- Canada

- /

- Metals and Mining

- /

- TSX:ARG

TSX Penny Stocks Under CA$500M Market Cap To Watch

Reviewed by Simply Wall St

As the Canadian market continues to navigate its third year of a bull run, marked by impressive gains since October 2022, investors are exploring opportunities beyond established giants. With trade tensions and economic shifts in mind, penny stocks remain an intriguing option for those seeking growth potential in smaller or newer companies. Though the term "penny stocks" may seem outdated, these investments can still offer significant value when backed by strong financials and clear growth prospects.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.69 | CA$67.75M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.50 | CA$247.84M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.40 | CA$3.17M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.08 | CA$765.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.99 | CA$20.41M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.01 | CA$812.82M | ✅ 4 ⚠️ 3 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.72 | CA$431.18M | ✅ 3 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.07 | CA$174.09M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.16 | CA$201.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.83M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Amerigo Resources (TSX:ARG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amerigo Resources Ltd., with a market cap of CA$431.18 million, operates through its subsidiary Minera Valle Central S.A. to produce copper and molybdenum concentrates in Chile.

Operations: The company's revenue is primarily generated from the production of copper concentrates under a tolling agreement with DET, amounting to $191.28 million.

Market Cap: CA$431.18M

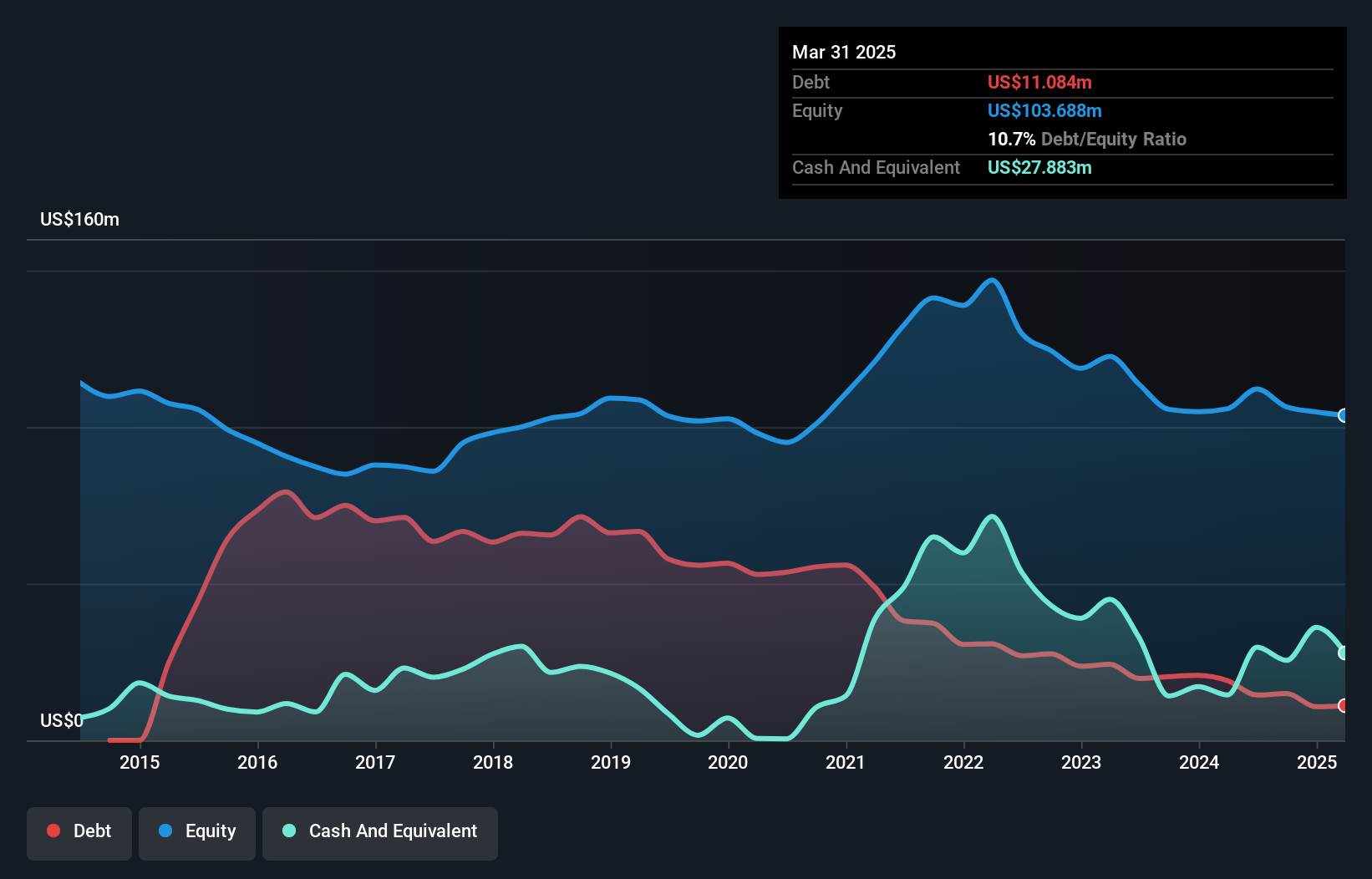

Amerigo Resources Ltd. presents a mixed picture for investors interested in penny stocks. The company has demonstrated strong earnings growth of 32.3% over the past year and maintains high-quality earnings, with interest payments well covered by EBIT at 15.1 times coverage and operating cash flow covering debt by a very large margin. However, short-term liabilities exceed short-term assets, posing potential liquidity concerns despite having more cash than total debt. Recent developments include the declaration of its seventeenth consecutive quarterly dividend and a new three-year labor agreement in Chile, reflecting operational stability amidst challenges such as lower-than-forecast tailings throughput from El Teniente mine operations.

