- Canada

- /

- Healthtech

- /

- TSX:VHI

Top TSX Growth Companies With High Insider Ownership For August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has dropped 2.3%, but it remains up 9.5% over the past year, with earnings expected to grow by 15% annually in the coming years. In this context, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business and potential for robust performance amidst favorable market conditions.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.6% | 58.4% |

| goeasy (TSX:GSY) | 21.5% | 16.3% |

| Payfare (TSX:PAY) | 14.8% | 38.6% |

| Ivanhoe Mines (TSX:IVN) | 12.3% | 41.3% |

| Allied Gold (TSX:AAUC) | 22.5% | 58.0% |

| Alpha Cognition (CNSX:ACOG) | 17.9% | 66.5% |

| Aya Gold & Silver (TSX:AYA) | 10.3% | 68.5% |

| Artemis Gold (TSXV:ARTG) | 29.8% | 43.6% |

| Magna Mining (TSXV:NICU) | 10.6% | 94.7% |

| Silver X Mining (TSXV:AGX) | 14.1% | 144.2% |

Underneath we present a selection of stocks filtered out by our screen.

Stingray Group (TSX:RAY.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stingray Group Inc. operates as a music, media, and technology company worldwide with a market cap of CA$562.03 million.

Operations: Stingray Group Inc. generates revenue from two main segments: CA$129.37 million from Radio and CA$216.06 million from Broadcasting and Commercial Music.

Insider Ownership: 25.6%

Stingray Group Inc. demonstrates potential as a growth company with high insider ownership, marked by recent substantial insider buying and no significant selling. The company is forecast to become profitable within three years, although it currently has a high level of debt and its revenue growth (5.3% per year) lags behind the Canadian market average (6.8%). Recent product launches on The Roku Channel and Samsung VXT platforms could enhance revenue streams, despite reporting a net loss of C$13.74 million for the fiscal year ended March 31, 2024.

- Click to explore a detailed breakdown of our findings in Stingray Group's earnings growth report.

- Our expertly prepared valuation report Stingray Group implies its share price may be lower than expected.

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market cap of CA$1.37 billion.

Operations: The company's revenue segments include Patient Care at CA$183.82 million and Segment Adjustment at CA$650.96 million.

Insider Ownership: 19.6%

Savaria Corporation, with high insider ownership, shows promising growth potential. Its earnings are forecast to grow significantly at 24.87% per year, outpacing the Canadian market's 15.2%. However, the company has experienced shareholder dilution over the past year and significant insider selling in recent months. Savaria consistently pays a reliable monthly dividend of C$0.0433 per share and recently reported strong Q1 earnings with net income rising to C$11.05 million from C$6.04 million last year.

- Dive into the specifics of Savaria here with our thorough growth forecast report.

- Our valuation report here indicates Savaria may be overvalued.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. provides technology solutions for health and human service providers across multiple regions, including Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally; it has a market cap of CA$407.84 million.

