- Canada

- /

- Interactive Media and Services

- /

- TSXV:MVY

The Moovly Media (CVE:MVY) Share Price Has Soared 800%, Delighting Many Shareholders

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When you buy and hold the right company, the returns can make a huge difference to both you and your family. For example, the Moovly Media Inc. (CVE:MVY) share price rocketed moonwards 800% in just one year. It's also good to see the share price up 479% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. Looking back further, the stock price is 440% higher than it was three years ago.

It really delights us to see such great share price performance for investors.

See our latest analysis for Moovly Media

Moovly Media isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year Moovly Media saw its revenue grow by 21%. We respect that sort of growth, no doubt. Arguably it's more than reflected in the truly wondrous share price gain of 800% in the last year. While we are always careful about jumping on a hot stock too late, there's certainly good reason to keep an eye on Moovly Media.

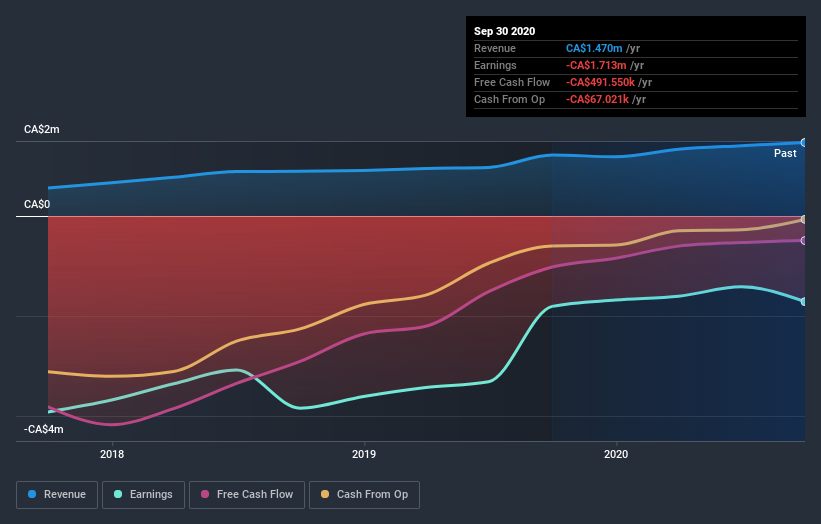

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Moovly Media's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Pleasingly, Moovly Media's total shareholder return last year was 800%. That gain actually surpasses the 75% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Moovly Media on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 5 warning signs for Moovly Media (of which 1 is significant!) you should know about.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade Moovly Media, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:MVY

Moovly Media

Engages in creating, marketing, communications and training videos, and video presentations business in Canada.

Moderate and overvalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026