- Click here and access our complete financial health analysis report to understand the dynamics of Amerigo Resources.

- Review our growth performance report to gain insights into Amerigo Resources' future.

Mega Uranium (TSX:MGA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Mega Uranium Ltd. is a uranium mining and investment company focused on exploring uranium properties mainly in Canada and Australia, with a market cap of CA$147.24 million.

Operations: Mega Uranium Ltd. does not report specific revenue segments.

Market Cap: CA$147.24M

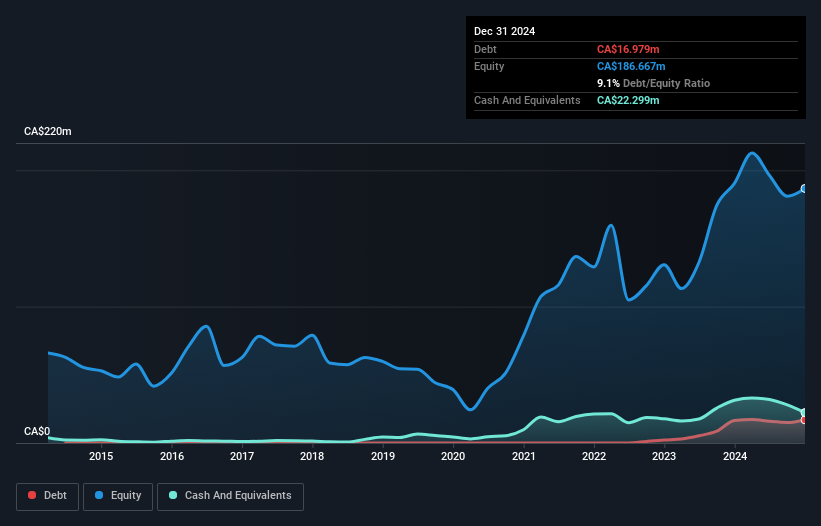

Mega Uranium Ltd. offers a complex scenario for investors exploring penny stocks. Despite being pre-revenue, the company reported a net income of CA$5.87 million for Q3 2025, contrasting with a loss in the same quarter last year. However, it remains unprofitable over nine months with increased losses compared to the previous year. The company's short-term assets slightly lag behind its liabilities, although it has more cash than debt and sufficient cash runway exceeding three years if current free cash flow trends persist. Leadership is seasoned with experienced management and board members averaging tenures of over nine years each.

- Click here to discover the nuances of Mega Uranium with our detailed analytical financial health report.

- Gain insights into Mega Uranium's historical outcomes by reviewing our past performance report.

Regulus Resources (TSXV:REG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Regulus Resources Inc. is a mineral exploration company operating in Canada and Peru, with a market cap of CA$328.74 million.

Operations: Regulus Resources Inc. does not report any revenue segments.

Market Cap: CA$328.74M

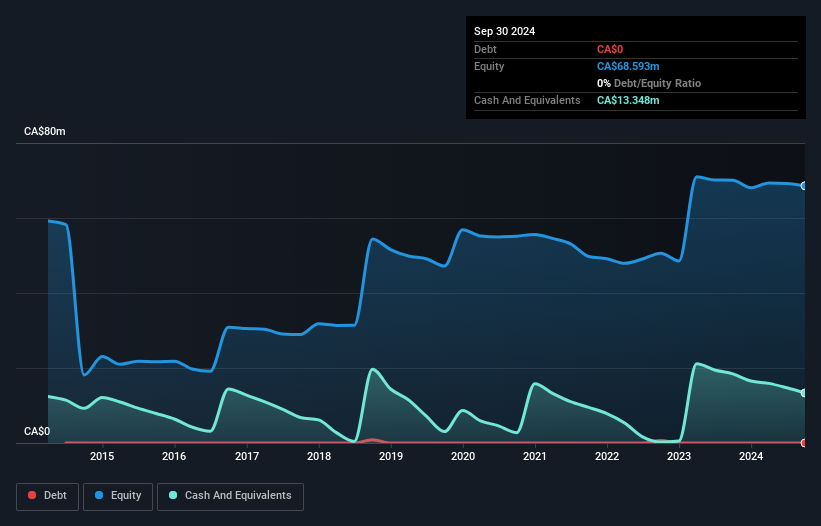

Regulus Resources Inc. presents a mixed picture for penny stock investors. As a pre-revenue mineral exploration company, it remains unprofitable with a net loss of CA$2.06 million for Q3 2025, an increase from the previous year. Despite this, Regulus is debt-free and its short-term assets substantially exceed liabilities, offering financial stability with over a year’s cash runway at current free cash flow levels. The seasoned management and board members bring extensive experience to the table, which could be beneficial as the company continues to navigate its exploration activities in Canada and Peru.

- Dive into the specifics of Regulus Resources here with our thorough balance sheet health report.

- Explore historical data to track Regulus Resources' performance over time in our past results report.

Where To Now?

- Click here to access our complete index of 410 TSX Penny Stocks.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARG

Amerigo Resources

Through its subsidiary, Minera Valle Central S.A., produces copper and molybdenum concentrates in Chile.

Flawless balance sheet and good value.

Market Insights

Community Narratives