- Canada

- /

- Metals and Mining

- /

- TSX:STGO

Undiscovered Gems In Canada November 2025

Reviewed by Simply Wall St

In the current Canadian market landscape, investors are observing a shift in mega-cap tech companies towards more asset-heavy models due to substantial investments in AI infrastructure, while maintaining optimism about capital expenditure plans. With no immediate signs of aggressive rate hikes or recessionary pressures, diversification remains crucial, and this environment presents an opportunity to explore lesser-known stocks that may offer potential growth and valuation expansion. In this context, identifying undiscovered gems involves looking for companies with strong fundamentals and growth prospects that align with these broader market trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.62% | 30.86% | ★★★★★★ |

| Itafos | 20.68% | 9.86% | 37.00% | ★★★★★★ |

| D-BOX Technologies | 1.78% | 25.62% | 81.11% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| GoGold Resources | NA | -0.04% | -59.92% | ★★★★★★ |

| Dundee | 1.46% | 5.82% | 52.46% | ★★★★★☆ |

| Melcor Developments | 47.67% | 8.75% | 12.05% | ★★★★☆☆ |

| Corby Spirit and Wine | 54.56% | 11.67% | -4.04% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.68% | -3.30% | -0.82% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Queen's Road Capital Investment (TSX:QRC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Queen's Road Capital Investment Ltd. is a resource-focused investment company that invests in privately held and publicly traded resource companies, with a market cap of CA$449.49 million.

Operations: The company generates revenue primarily through interest income and capital gains from its investments in resource companies. It reported a net profit margin of 65%, indicating efficient cost management relative to its revenue.

Queen's Road Capital Investment, a smaller player in the investment landscape, has shown remarkable financial performance with earnings surging by 538% over the past year, outpacing its industry peers. The company's net income soared to US$115.08 million from US$18.04 million last year, reflecting a significant improvement in profitability. With an appealing price-to-earnings ratio of 2.8x compared to the Canadian market's average of 16x, it presents good value. Furthermore, its debt management appears prudent with a net debt-to-equity ratio at 6.9%, well within satisfactory levels for investors seeking stability and growth potential.

- Unlock comprehensive insights into our analysis of Queen's Road Capital Investment stock in this health report.

Learn about Queen's Road Capital Investment's historical performance.

Steppe Gold (TSX:STGO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Steppe Gold Ltd. focuses on the operation, development, exploration, and acquisition of precious metal projects in Mongolia and Peru, with a market cap of CA$455.09 million.

Operations: Steppe Gold's revenue primarily stems from its precious metal projects, with a focus on gold production. The company experienced a gross profit margin of 60% in the latest financial period, reflecting effective cost management relative to its revenue generation.

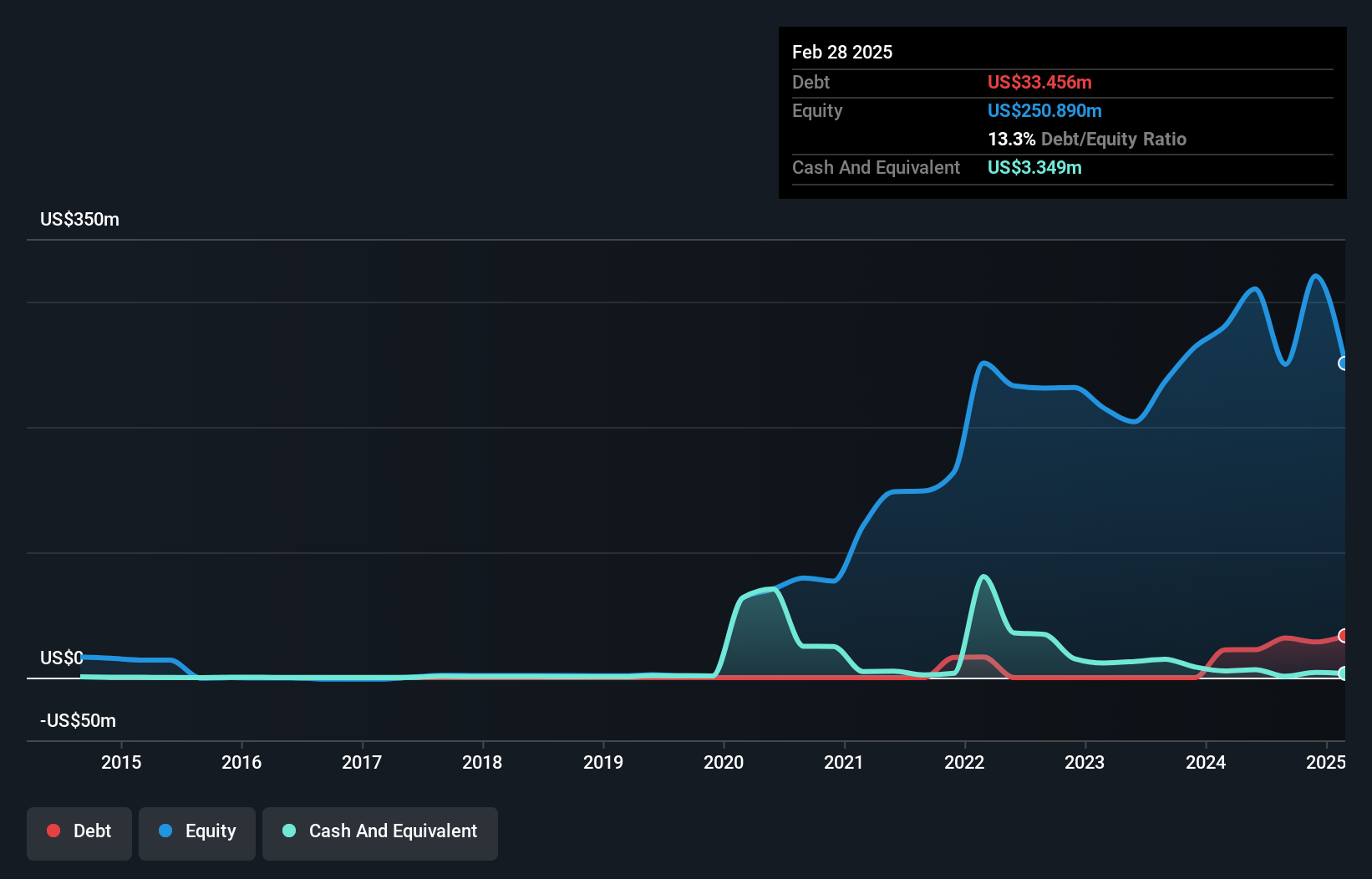

Steppe Gold, a small player in the mining sector, has shown mixed financial performance recently. The company's third-quarter sales were US$29.4 million, down from US$37.33 million the previous year, while net income fell to US$7.07 million from US$8.26 million. Despite these figures, its Price-To-Earnings ratio of 7.8x suggests it is undervalued compared to the broader Canadian market at 15.9x. With a satisfactory net debt to equity ratio of 39%, Steppe Gold's interest payments are well-covered by EBIT at 5.1 times coverage, indicating manageable debt levels amidst challenging earnings growth compared to industry peers.

- Click here and access our complete health analysis report to understand the dynamics of Steppe Gold.

Assess Steppe Gold's past performance with our detailed historical performance reports.

Thor Explorations (TSXV:THX)

Simply Wall St Value Rating: ★★★★★★

Overview: Thor Explorations Ltd., along with its subsidiaries, functions as a gold producer and explorer with a market cap of CA$718.52 million.

Operations: Thor Explorations generates revenue primarily through gold production and exploration activities. The company has a market capitalization of CA$718.52 million.

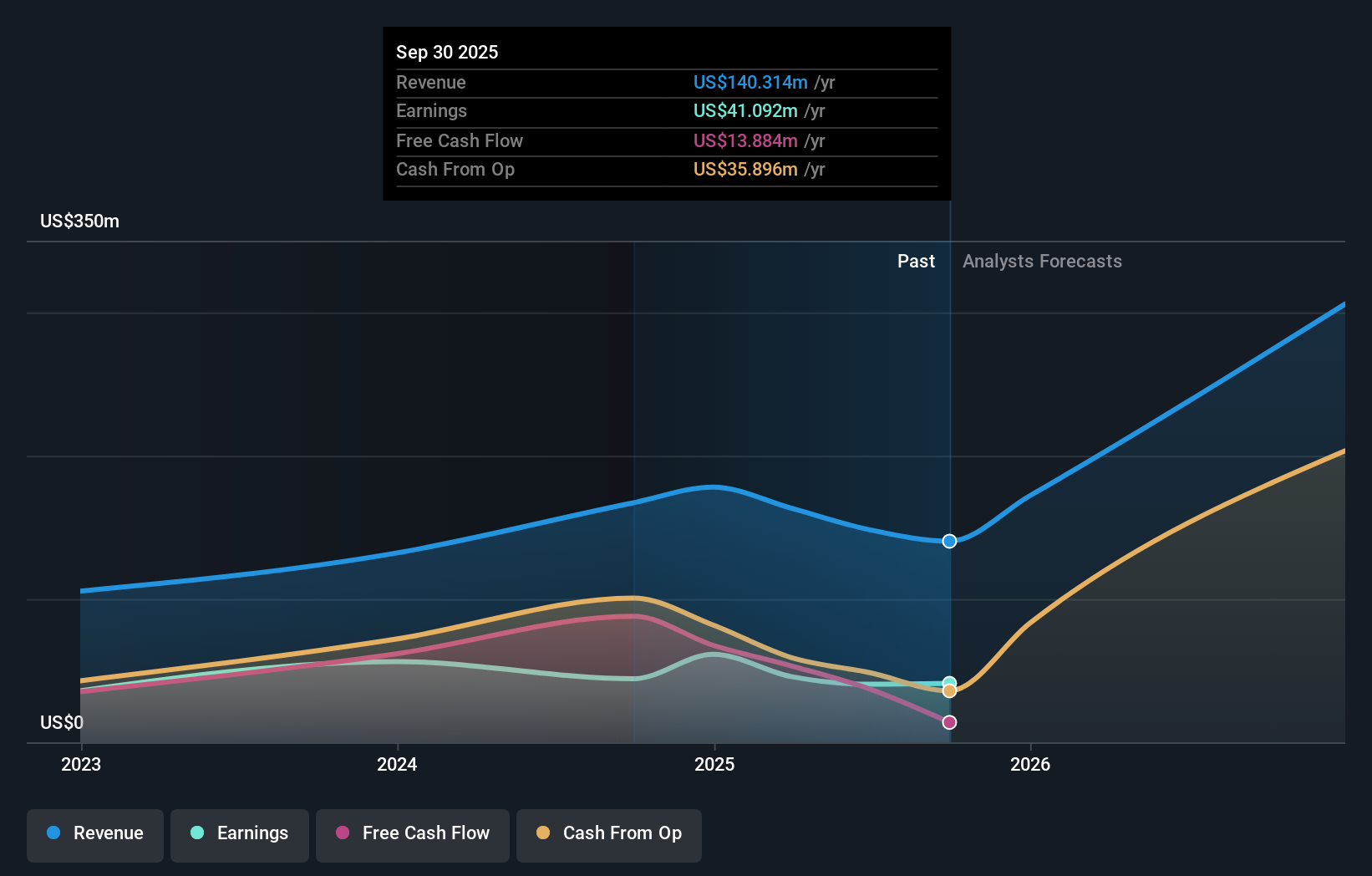

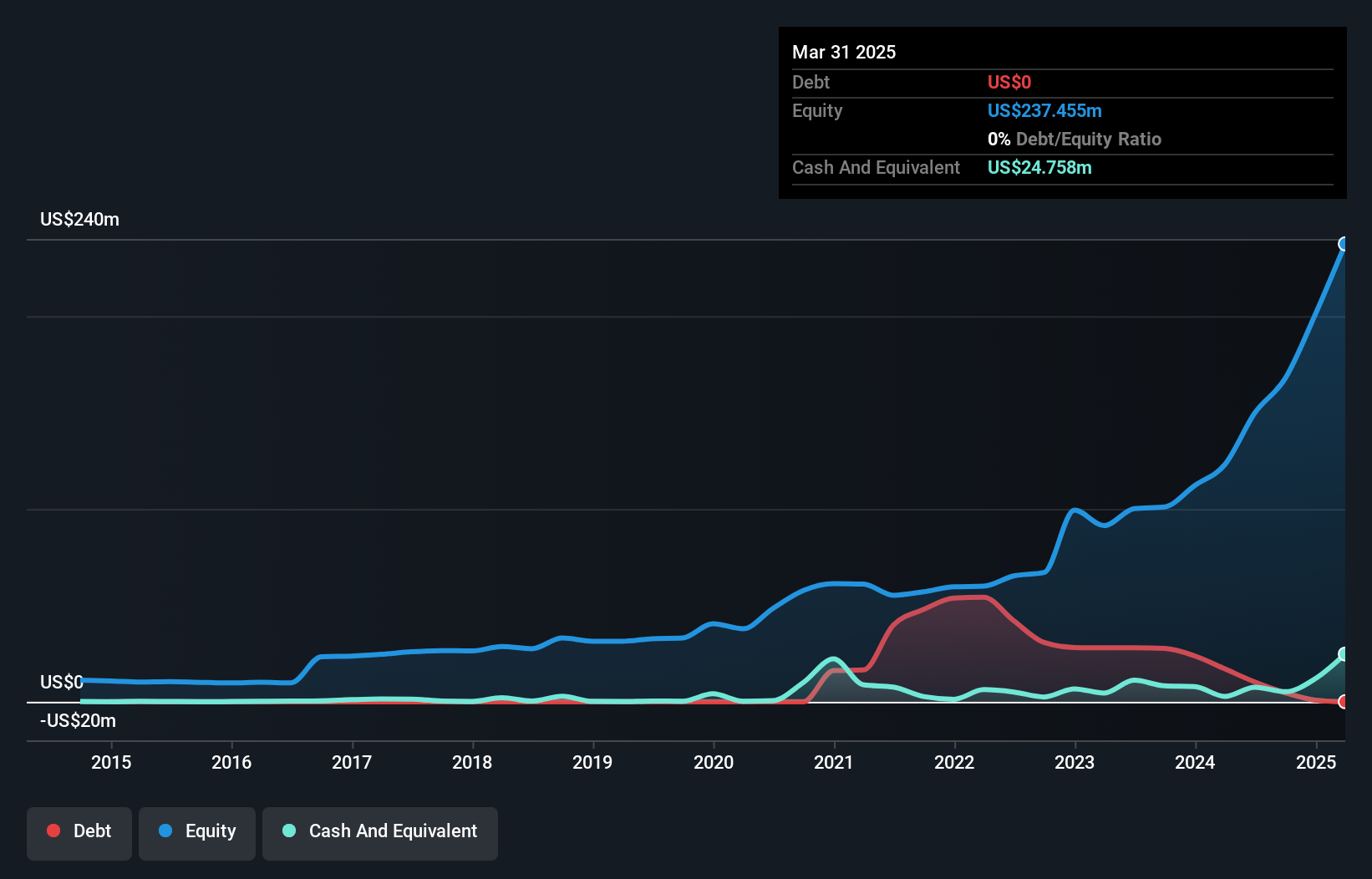

Thor Explorations, a nimble player in the gold mining sector, has shown impressive growth with earnings surging 312% over the past year. The company reported third-quarter sales of US$69.87 million, up from US$40.22 million a year ago, and net income rose to US$43.1 million from US$17.5 million previously. Despite being debt-free and trading at 78% below its estimated fair value, Thor faces challenges with forecasted earnings expected to decline by an average of 30.8% annually over the next three years due to its reliance on gold prices and limited asset diversification beyond its Segilola Gold Mine in Nigeria.

Summing It All Up

- Click here to access our complete index of 45 TSX Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:STGO

Steppe Gold

Engages in operating, developing, exploring, and acquiring precious metal projects in Mongolia and Peru.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives