Just because a business does not make any money, does not mean that the stock will go down. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So, the natural question for Wolfden Resources (CVE:WLF) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Wolfden Resources

Does Wolfden Resources Have A Long Cash Runway?

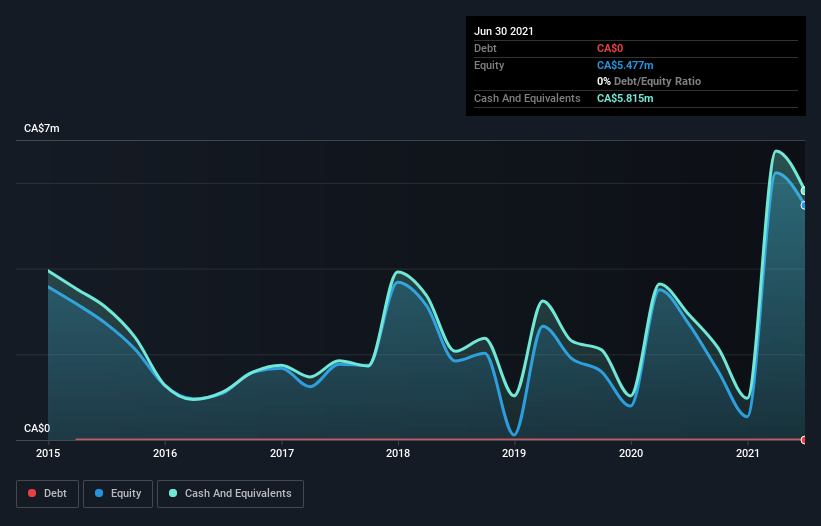

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In June 2021, Wolfden Resources had CA$5.8m in cash, and was debt-free. In the last year, its cash burn was CA$3.3m. That means it had a cash runway of around 21 months as of June 2021. Notably, however, the one analyst we see covering the stock thinks that Wolfden Resources will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. Depicted below, you can see how its cash holdings have changed over time.

Can Wolfden Resources Raise More Cash Easily?

Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Wolfden Resources' cash burn of CA$3.3m is about 12% of its CA$28m market capitalisation. Given that situation, it's fair to say the company wouldn't have much trouble raising more cash for growth, but shareholders would be somewhat diluted.

Is Wolfden Resources' Cash Burn A Worry?

Because Wolfden Resources is an early stage company, we don't have a great deal of data on which to form an opinion of its cash burn. Certainly, we'd be more confident in the stock if it was generating operating revenue. And it is worth keeping in mind that early stage companies are generally more risky than well established ones. Overall, we think its cash burn seems perfectly reasonable, and we are not concerned by it. Taking a deeper dive, we've spotted 6 warning signs for Wolfden Resources you should be aware of, and 2 of them make us uncomfortable.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

Valuation is complex, but we're here to simplify it.

Discover if Wolfden Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:WLF

Wolfden Resources

Engages in the acquisition, exploration, and development of mineral properties in Canada and the United States.

Flawless balance sheet with slight risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026