As the Canadian market navigates through trade developments, central bank meetings, and fiscal debates, investors are keeping a close eye on potential volatility and opportunities. Penny stocks, often representing smaller or newer companies, remain an intriguing investment area despite being considered somewhat outdated. These stocks can offer growth at lower price points when backed by strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| PetroTal (TSX:TAL) | CA$0.66 | CA$603.79M | ✅ 3 ⚠️ 3 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.29 | CA$691.1M | ✅ 4 ⚠️ 2 View Analysis > |

| Dynacor Group (TSX:DNG) | CA$4.51 | CA$190.55M | ✅ 4 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.44 | CA$12.89M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.73 | CA$485.67M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.93 | CA$17.24M | ✅ 2 ⚠️ 4 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.35 | CA$98.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.20 | CA$132.66M | ✅ 3 ⚠️ 2 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.84 | CA$177.31M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$0.95 | CA$5.42M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 878 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

BTQ Technologies (NEOE:BTQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: BTQ Technologies Corp. focuses on developing computer-based technology for post-quantum cryptography in blockchain applications, with a market cap of CA$595.17 million.

Operations: BTQ Technologies Corp. has not reported any revenue segments.

Market Cap: CA$595.17M

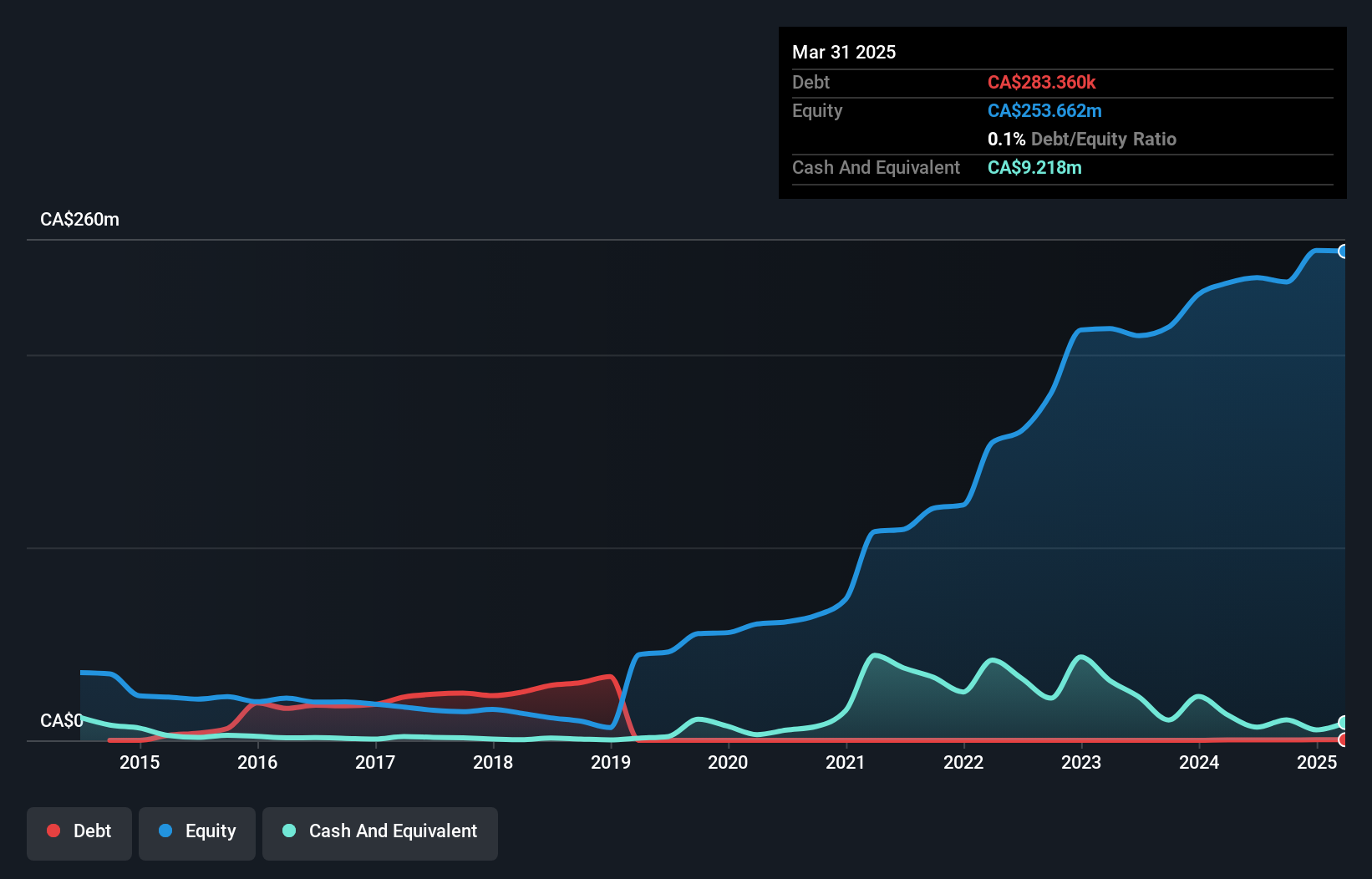

BTQ Technologies Corp., a pre-revenue company focusing on post-quantum cryptography, has recently formed strategic alliances to enhance its quantum-secure technologies. Notably, it partnered with QPerfect to co-develop secure digital transaction solutions using neutral atom quantum processors. Its proprietary CASH architecture demonstrates significant performance advantages, including up to 5x faster encryption processing and ultra-low power consumption, positioning BTQ as a potential leader in the quantum-safe technology space. Despite high share price volatility and negative return on equity, BTQ remains debt-free with sufficient cash runway for over a year based on current free cash flow trends.

- Jump into the full analysis health report here for a deeper understanding of BTQ Technologies.

- Understand BTQ Technologies' earnings outlook by examining our growth report.

Talon Metals (TSX:TLO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Talon Metals Corp. is a mineral exploration company focused on exploring and developing mineral properties in the United States, with a market cap of CA$206.59 million.

Operations: Talon Metals Corp. does not report any specific revenue segments, as it is primarily engaged in mineral exploration and development activities.

Market Cap: CA$206.59M

Talon Metals Corp., a pre-revenue mineral exploration company, recently announced a CA$38.99 million private placement to bolster its financial position. The company is focused on developing its Tamarack Nickel Copper Project, showcasing promising drill results with high-grade nickel and copper intercepts. Despite the positive drilling outcomes, Talon remains unprofitable with limited revenue generation and has experienced increased share price volatility. However, it benefits from a seasoned management team and board of directors. The recent capital raise extends its cash runway significantly beyond the previous five months based on last reported free cash flow figures.

- Click to explore a detailed breakdown of our findings in Talon Metals' financial health report.

- Review our growth performance report to gain insights into Talon Metals' future.

Standard Lithium (TSXV:SLI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Standard Lithium Ltd. explores, develops, and processes lithium brine properties in the United States with a market cap of CA$482.60 million.

Operations: Standard Lithium Ltd. has not reported any revenue segments at this time.

Market Cap: CA$482.6M

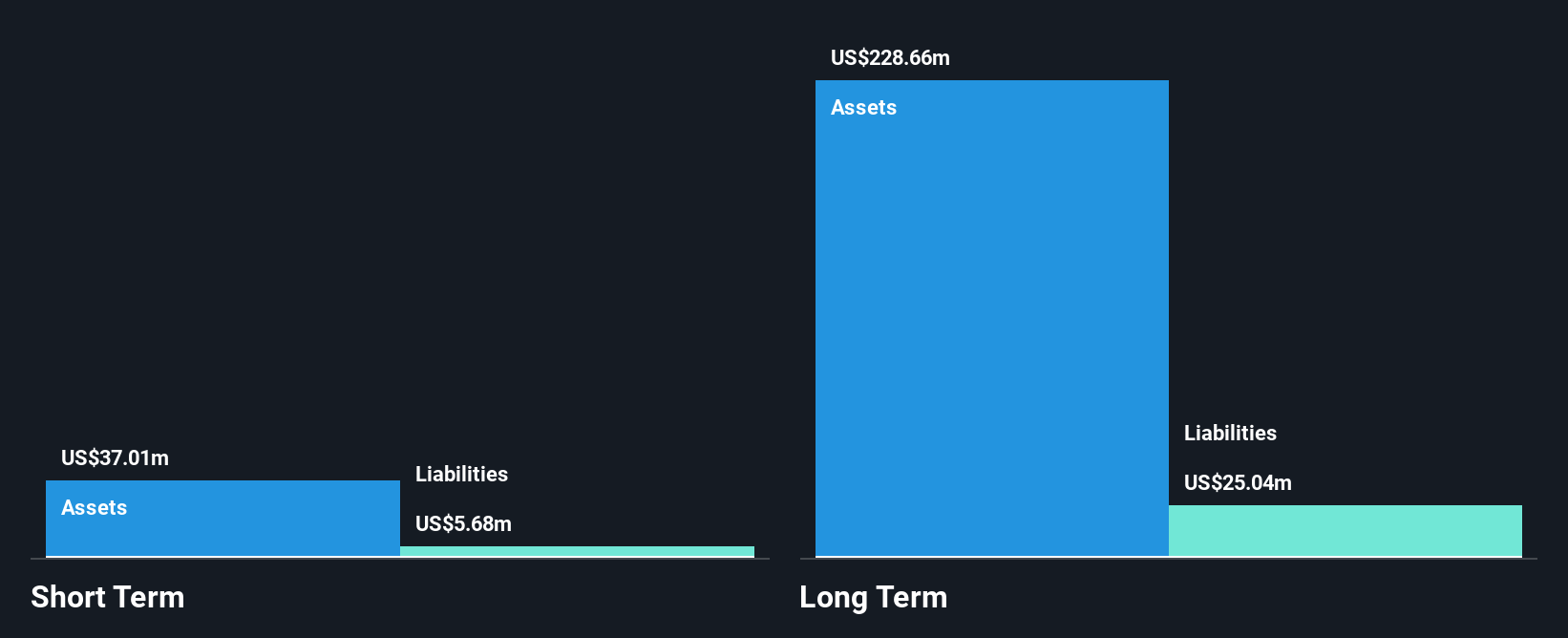

Standard Lithium Ltd., a pre-revenue company with a market cap of CA$482.60 million, is advancing its lithium brine projects in the U.S. The company recently announced successful production of battery-quality lithium sulfide through a collaboration with Telescope Innovations, highlighting its innovative approach in developing next-generation battery materials. Despite not yet generating significant revenue, Standard Lithium has reduced its net losses over the past year and maintains strong financial health with short-term assets exceeding both short- and long-term liabilities. Additionally, it remains debt-free and has filed for a $1 billion shelf registration to potentially support future growth initiatives.

- Get an in-depth perspective on Standard Lithium's performance by reading our balance sheet health report here.

- Evaluate Standard Lithium's prospects by accessing our earnings growth report.

Where To Now?

- Take a closer look at our TSX Penny Stocks list of 878 companies by clicking here.

- Want To Explore Some Alternatives? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BTQ Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NEOE:BTQ

BTQ Technologies

Engages in the development of computer-based technology related to post-quantum cryptography for applications in blockchain and related technologies.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives