- Canada

- /

- Metals and Mining

- /

- TSXV:AMM

TSX Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The Canadian market is currently experiencing a subdued growth outlook, influenced by slower consumer spending and population growth, though there are expectations for improvement in 2026 with interest rate cuts and fiscal stimulus. In this context, penny stocks—often smaller or newer companies—offer intriguing opportunities for investors seeking affordable entry points with potential for growth. Despite being considered an outdated term, these stocks can provide significant upside when backed by strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$54.35M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.85 | CA$186.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.325 | CA$48.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.15 | CA$765.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.13 | CA$22.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.16 | CA$928.53M | ✅ 4 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.79 | CA$141.61M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.18 | CA$206.45M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.72 | CA$9.82M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 402 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

C21 Investments (CNSX:CXXI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: C21 Investments Inc. is an integrated cannabis company that cultivates, processes, distributes, and sells cannabis and hemp-derived consumer products in the United States with a market cap of CA$44.24 million.

Operations: C21 Investments generates revenue from its cannabis cultivation operations, totaling $33.04 million.

Market Cap: CA$44.24M

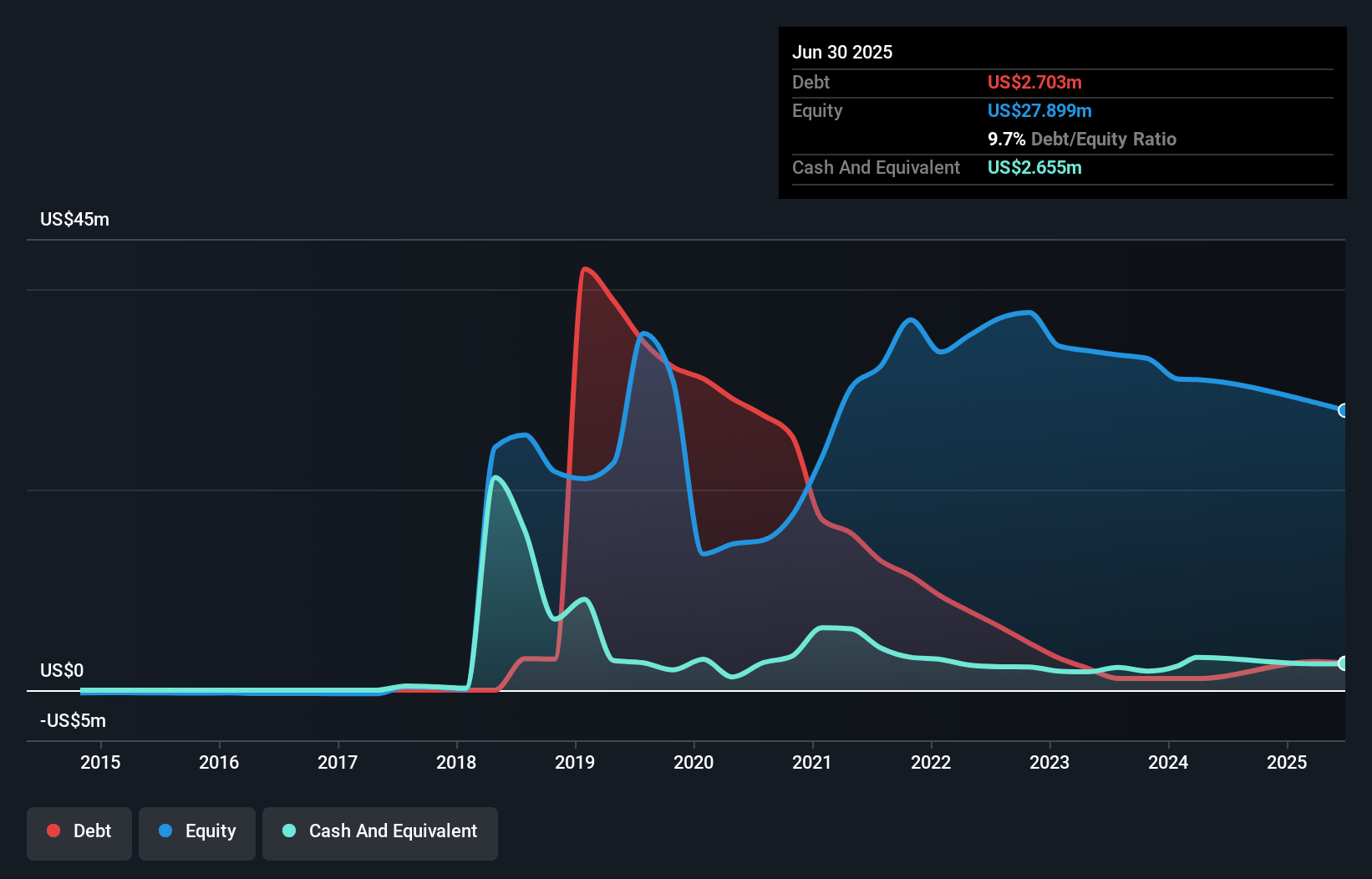

C21 Investments Inc., with a market cap of CA$44.24 million, has shown revenue growth, reporting US$8.47 million in sales for the recent quarter compared to US$7.51 million a year ago, though it remains unprofitable with a net loss of US$0.49 million. The company has reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt, providing financial stability despite high volatility and negative return on equity. Recent legal settlements and shelf registration filings indicate ongoing strategic adjustments while maintaining sufficient cash runway for over three years even as free cash flow shrinks annually by 16.8%.

- Get an in-depth perspective on C21 Investments' performance by reading our balance sheet health report here.

- Understand C21 Investments' track record by examining our performance history report.

Almaden Minerals (TSXV:AMM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Almaden Minerals Ltd. is an exploration stage company focused on acquiring, exploring, evaluating, and developing mineral properties in Mexico with a market cap of CA$28.85 million.

Operations: Currently, there are no reported revenue segments for this exploration stage company.

Market Cap: CA$28.85M

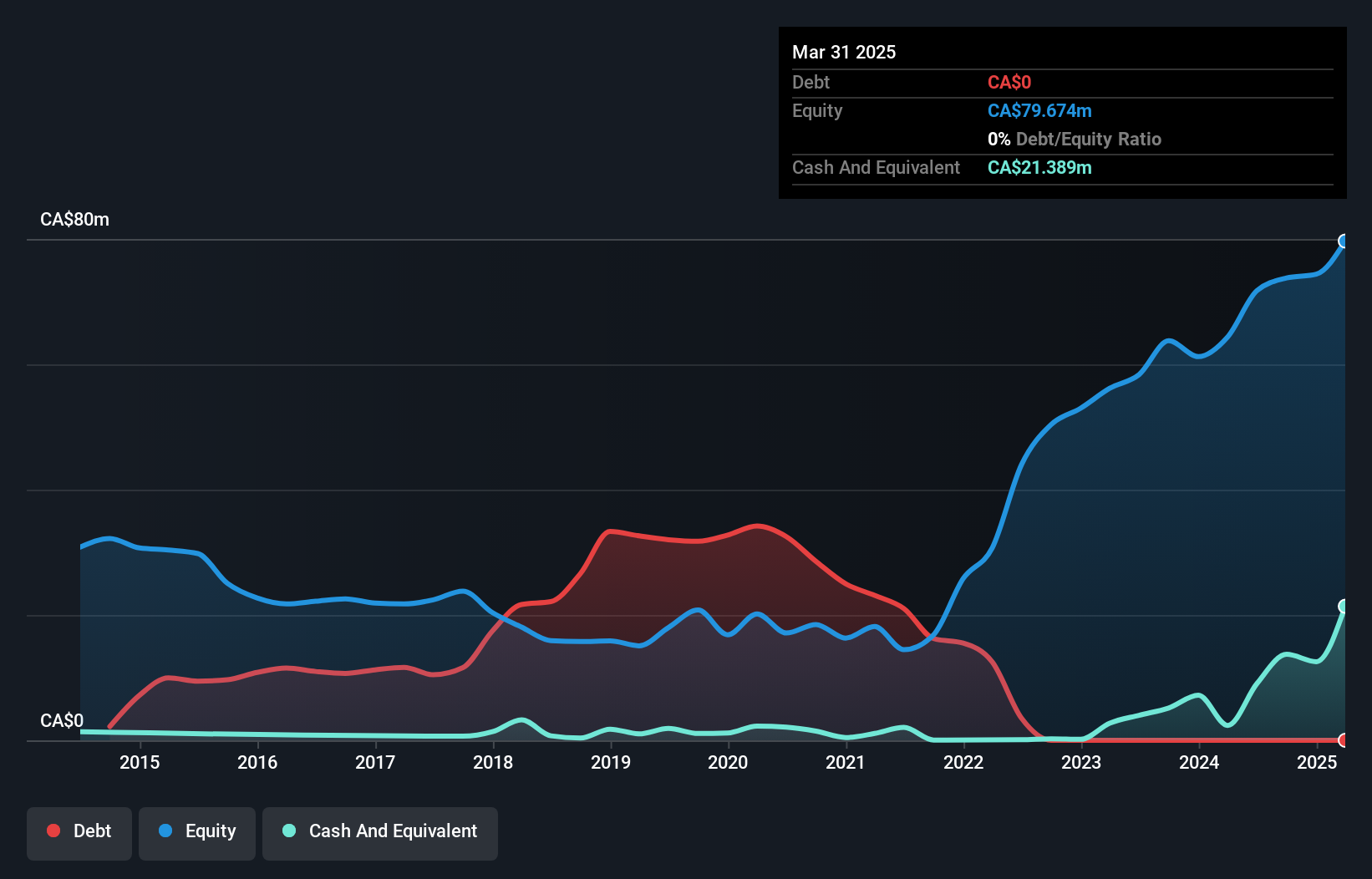

Almaden Minerals Ltd., with a market cap of CA$28.85 million, is pre-revenue and has recently become profitable, reporting net income of CA$4.51 million in the third quarter of 2025 due to a significant one-off gain. The company boasts an outstanding return on equity at 49.7% and remains debt-free, enhancing its financial stability. Recent executive changes saw Douglas McDonald appointed as President and CEO, bringing extensive experience in resources and trade policy to the leadership team. Almaden's short-term assets comfortably cover both short- and long-term liabilities, supporting operational resilience amidst industry volatility.

- Dive into the specifics of Almaden Minerals here with our thorough balance sheet health report.

- Explore historical data to track Almaden Minerals' performance over time in our past results report.

Hemisphere Energy (TSXV:HME)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hemisphere Energy Corporation is involved in the acquisition, exploration, development, and production of petroleum and natural gas properties in Canada with a market cap of CA$206.45 million.

Operations: The company generates revenue of CA$82.14 million from its petroleum and natural gas interests.

Market Cap: CA$206.45M

Hemisphere Energy Corporation, with a market cap of CA$206.45 million, stands out for its debt-free status and solid financial health, as evidenced by short-term assets covering both short- and long-term liabilities. The company's earnings growth of 7.8% over the past year surpasses industry averages, although it falls below its impressive five-year average growth rate of 48.2%. Despite recent insider selling, Hemisphere trades at a favorable price-to-earnings ratio compared to the broader Canadian market and maintains high-quality earnings with an outstanding return on equity of 40.3%, reflecting robust operational efficiency in a volatile sector.

- Unlock comprehensive insights into our analysis of Hemisphere Energy stock in this financial health report.

- Assess Hemisphere Energy's future earnings estimates with our detailed growth reports.

Key Takeaways

- Embark on your investment journey to our 402 TSX Penny Stocks selection here.

- Searching for a Fresh Perspective? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AMM

Almaden Minerals

An exploration stage company, engages in the acquisition, exploration, evaluation, and development of mineral properties in Mexico.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives