Here's What We Learned About The CEO Pay At Glacier Media Inc. (TSE:GVC)

Jonathon James Kennedy became the CEO of Glacier Media Inc. (TSE:GVC) in 1998, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for Glacier Media.

See our latest analysis for Glacier Media

How Does Total Compensation For Jonathon James Kennedy Compare With Other Companies In The Industry?

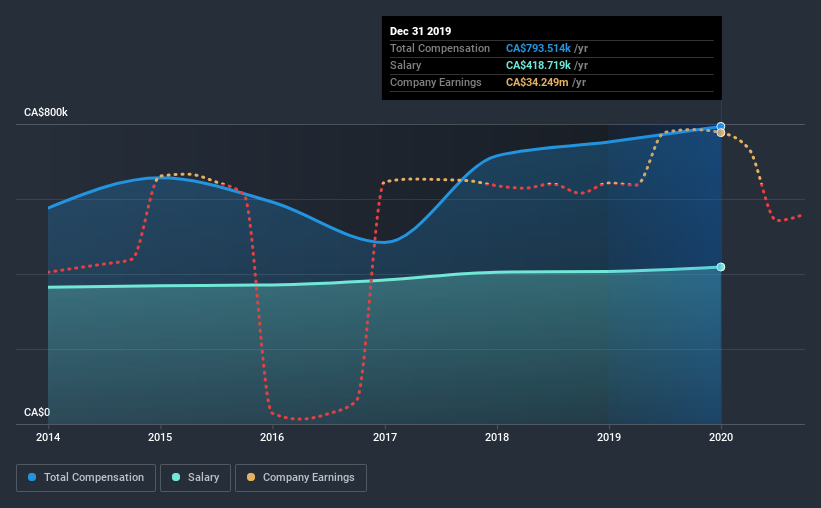

At the time of writing, our data shows that Glacier Media Inc. has a market capitalization of CA$34m, and reported total annual CEO compensation of CA$794k for the year to December 2019. That's a modest increase of 5.5% on the prior year. We note that the salary portion, which stands at CA$418.7k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the industry with market capitalizations below CA$256m, we found that the median total CEO compensation was CA$681k. From this we gather that Jonathon James Kennedy is paid around the median for CEOs in the industry. Furthermore, Jonathon James Kennedy directly owns CA$86k worth of shares in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | CA$419k | CA$407k | 53% |

| Other | CA$375k | CA$345k | 47% |

| Total Compensation | CA$794k | CA$752k | 100% |

Speaking on an industry level, salary and non-salary portions, both make up 50% each of the total remuneration. Glacier Media is largely mirroring the industry average when it comes to the share a salary enjoys in overall compensation. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Glacier Media Inc.'s Growth Numbers

Over the past three years, Glacier Media Inc. has seen its earnings per share (EPS) grow by 14% per year. In the last year, its revenue is down 16%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Glacier Media Inc. Been A Good Investment?

Given the total shareholder loss of 57% over three years, many shareholders in Glacier Media Inc. are probably rather dissatisfied, to say the least. So shareholders would probably want the company to be lessto generous with CEO compensation.

In Summary...

As we noted earlier, Glacier Media pays its CEO in line with similar-sized companies belonging to the same industry. On the other hand, the company has logged negative shareholder returns over the previous three years. But EPS growth is moving in a favorable direction, certainly a positive sign. Considering positive EPS growth, we'd say compensation is fair, but shareholders may be wary of a bump in pay before the company logs positive returns.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 2 warning signs for Glacier Media that investors should think about before committing capital to this stock.

Important note: Glacier Media is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Glacier Media, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:GVC

Glacier Media

Operates as an information and marketing solutions company in Canada and the United States.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success