- Canada

- /

- Metals and Mining

- /

- TSXV:SCZ

Can Santacruz Silver Mining's (TSXV:SCZ) Board Refresh Unlock Greater Emerging Markets Potential?

Reviewed by Sasha Jovanovic

- Santacruz Silver Mining Ltd. announced the appointment of Bruce Wolfson to its board of directors effective November 17, 2025, bringing over 40 years of international finance, legal, and emerging market investment experience, especially in Latin America and Asia.

- This leadership change, alongside board transition plans, brings an influential governance background that could shape future opportunities for the company.

- We will explore how Bruce Wolfson's deep expertise in emerging markets may influence Santacruz Silver Mining's investment narrative going forward.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Santacruz Silver Mining's Investment Narrative?

For anyone considering a position in Santacruz Silver Mining, the underlying thesis still centers on exposure to silver production with assets in Latin America, leveraging favorable silver prices and the successful integration of new acquisitions like the Soracaya Project. The appointment of Bruce Wolfson, whose experience in international finance and emerging markets spans decades, signals a shift toward more experienced governance at a time when the company continues to expand in Bolivia and make substantial payments on prior acquisitions. In the short term, attention remains on silver output stability and progress on full permitting at Soracaya, core catalysts currently driving sentiment. While the board refresh could improve risk management and capital allocation, its impact is likely to be gradual rather than immediate. Major risks remain, including previous concerns flagged by auditors about the company’s ability to continue as a going concern, production variability, and insider selling. The recent board change has the potential to strengthen leadership, but does not directly address these near-term challenges. On the flip side, ongoing insider selling is something every shareholder should keep in mind.

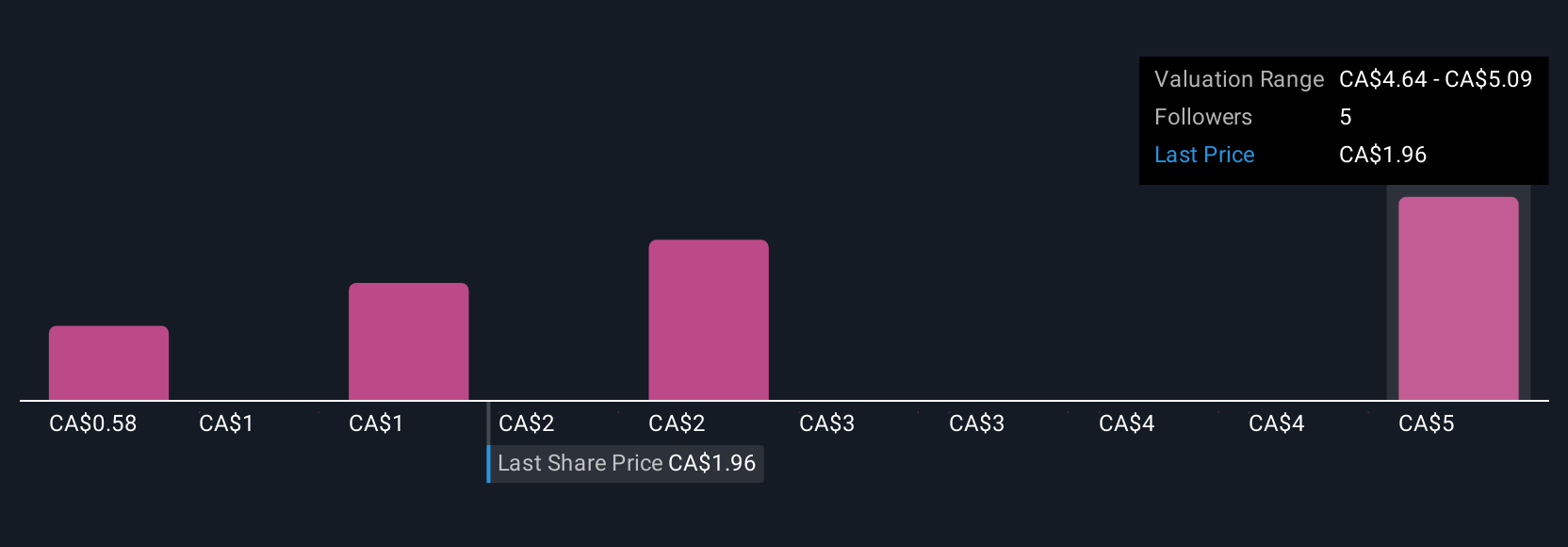

Despite retreating, Santacruz Silver Mining's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 11 other fair value estimates on Santacruz Silver Mining - why the stock might be worth less than half the current price!

Build Your Own Santacruz Silver Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Santacruz Silver Mining research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Santacruz Silver Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Santacruz Silver Mining's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SCZ

Santacruz Silver Mining

Engages in the acquisition, exploration, development, production, and operation of mineral properties in Latin America.

Flawless balance sheet and good value.

Market Insights

Community Narratives