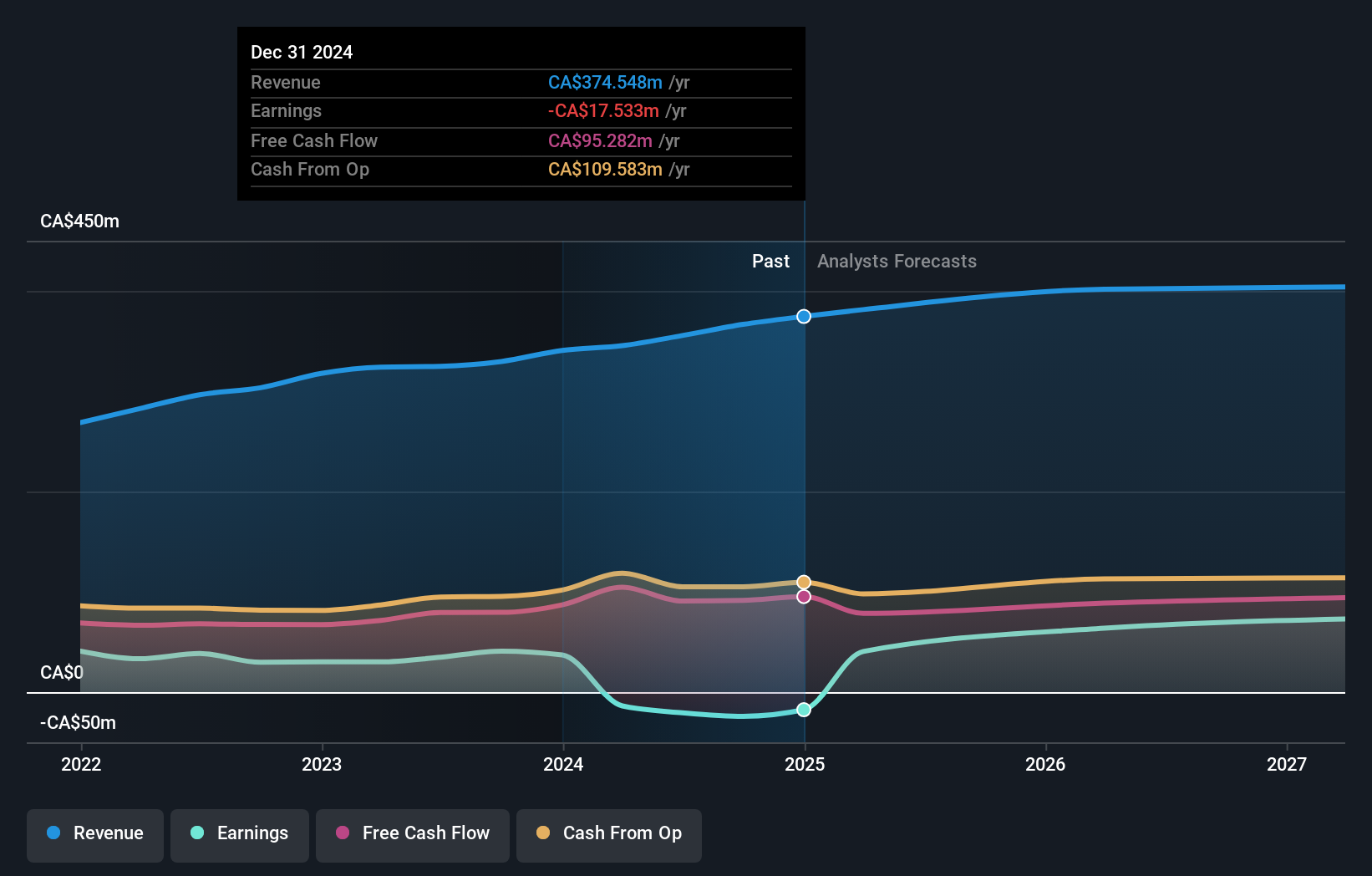

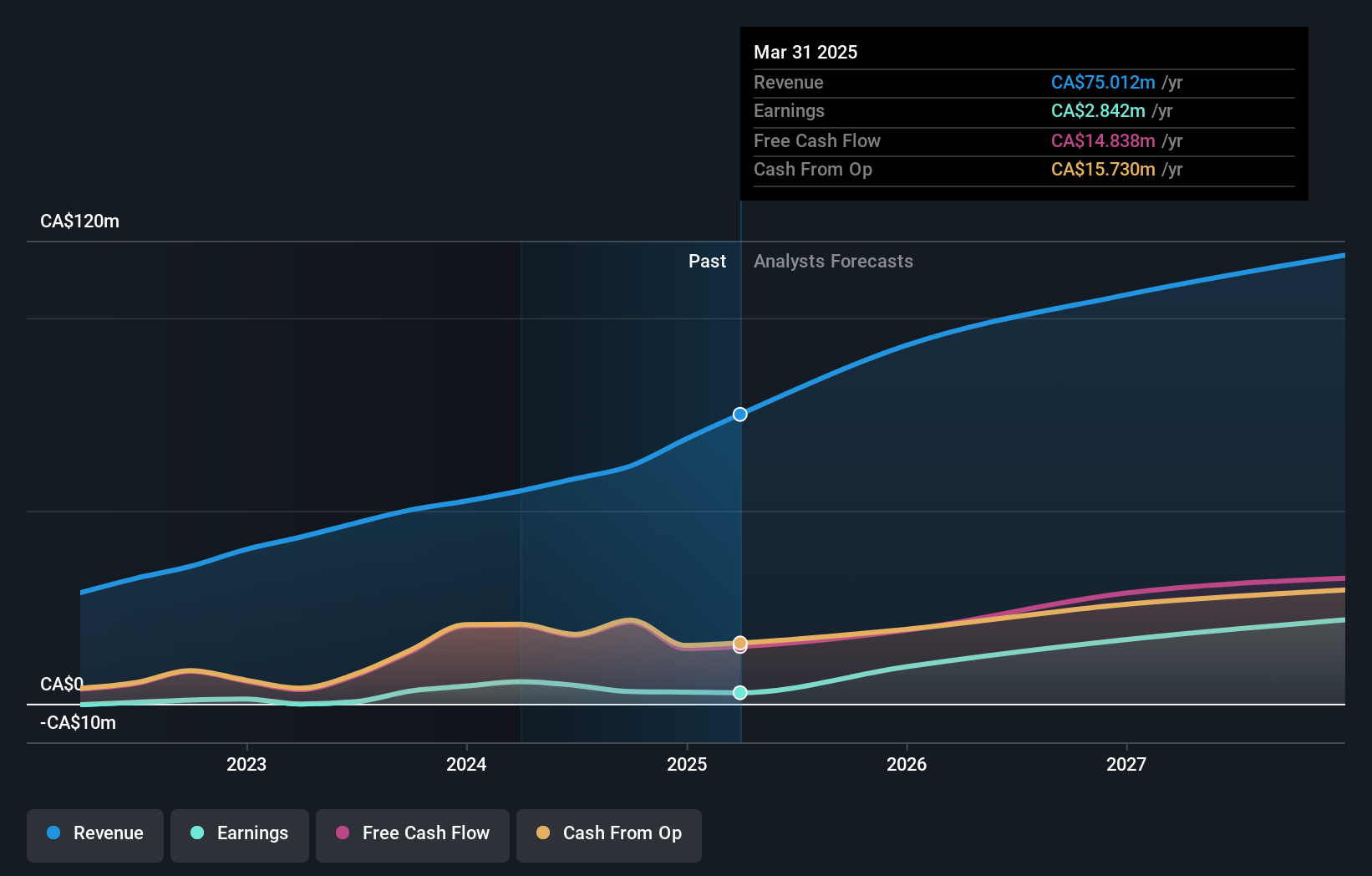

Operations: The company's revenue from healthcare software amounts to CA$55.17 million.

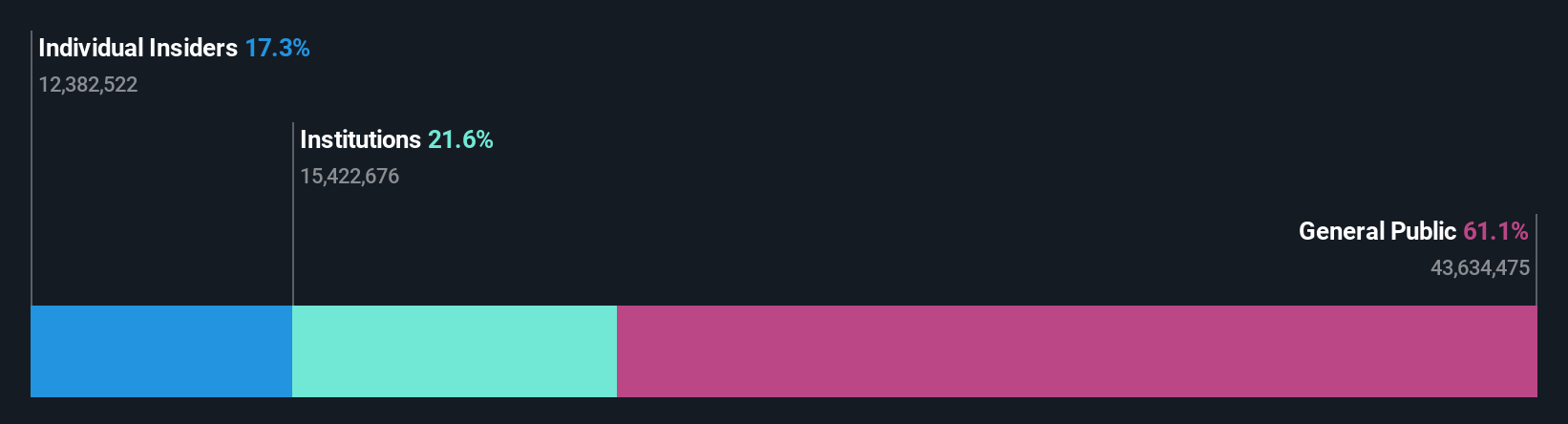

Insider Ownership: 15.1%

Vitalhub, a growth company with high insider ownership, has shown impressive financial performance. Their Q1 2024 earnings reported revenue of C$15.26 million and net income of C$1.32 million, both up from the previous year. The company's earnings are expected to grow significantly at 39.57% per year over the next three years, outpacing the Canadian market's 15.2%. Additionally, Vitalhub recently partnered with Lumenus Community Services to enhance data management and client tracking through their TREAT system implementation.

- Unlock comprehensive insights into our analysis of Vitalhub stock in this growth report.

- The analysis detailed in our Vitalhub valuation report hints at an deflated share price compared to its estimated value.

Turning Ideas Into Actions

- Investigate our full lineup of 30 Fast Growing TSX Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Flawless balance sheet with reasonable growth potential.