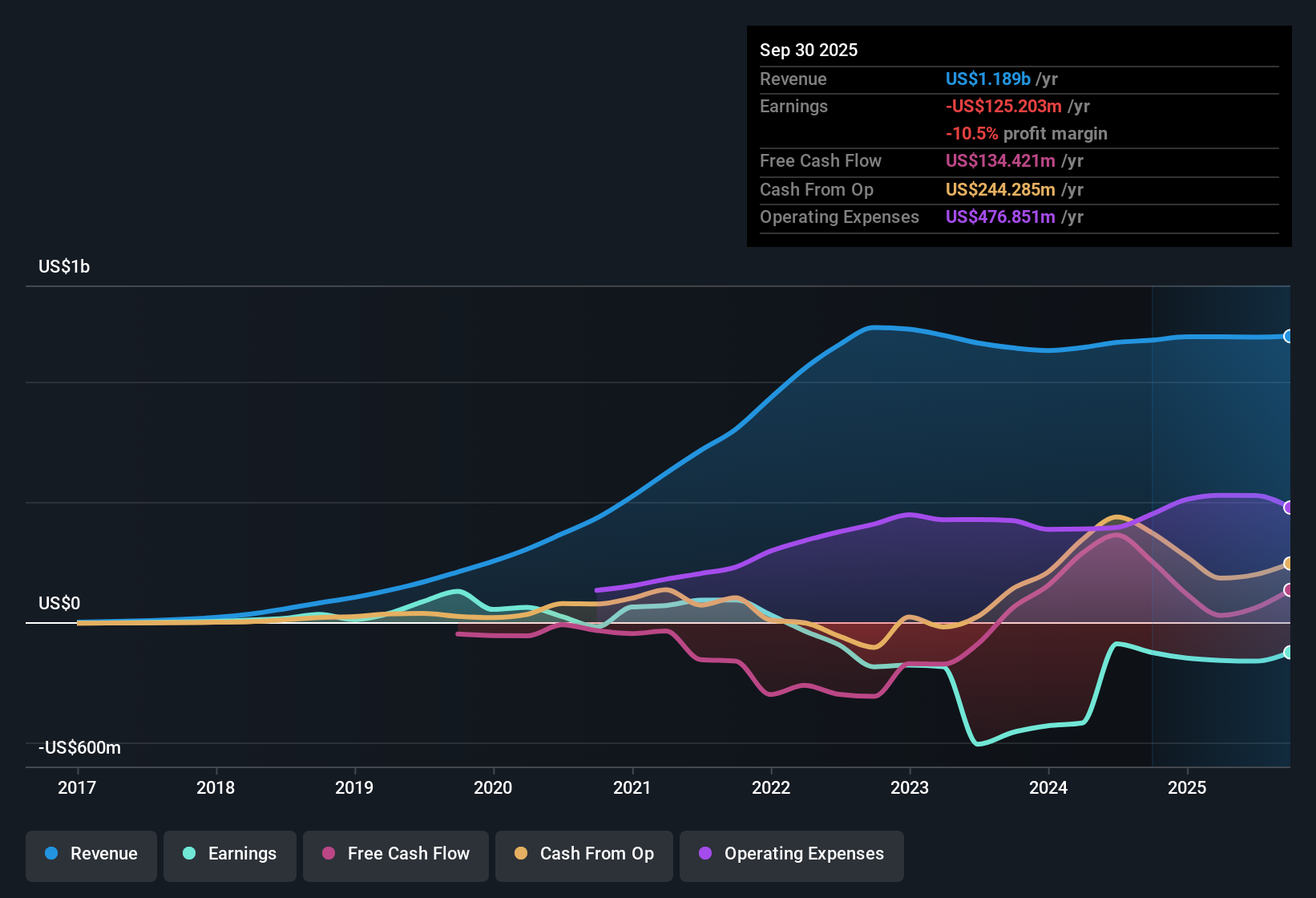

Trulieve Cannabis (CNSX:TRUL): Losses Have Grown 41% Annually With Slower Revenue Growth Than Peers

Reviewed by Simply Wall St

Trulieve Cannabis (CNSX:TRUL) remains unprofitable, with losses accelerating at an average of 41% per year over the past five years. Although revenue is forecast to grow 2.6% annually, this pace trails the broader Canadian market’s projected 5.1% growth rate. Despite no improvement in profit margins, some investors may see value given the shares trade at CA$9.3, which is well below a fair value estimate of CA$69.2. However, major risks around profitability and growth remain top of mind.

See our full analysis for Trulieve Cannabis.The next section will put these results in context by testing how the numbers reinforce or challenge the most widely followed narratives about Trulieve.

See what the community is saying about Trulieve Cannabis

Margin Recovery Hinging on Regulatory Reform

- Analysts agree Trulieve is unlikely to become profitable in the next three years, as its profit margin would need to swing from -13.7% today to the Canadian Pharmaceuticals industry average of 1.2% by 2028 just to reach a projected $15.0 million in earnings.

- Consensus narrative notes that future margin improvement and profitability depend heavily on U.S. policy changes, especially rescheduling cannabis and enacting SAFER Banking reforms, which would reduce Trulieve's tax burden and open up new financial channels.

- These regulatory catalysts, if realized, could allow net margin and cash flows to rebound, directly supporting the bullish case for higher long-term earnings.

- If reforms stall, however, Trulieve would likely remain weighed down by punitive taxation and high operating costs, challenging its ability to close the profitability gap.

Price-to-Sales Value Looks Attractive, Not Without Risk

- Trulieve’s price-to-sales ratio stands at 1.1x, below the peer average of 2.7x and slightly above the Canadian Pharmaceuticals sector average of 1x. This suggests value versus peers but also raises questions about industry-wide expectations.

- Analysts' consensus view highlights that a low price-to-sales multiple appeals to value-focused investors given Trulieve’s aggressive brand roll-outs and retail upgrades. However, heavy reliance on regulatory change and exposure to intense pricing pressure still overshadow this discount.

- Bulls cite new branded product launches and tech-enabled retail as catalysts for expanding margins and recurring revenues, supporting the case for a higher valuation multiple.

- Bears argue that the stock’s thin margin for error could be erased quickly by delays in policy reform or intensifying competition.

Analyst Targets Far Outpace Current Price

- With the latest share price at CA$9.30 and the analyst average price target at CA$18.18, the implied upside is nearly 96%. However, this target requires Trulieve to trade at a steep 203x PE in 2028, which is well above the current industry average of 37.5x.

- According to analysts' consensus view, for Trulieve’s shares to reach this target, investors must believe revenues will climb to $1.2 billion and earnings will swing positive despite stubborn losses and share count dilution.

- Meeting analyst expectations assumes significant industry tailwinds and operational execution beyond what Trulieve has delivered in recent years.

- This creates a sharp tension between deep value signals from today’s price and the high bar set by consensus forecasts.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Trulieve Cannabis on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think these numbers tell a different story? Take a few minutes to turn your insight into a custom narrative and add your unique perspective: Do it your way

A great starting point for your Trulieve Cannabis research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Trulieve’s path to profitability remains uncertain as persistent losses, thin margins, and dependence on regulatory change put consistent growth out of reach for now.

If you want greater reliability, use our stable growth stocks screener (2074 results) to discover companies delivering smoother revenue and earnings expansion regardless of market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trulieve Cannabis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:TRUL

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives