- Canada

- /

- Metals and Mining

- /

- TSXV:SLI

We're Not Very Worried About Standard Lithium's (CVE:SLI) Cash Burn Rate

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, Standard Lithium (CVE:SLI) shareholders have done very well over the last year, with the share price soaring by 471%. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So notwithstanding the buoyant share price, we think it's well worth asking whether Standard Lithium's cash burn is too risky. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

See our latest analysis for Standard Lithium

When Might Standard Lithium Run Out Of Money?

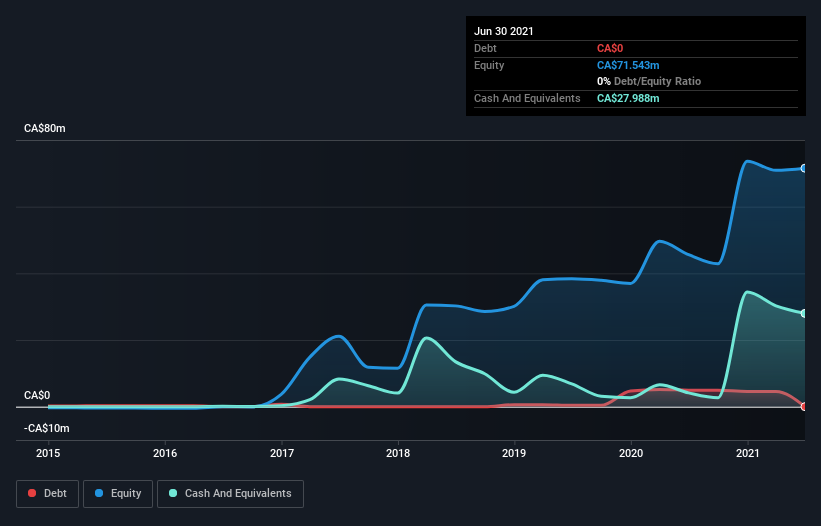

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at June 2021, Standard Lithium had cash of CA$28m and no debt. In the last year, its cash burn was CA$19m. So it had a cash runway of approximately 17 months from June 2021. Notably, analysts forecast that Standard Lithium will break even (at a free cash flow level) in about 3 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. You can see how its cash balance has changed over time in the image below.

How Is Standard Lithium's Cash Burn Changing Over Time?

Because Standard Lithium isn't currently generating revenue, we consider it an early-stage business. Nonetheless, we can still examine its cash burn trajectory as part of our assessment of its cash burn situation. It seems likely that the business is content with its current spending, as the cash burn rate stayed steady over the last twelve months. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can Standard Lithium Raise Cash?

While Standard Lithium is showing a solid reduction in its cash burn, it's still worth considering how easily it could raise more cash, even just to fuel faster growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Standard Lithium has a market capitalisation of CA$1.9b and burnt through CA$19m last year, which is 1.0% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is Standard Lithium's Cash Burn A Worry?

Standard Lithium appears to be in pretty good health when it comes to its cash burn situation. One the one hand we have its solid cash runway, while on the other it can also boast very strong cash burn relative to its market cap. Shareholders can take heart from the fact that analysts are forecasting it will reach breakeven. Based on the factors mentioned in this article, we think its cash burn situation warrants some attention from shareholders, but we don't think they should be worried. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Standard Lithium (3 are significant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies, and this list of stocks growth stocks (according to analyst forecasts)

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:SLI

Standard Lithium

Explores for, develops, and processes lithium brine properties in the United States.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success