- Canada

- /

- Metals and Mining

- /

- TSXV:MMG

Discover 3 TSX Penny Stocks With Market Caps Over CA$30M

Reviewed by Simply Wall St

The TSX is having a strong year, up more than 17%, reflecting the broader trend of robust market performance seen in major indices like the S&P 500. Amidst this backdrop, investors are increasingly exploring diverse opportunities, including those presented by penny stocks. Although often associated with smaller or newer companies, these stocks can offer surprising value and growth potential when backed by solid financial foundations.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$620.84M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$5.18M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.34 | CA$304.56M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$116.65M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$298.44M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.37 | CA$236.62M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$29.82M | ★★★★★★ |

Click here to see the full list of 948 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Apollo Silver (TSXV:APGO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Apollo Silver Corp. is involved in the exploration and development of silver properties in the United States, with a market cap of CA$50.66 million.

Operations: Apollo Silver Corp. has not reported any revenue segments.

Market Cap: CA$50.66M

Apollo Silver Corp., with a market cap of CA$50.66 million, is pre-revenue and currently unprofitable, reflecting its stage as an exploration-focused entity in the mining sector. Despite this, it remains debt-free and has sufficient short-term assets to cover liabilities. The company recently announced a non-brokered private placement to raise up to CA$10 million, potentially extending its cash runway beyond the current eight months forecasted from free cash flow estimates. Additionally, Apollo's board has seen recent changes with the appointment of Alex Tsakumis, bringing extensive industry expertise that may influence strategic direction positively.

- Unlock comprehensive insights into our analysis of Apollo Silver stock in this financial health report.

- Understand Apollo Silver's track record by examining our performance history report.

Metallic Minerals (TSXV:MMG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metallic Minerals Corp. focuses on acquiring, exploring, and developing mineral properties in Canada and the United States, with a market cap of CA$37.80 million.

Operations: Metallic Minerals Corp. has not reported any revenue segments.

Market Cap: CA$37.8M

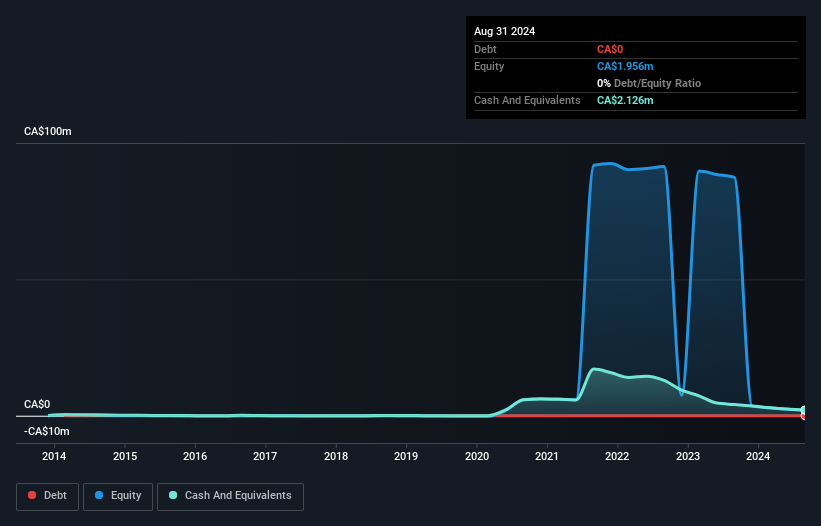

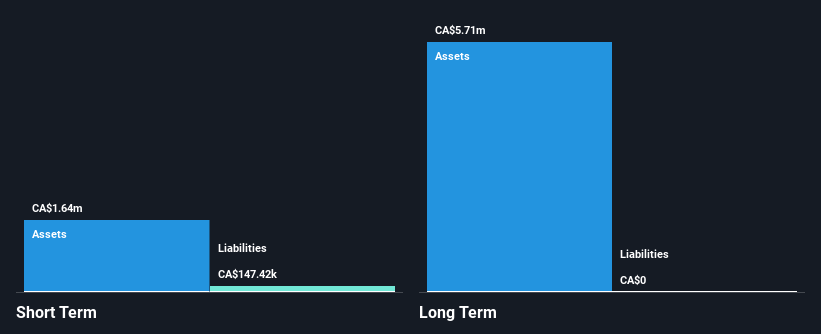

Metallic Minerals Corp., with a market cap of CA$37.80 million, is pre-revenue and unprofitable, typical for an exploration-focused entity. The company is debt-free and has no long-term liabilities, though shareholders experienced dilution with a 5.5% increase in shares outstanding over the past year. Short-term assets of CA$1.6 million comfortably cover its short-term liabilities of CA$147.4K, but its cash runway was limited to one month as of April 2024 before raising additional capital. Despite high share price volatility, the management team and board are considered experienced, potentially guiding strategic advancements effectively.

- Dive into the specifics of Metallic Minerals here with our thorough balance sheet health report.

- Gain insights into Metallic Minerals' historical outcomes by reviewing our past performance report.

Standard Lithium (TSXV:SLI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Standard Lithium Ltd. explores, develops, and processes lithium brine properties in the United States with a market cap of CA$502.06 million.

Operations: Standard Lithium Ltd. currently does not report any revenue segments.

Market Cap: CA$502.06M

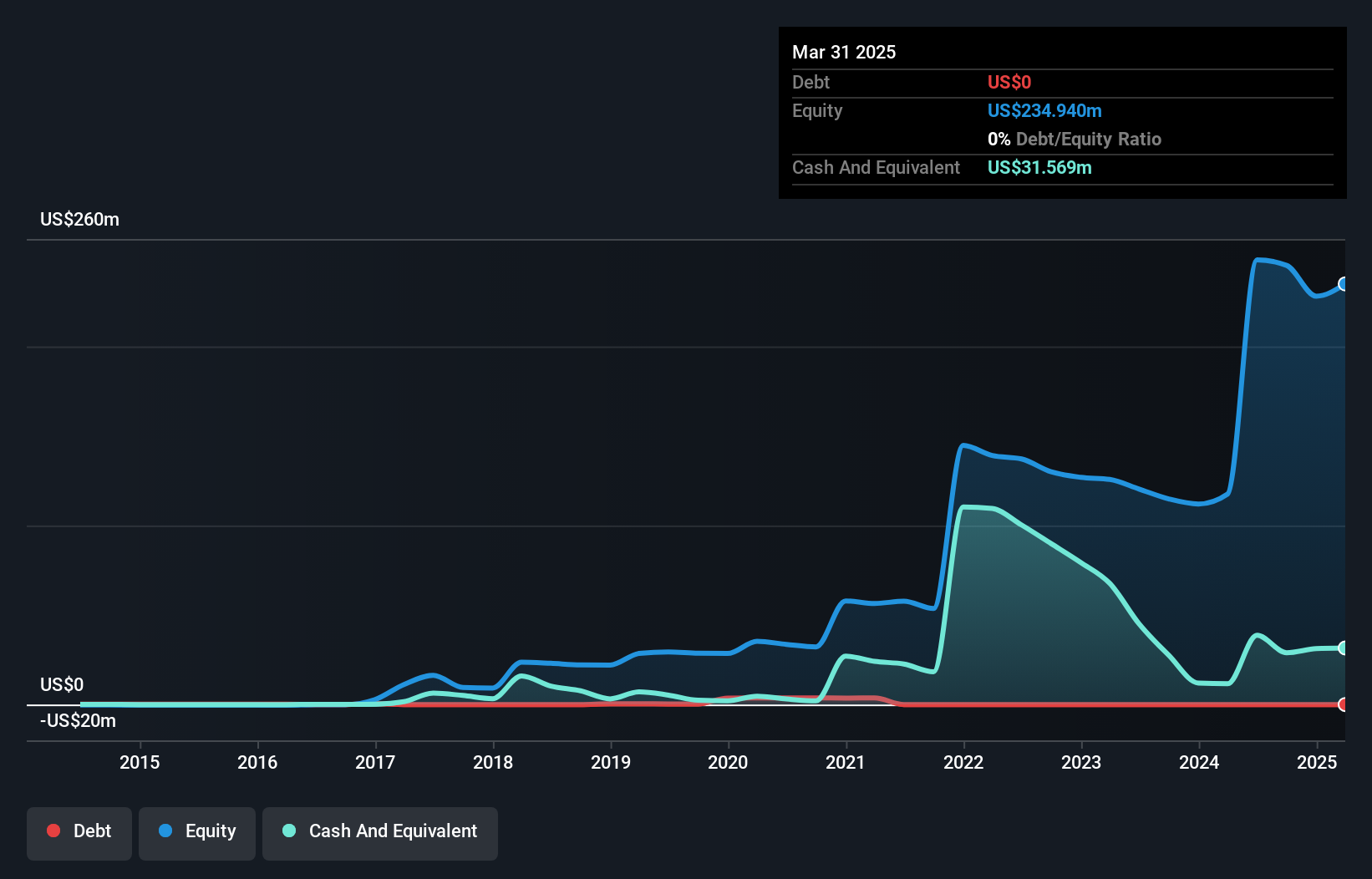

Standard Lithium Ltd., with a market cap of CA$502.06 million, has transitioned to profitability, reporting a net income of CA$147.45 million for the year ended June 2024. The company is debt-free and boasts an outstanding Return on Equity of 43.4%. However, it remains pre-revenue with less than US$1m in revenue reported. Recent developments include securing up to US$225 million from the U.S. Department of Energy for its South West Arkansas project, aimed at producing lithium carbonate using Direct Lithium Extraction technology. Despite significant insider selling and shareholder dilution over the past year, Standard Lithium's strategic partnerships and leadership changes position it for potential growth in critical mineral supply chains.

- Click here and access our complete financial health analysis report to understand the dynamics of Standard Lithium.

- Explore Standard Lithium's analyst forecasts in our growth report.

Seize The Opportunity

- Explore the 948 names from our TSX Penny Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MMG

Metallic Minerals

Engages in the acquisition, exploration, and development of mineral properties in Canada and the United States.

Flawless balance sheet moderate.