Ayr Wellness Inc. (CSE:AYR.A) Not Doing Enough For Some Investors As Its Shares Slump 30%

To the annoyance of some shareholders, Ayr Wellness Inc. (CSE:AYR.A) shares are down a considerable 30% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 74% loss during that time.

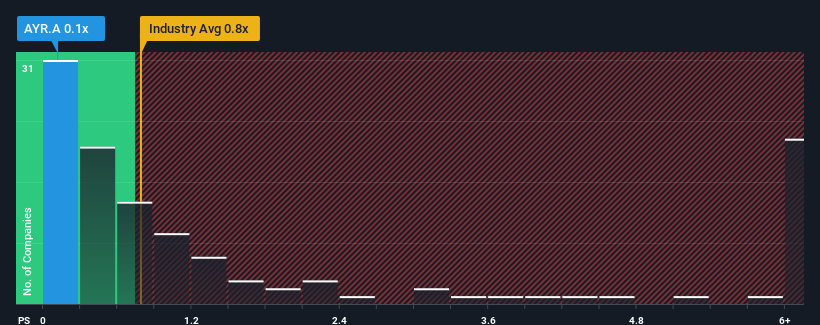

After such a large drop in price, when close to half the companies operating in Canada's Pharmaceuticals industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider Ayr Wellness as an enticing stock to check out with its 0.1x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Ayr Wellness

How Ayr Wellness Has Been Performing

With revenue growth that's inferior to most other companies of late, Ayr Wellness has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Ayr Wellness' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Ayr Wellness' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 58% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 4.0% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 9.9% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Ayr Wellness' P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Ayr Wellness' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Ayr Wellness' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for Ayr Wellness you should be aware of, and 2 of them don't sit too well with us.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CNSX:AYR.A

Ayr Wellness

Ayr Wellness Inc. cultivates, manufactures, and retails cannabis products and branded cannabis packaged goods in United States.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives