- Canada

- /

- Paper and Forestry Products

- /

- TSXV:WBE

Should You Be Adding WestBond Enterprises (CVE:WBE) To Your Watchlist Today?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

In contrast to all that, I prefer to spend time on companies like WestBond Enterprises (CVE:WBE), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for WestBond Enterprises

WestBond Enterprises's Improving Profits

In the last three years WestBond Enterprises's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. As a result, I'll zoom in on growth over the last year, instead. Like the last firework on New Year's Eve accelerating into the sky, WestBond Enterprises's EPS shot from CA$0.013 to CA$0.025, over the last year. You don't see 84% year-on-year growth like that, very often.

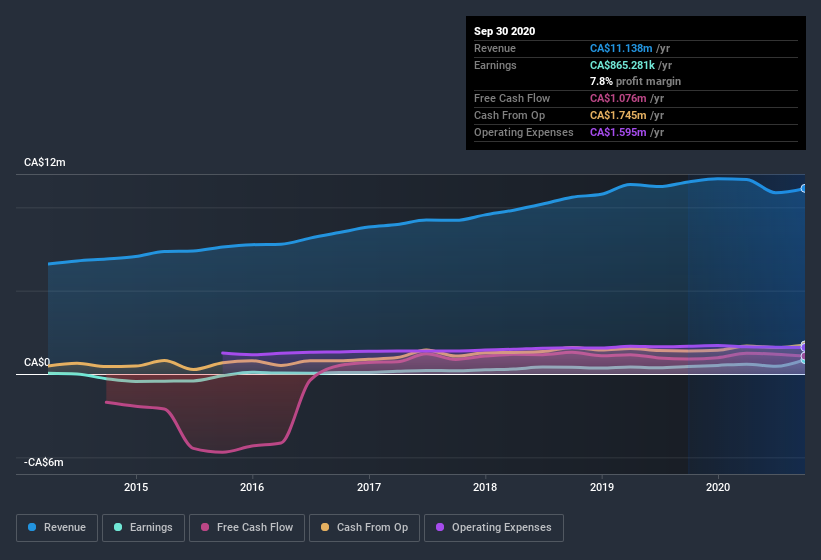

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Unfortunately, WestBond Enterprises's revenue dropped 3.4% last year, but the silver lining is that EBIT margins improved from 7.3% to 11%. That's not ideal.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

WestBond Enterprises isn't a huge company, given its market capitalization of CA$31m. That makes it extra important to check on its balance sheet strength.

Are WestBond Enterprises Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for WestBond Enterprises shareholders is that no insiders reported selling shares in the last year. With that in mind, it's heartening that Peter Toigo, the Independent Director of the company, paid CA$32k for shares at around CA$0.32 each.

And the insider buying isn't the only sign of alignment between shareholders and the board, since WestBond Enterprises insiders own more than a third of the company. Indeed, with a collective holding of 52%, company insiders are in control and have plenty of capital behind the venture. This makes me think they will be incentivised to plan for the long term - something I like to see. Valued at only CA$31m WestBond Enterprises is really small for a listed company. So despite a large proportional holding, insiders only have CA$16m worth of stock. That might not be a huge sum but it should be enough to keep insiders motivated!

Is WestBond Enterprises Worth Keeping An Eye On?

WestBond Enterprises's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. Because of the potential that it has reached an inflection point, I'd suggest WestBond Enterprises belongs on the top of your watchlist. You should always think about risks though. Case in point, we've spotted 3 warning signs for WestBond Enterprises you should be aware of.

As a growth investor I do like to see insider buying. But WestBond Enterprises isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you’re looking to trade WestBond Enterprises, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if WestBond Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:WBE

WestBond Enterprises

Together with its subsidiary WestBond Industries Inc., engages in the manufacture and sale of disposable paper products for medical, hygienic, and industrial uses in Canada and the United States.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success