Revenues Not Telling The Story For Postmedia Network Canada Corp. (TSE:PNC.B) After Shares Rise 78%

Postmedia Network Canada Corp. (TSE:PNC.B) shares have had a really impressive month, gaining 78% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 6.0% in the last twelve months.

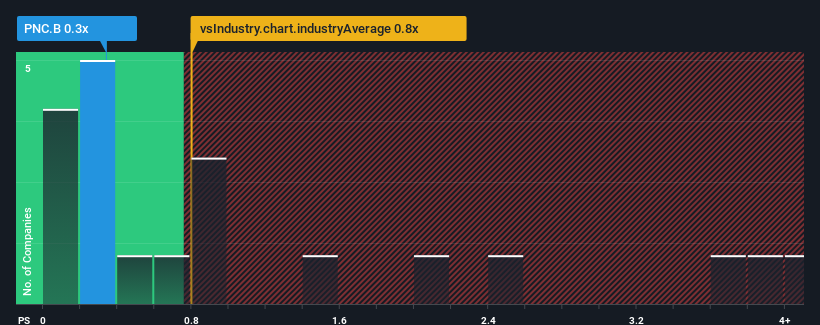

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Postmedia Network Canada's P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Media industry in Canada is also close to 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Postmedia Network Canada

What Does Postmedia Network Canada's Recent Performance Look Like?

We'd have to say that with no tangible growth over the last year, Postmedia Network Canada's revenue has been unimpressive. It might be that many expect the uninspiring revenue performance to only match most other companies at best over the coming period, which has kept the P/S from rising. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Postmedia Network Canada will help you shine a light on its historical performance.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Postmedia Network Canada's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 5.7% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 1.0% shows it's an unpleasant look.

With this information, we find it concerning that Postmedia Network Canada is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Postmedia Network Canada's P/S Mean For Investors?

Postmedia Network Canada appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our look at Postmedia Network Canada revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Postmedia Network Canada that you need to be mindful of.

If these risks are making you reconsider your opinion on Postmedia Network Canada, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:PNC.B

Postmedia Network Canada

Through its subsidiary, engages in publishing daily and non-daily newspapers in Canada.

Good value with slight risk.

Similar Companies

Market Insights

Community Narratives