One IM Cannabis Corp. (CSE:IMCC) Analyst Just Slashed Their 2020 Revenue Estimates

One thing we could say about the covering analyst on IM Cannabis Corp. (CSE:IMCC) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue estimates were cut sharply as the analyst signalled a weaker outlook - perhaps a sign that investors should temper their expectations as well. Bidders are definitely seeing a different story, with the stock price of CA$0.85 reflecting a 27% rise in the past week. With such a sharp increase, it seems brokers may have seen something that is not yet being priced in by the wider market.

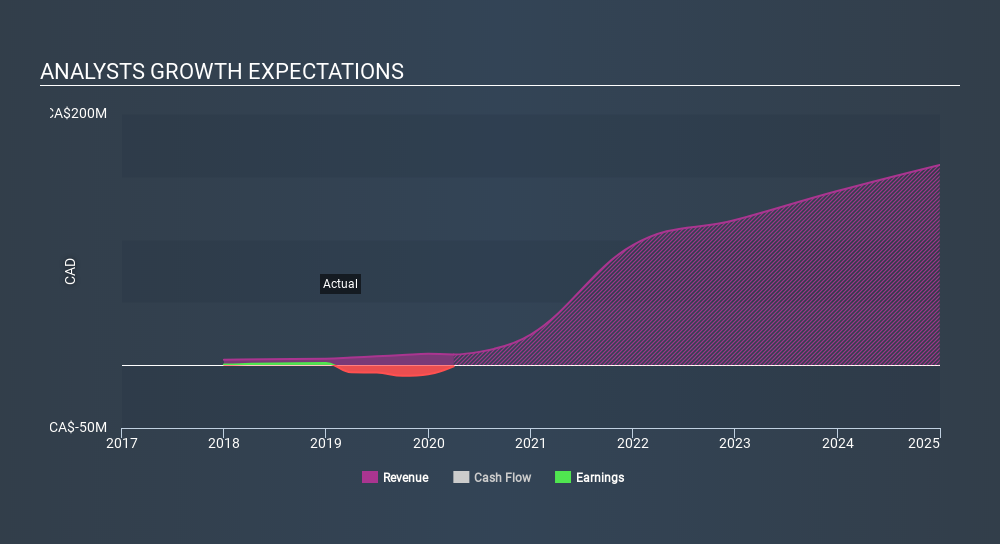

Following the downgrade, the current consensus from IM Cannabis' lone analyst is for revenues of CA$24m in 2020 which - if met - would reflect a sizeable 188% increase on its sales over the past 12 months. Prior to the latest estimates, the analyst was forecasting revenues of CA$31m in 2020. The consensus view seems to have become more pessimistic on IM Cannabis, noting the sizeable cut to revenue estimates in this update.

View our latest analysis for IM Cannabis

The consensus price target rose 36% to CA$0.95, with the analyst clearly more optimistic about IM Cannabis' prospects following this update.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. The analyst is definitely expecting IM Cannabis' growth to accelerate, with the forecast 188% growth ranking favourably alongside historical growth of 40% per annum over the past year. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 32% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analyst also expect IM Cannabis to grow faster than the wider industry.

The Bottom Line

The clear low-light was that the analyst slashing their revenue forecasts for IM Cannabis this year. The analyst also expects revenues to grow faster than the wider market. There was also a nice increase in the price target, with the analyst apparently feeling that the intrinsic value of the business is improving. Overall, given the drastic downgrade to this year's forecasts, we'd be feeling a little more wary of IM Cannabis going forwards.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with IM Cannabis' business, like a short cash runway. Learn more, and discover the 2 other concerns we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About CNSX:IMCC

IM Cannabis

Engages in breeding, growing, and supply of medical cannabis products in Israel and Germany.

Good value slight.

Similar Companies

Market Insights

Community Narratives