A Look at Green Thumb Industries (CNSX:GTII) Valuation After Q3 Earnings Growth and Minnesota Market Expansion

Reviewed by Simply Wall St

Green Thumb Industries (CNSX:GTII) posted its third quarter 2025 earnings this week, showing both revenue and net income on the rise. The company’s results benefited from launching adult-use cannabis sales at all eight RISE Dispensaries in Minnesota. Additional share repurchases and a new labor deal added to the strong narrative.

See our latest analysis for Green Thumb Industries.

Green Thumb Industries’ recent third-quarter results and expansion into the Minnesota adult-use market have caught investors’ attention, but the stock’s momentum has yet to fully turn around. Despite these operational wins and a newly authorized share buyback, the 1-year total shareholder return still stands at -23.0%, reflecting a challenging climate for cannabis stocks. Signs of stabilization suggest downside pressure could be moderating over the longer term.

If you are curious about where innovation is showing real promise beyond cannabis, it’s a great time to explore opportunities among fast growing stocks with high insider ownership. Consider broadening your search with fast growing stocks with high insider ownership.

With the stock still trading well below analysts’ price targets despite improved earnings and strategic wins, investors face a key question: Is Green Thumb Industries undervalued at current levels, or is future growth already reflected in the share price?

Most Popular Narrative: 43.5% Undervalued

Compared to the previous closing price, the consensus narrative estimates Green Thumb Industries’ fair value significantly higher. This highlights a clear gap between market expectations and the company’s recent valuation. As cautious optimism grows around future earnings, one catalyst stands out as central to justifying a higher price.

Strategic investments in alternative consumption formats, notably the rapid expansion of THC drinks (via Rythm and Agrify partnership), enable participation in fast-growing categories aligned with declining alcohol consumption and plant-based wellness demand. This creates new, higher-growth revenue streams.

Want to know the bold financial leap that underpins this value? The narrative centers on explosive earnings growth and a narrowing profit margin gap. Uncover the surprising revenue and profit trajectory that sets the foundation for this pricing thesis.

Result: Fair Value of $17.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent regulatory uncertainty or continued price pressure in key markets could challenge the bullish outlook and disrupt Green Thumb Industries' growth momentum.

Find out about the key risks to this Green Thumb Industries narrative.

Another View: Pricing Signals Conflict

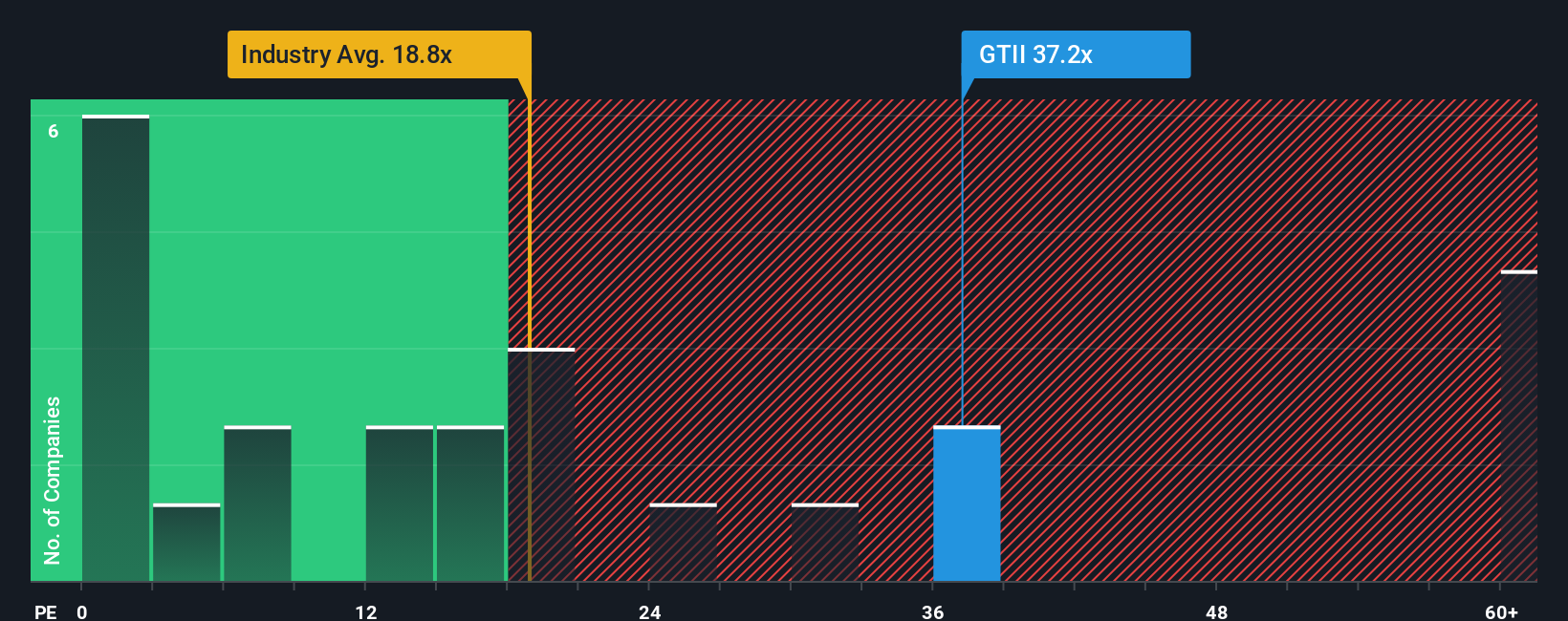

While analysts suggest Green Thumb Industries is deeply undervalued, the market’s price-to-earnings ratio tells a tougher story. At 54.5x, it is much pricier than both the North American Pharmaceuticals industry average of 20.8x and its peer group’s 29.6x. The fair ratio the market could move toward is 59.9x, hinting at potential moves in either direction.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Green Thumb Industries Narrative

If these perspectives do not fit your outlook, or you want to dig deeper into the numbers yourself, you can easily craft your own narrative based on the data in just a few minutes. Do it your way

A great starting point for your Green Thumb Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let fresh opportunities pass you by. Use the Simply Wall Street Screener to get ahead of the crowd and refine your investment strategy today.

- Tap into promising, cash-rich companies with attractive valuations by checking out these 849 undervalued stocks based on cash flows before the market catches on.

- Fuel your portfolio with the future of healthcare tech by viewing these 33 healthcare AI stocks powering breakthroughs in medical innovation and AI-driven solutions.

- Capitalize on innovation and trends shaking up the digital world by exploring these 81 cryptocurrency and blockchain stocks involved in cryptocurrency and blockchain advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives