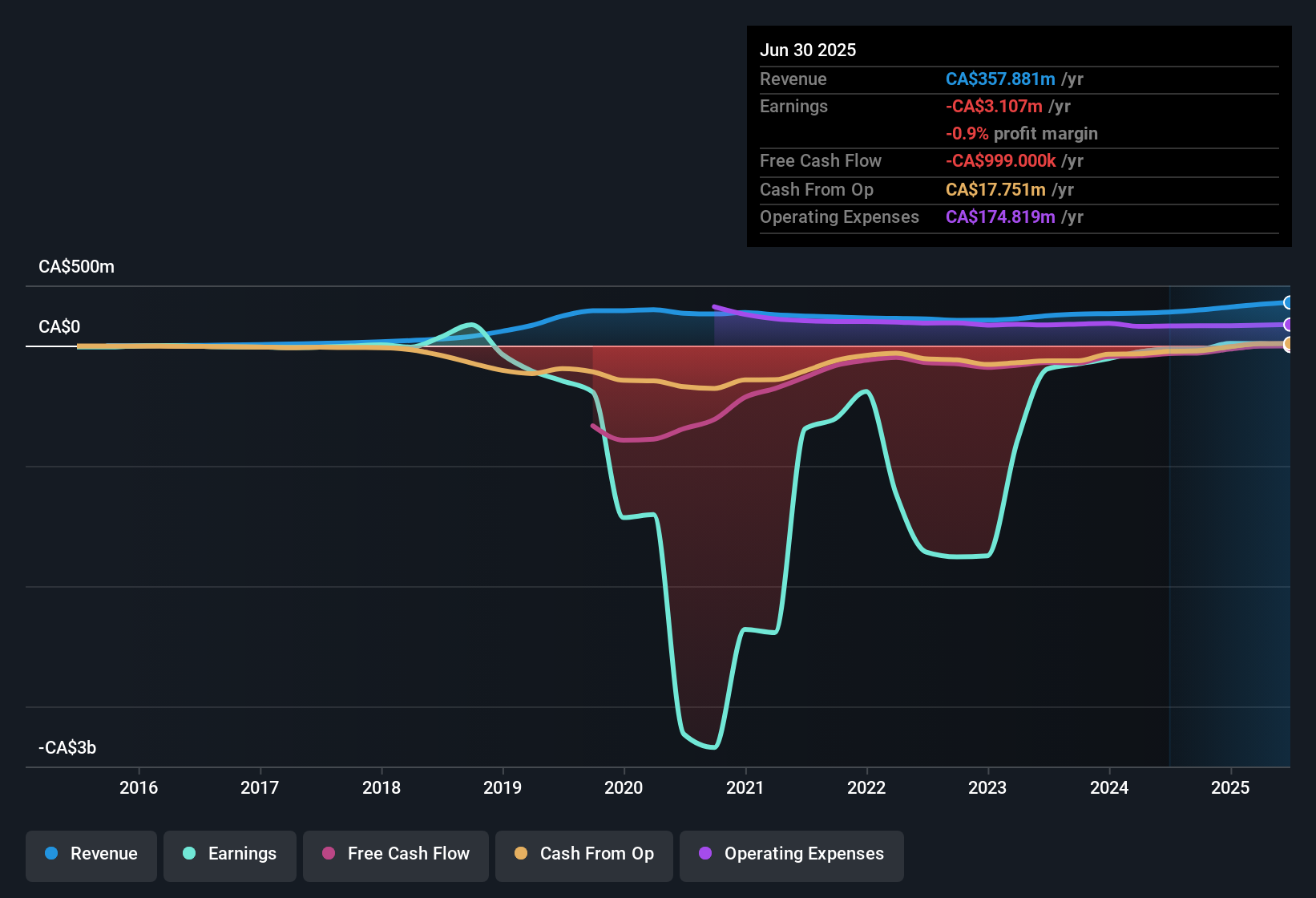

Aurora Cannabis (TSX:ACB) remains unprofitable, but the company has reduced its losses at an impressive annual rate of 61.2% over the past five years. The stock trades at a Price-to-Sales ratio of 1x, below its peer average of 2.1x, and sits well below an estimated fair value of CA$23.27 with a current share price of CA$6.29. With revenue expected to grow 6.49% per year, outpacing the broader Canadian market, investors may see the trend of narrowing losses and steady forecasted growth as encouraging signals.

See our full analysis for Aurora Cannabis.The next section sets the latest earnings data against the prevailing narratives to see which investor stories hold up and which may need a rethink.

See what the community is saying about Aurora Cannabis

Profit Margins Projected to Swing Positive

- Analysts expect profit margins to rise from -0.9% today to 10.1% in three years, which highlights the anticipated turnaround from current unprofitability.

- Analysts' consensus view sees operational efficiencies and a strategic focus on high-margin international medical cannabis as strong drivers behind this expected margin expansion.

- Consensus narrative notes Aurora's international expansion and regulatory expertise should foster sustainable improvements in margins and resilience against new market entrants.

- Consolidated margins are also set to benefit from a shift away from low-margin consumer segments according to analysts' projections.

- With a forecast for sustained margin gains, see if the full consensus is holding up in our detailed narrative. 📊 Read the full Aurora Cannabis Consensus Narrative.

Balance Sheet Strength Shields Growth Path

- Aurora’s debt-free balance sheet and healthy cash reserves reduce the likelihood of shareholder dilution, supporting financial flexibility for growth and acquisitions.

- Analysts' consensus view claims this capital strength gives Aurora room to invest in new cultivation technology and R&D without resorting to equity raises.

- Analysts argue that this cash position helps protect EPS while giving Aurora the means to expand into fast-growing global medical cannabis markets.

- The company’s ability to self-fund also means it can potentially participate in industry consolidation and respond to emerging opportunities faster than peers who rely on external funding.

Valuation Gap vs. Price Targets

- With the current share price at CA$6.29 and analyst price target at CA$7.93, Aurora trades at a 14.6% discount to consensus expectations.

- Analysts' consensus narrative contends momentum in revenue growth and improved earnings could help the stock close this discount, but emphasizes that realizing the price target assumes Aurora achieves 2028 earnings of CA$42.4 million, trading at a PE ratio of 13.6x.

- The consensus highlights that this valuation still sits below the CA pharmaceuticals industry average PE of 37.5x, implying room for multiple expansion if forecasts are achieved.

- Even as peers trade at higher multiples, bulls will need confidence in Aurora’s ability to reach these long-term goals for the gap to close.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Aurora Cannabis on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different read on the figures? Share your outlook and craft a unique company narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Aurora Cannabis.

Explore Beyond Aurora

While Aurora Cannabis shows improving margins, it remains unprofitable and relies heavily on meeting ambitious growth targets to justify its current valuation.

If you prefer companies with proven earnings consistency and less dependence on turnaround scenarios, check out stable growth stocks screener (2074 results) to discover stocks delivering reliable growth through varying economic conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ACB

Aurora Cannabis

Engages in the production, distribution, and sale of cannabis and cannabis-derivative products in Canada and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives