Could Green Thumb Industries’ (CNSX:GTII) Pennsylvania Expansion Reveal Its Strategy for Regional Leadership?

Reviewed by Sasha Jovanovic

- Green Thumb Industries has opened its 19th Pennsylvania retail location, RISE Dispensary Lebanon, marking its 108th location nationwide and signaling continued expansion in the region.

- The grand opening supported a local nonprofit, underscoring the company's approach of pairing retail growth with community engagement initiatives.

- We'll examine how Green Thumb's ongoing Pennsylvania expansion and community integration might shape its investment narrative moving forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 33 best rare earth metal stocks of the very few that mine this essential strategic resource.

Green Thumb Industries Investment Narrative Recap

For those considering Green Thumb Industries, belief in the business hinges on robust expansion into new cannabis markets and the company's ability to convert growth into sustainable profits, all while managing industry margin pressures and regulatory unpredictability. The recent RISE Dispensary Lebanon opening highlights operational execution and community focus but does not materially alter the biggest short-term catalyst, adult-use legalization progress in major states, nor does it reduce the risk of ongoing price compression and margin squeeze seen across the sector. These local store additions, while positive, are unlikely to offset near-term revenue or profitability headwinds absent wider reform or price stability.

Among recent company news, the Q3 2025 earnings guidance, calling for flat or slightly declining revenue and further gross margin compression, resonates most with the RISE Lebanon opening. Steady store expansions are being weighed against softer retail sales and industry-wide price pressure, reinforcing the company's ongoing challenge of balancing growth with profitability in a highly competitive environment.

Yet, in contrast to the optimism of geographic expansion, investors should be aware that margin pressure from industry oversupply and competition remains a critical watchpoint as...

Read the full narrative on Green Thumb Industries (it's free!)

Green Thumb Industries is projected to reach $1.3 billion in revenue and $141.9 million in earnings by 2028. This outlook requires a 4.2% annual revenue growth rate and an earnings increase of $112.9 million from the current earnings of $29.0 million.

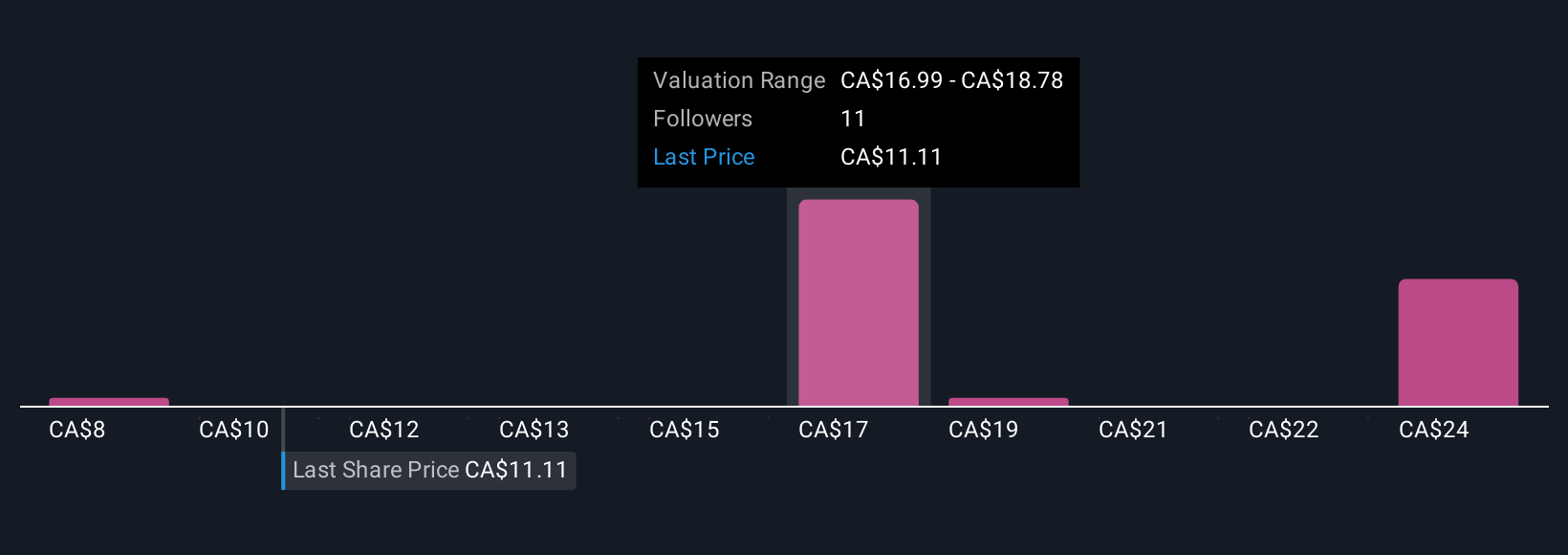

Uncover how Green Thumb Industries' forecasts yield a CA$17.00 fair value, a 41% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community have set fair value estimates for Green Thumb ranging from CA$8.05 to CA$26.26 per share. As price compression and margin erosion continue to influence industry outlook, you can explore these views to see how different market participants assess risk and reward.

Explore 4 other fair value estimates on Green Thumb Industries - why the stock might be worth over 2x more than the current price!

Build Your Own Green Thumb Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Green Thumb Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Green Thumb Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Green Thumb Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives