BZAM Ltd. (CSE:BZAM) Might Not Be As Mispriced As It Looks After Plunging 26%

The BZAM Ltd. (CSE:BZAM) share price has fared very poorly over the last month, falling by a substantial 26%. For any long-term shareholders, the last month ends a year to forget by locking in a 85% share price decline.

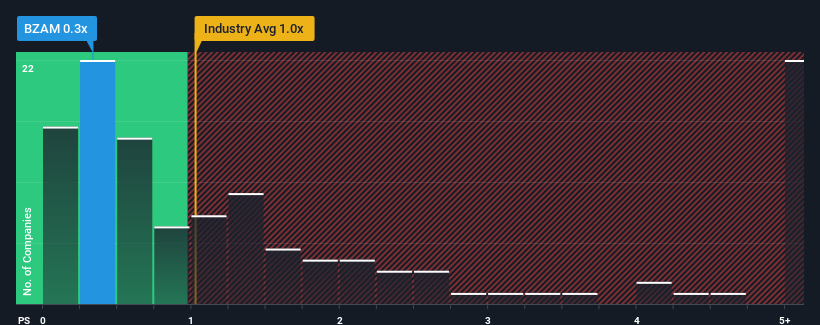

After such a large drop in price, it would be understandable if you think BZAM is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in Canada's Pharmaceuticals industry have P/S ratios above 1x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for BZAM

What Does BZAM's Recent Performance Look Like?

Recent times have been quite advantageous for BZAM as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. Those who are bullish on BZAM will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on BZAM's earnings, revenue and cash flow.How Is BZAM's Revenue Growth Trending?

In order to justify its P/S ratio, BZAM would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 81% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

This is in contrast to the rest of the industry, which is expected to grow by 5.5% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this in mind, we find it intriguing that BZAM's P/S isn't as high compared to that of its industry peers. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On BZAM's P/S

The southerly movements of BZAM's shares means its P/S is now sitting at a pretty low level. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of BZAM revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. Potential investors that are sceptical over continued revenue performance may be preventing the P/S ratio from matching previous strong performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to perceive a likelihood of revenue fluctuations in the future.

We don't want to rain on the parade too much, but we did also find 3 warning signs for BZAM (1 is potentially serious!) that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BZAM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:BZAM

BZAM

Operates as a cannabis producer with a focus on branded consumer goods.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives