- Canada

- /

- Specialty Stores

- /

- TSX:KITS

TSX Growth Companies With High Insider Ownership Unveiled

Reviewed by Simply Wall St

As the Canadian market navigates shifting business models and asset-heavy investments in technology, the focus remains on diversification to balance portfolios amid elevated valuations. In this context, growth companies with high insider ownership can offer unique insights into potential opportunities, as these insiders often have a vested interest in the long-term success of their firms.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| West Red Lake Gold Mines (TSXV:WRLG) | 11.1% | 78% |

| Stingray Group (TSX:RAY.A) | 22.8% | 33.9% |

| Robex Resources (TSXV:RBX) | 20.6% | 97.7% |

| Propel Holdings (TSX:PRL) | 30.6% | 32.1% |

| goeasy (TSX:GSY) | 21.7% | 27.3% |

| Enterprise Group (TSX:E) | 35.6% | 32.7% |

| CEMATRIX (TSX:CEMX) | 10.5% | 58.3% |

| California Nanotechnologies (TSXV:CNO) | 19% | 153% |

| Almonty Industries (TSX:AII) | 12.1% | 65.1% |

| Allied Gold (TSX:AAUC) | 14.9% | 104.6% |

Let's uncover some gems from our specialized screener.

Kits Eyecare (TSX:KITS)

Simply Wall St Growth Rating: ★★★★★☆

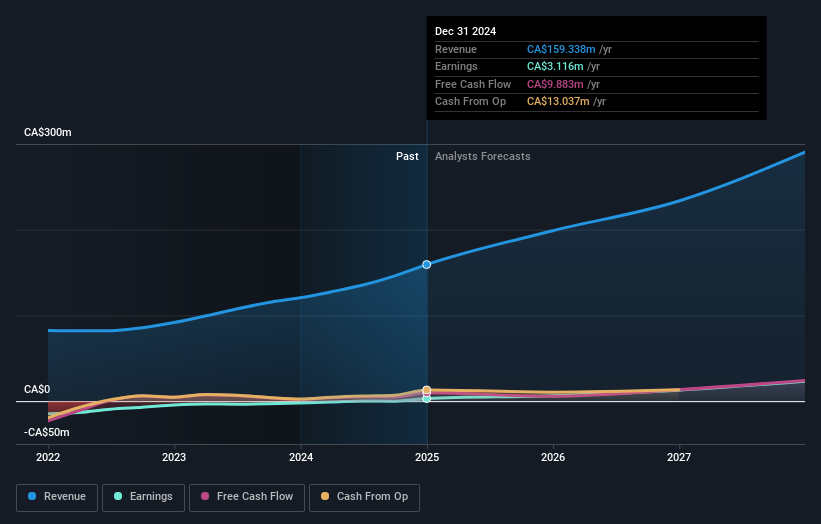

Overview: Kits Eyecare Ltd. operates a digital eyecare platform in the United States and Canada, with a market cap of CA$438.72 million.

Operations: The company's revenue primarily comes from the sale of eyewear products, totaling CA$193.40 million.

Insider Ownership: 23%

Revenue Growth Forecast: 20.1% p.a.

Kits Eyecare has seen substantial insider buying in the past three months, indicating confidence in its growth prospects. The company recently reported significant earnings growth, with Q3 2025 net income rising to C$1.94 million from C$0.132 million a year ago. Analysts expect Kits's earnings and revenue to grow significantly faster than the Canadian market over the next three years. Despite trading below estimated fair value, no substantial insider selling has been observed recently.

- Click here and access our complete growth analysis report to understand the dynamics of Kits Eyecare.

- Our comprehensive valuation report raises the possibility that Kits Eyecare is priced lower than what may be justified by its financials.

Robex Resources (TSXV:RBX)

Simply Wall St Growth Rating: ★★★★★★

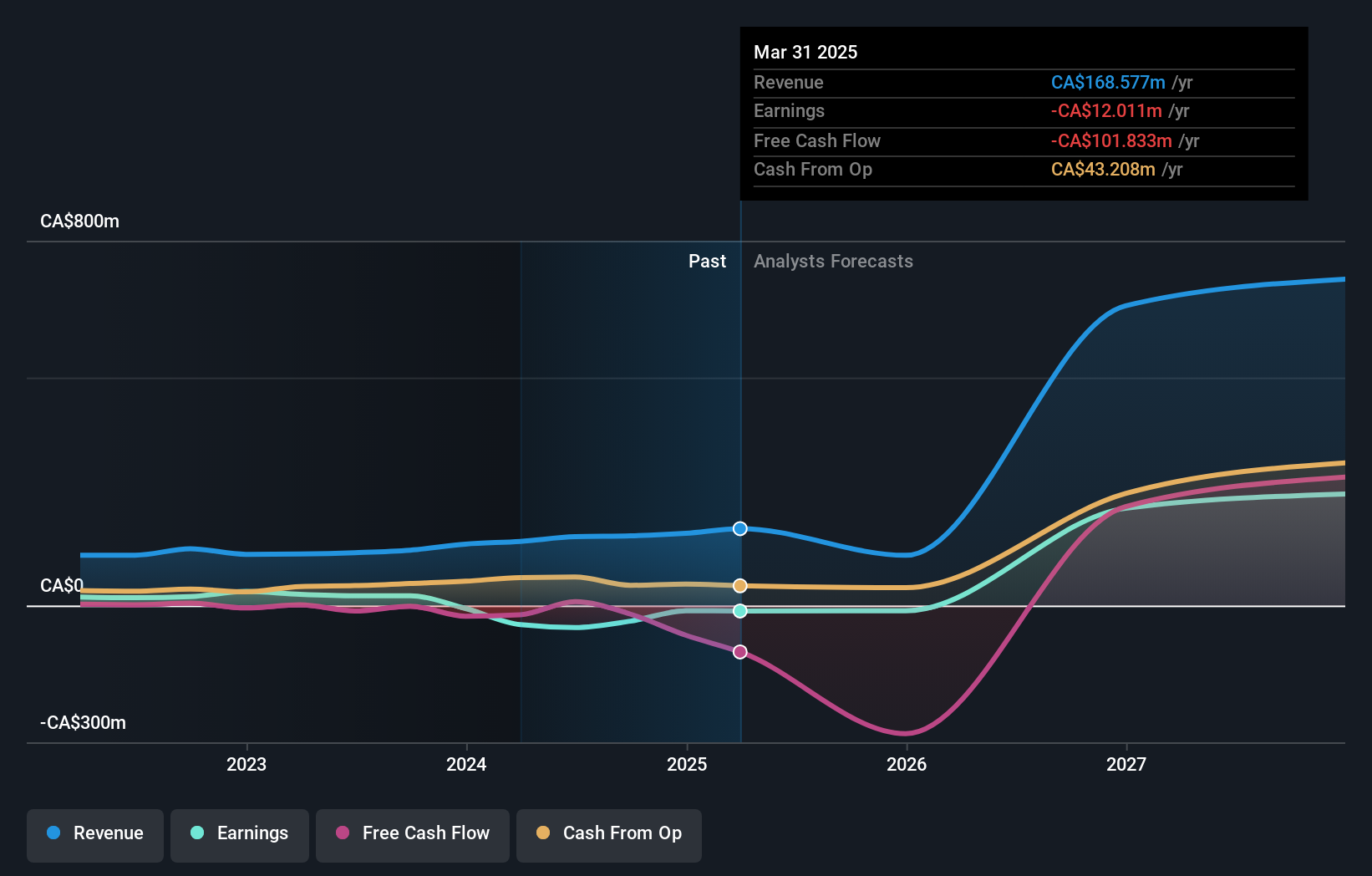

Overview: Robex Resources Inc. is involved in the exploration, development, and production of gold in West Africa with a market cap of CA$1.22 billion.

Operations: Robex Resources Inc. generates its revenue through activities related to gold exploration, development, and production in West Africa.

Insider Ownership: 20.6%

Revenue Growth Forecast: 59.2% p.a.

Robex Resources is poised for growth, with insiders substantially increasing their holdings over the past three months. The company is trading significantly below its estimated fair value and forecasts show it will achieve profitability within three years, with earnings expected to grow nearly 98% annually. Despite a recent net loss of C$17.79 million in Q3 2025, Robex's Kiniero Gold Project remains on track for production, supported by a merger with Predictive Discovery valued at approximately C$880 million.

- Click to explore a detailed breakdown of our findings in Robex Resources' earnings growth report.

- Our expertly prepared valuation report Robex Resources implies its share price may be lower than expected.

WELL Health Technologies (TSX:WELL)

Simply Wall St Growth Rating: ★★★★☆☆

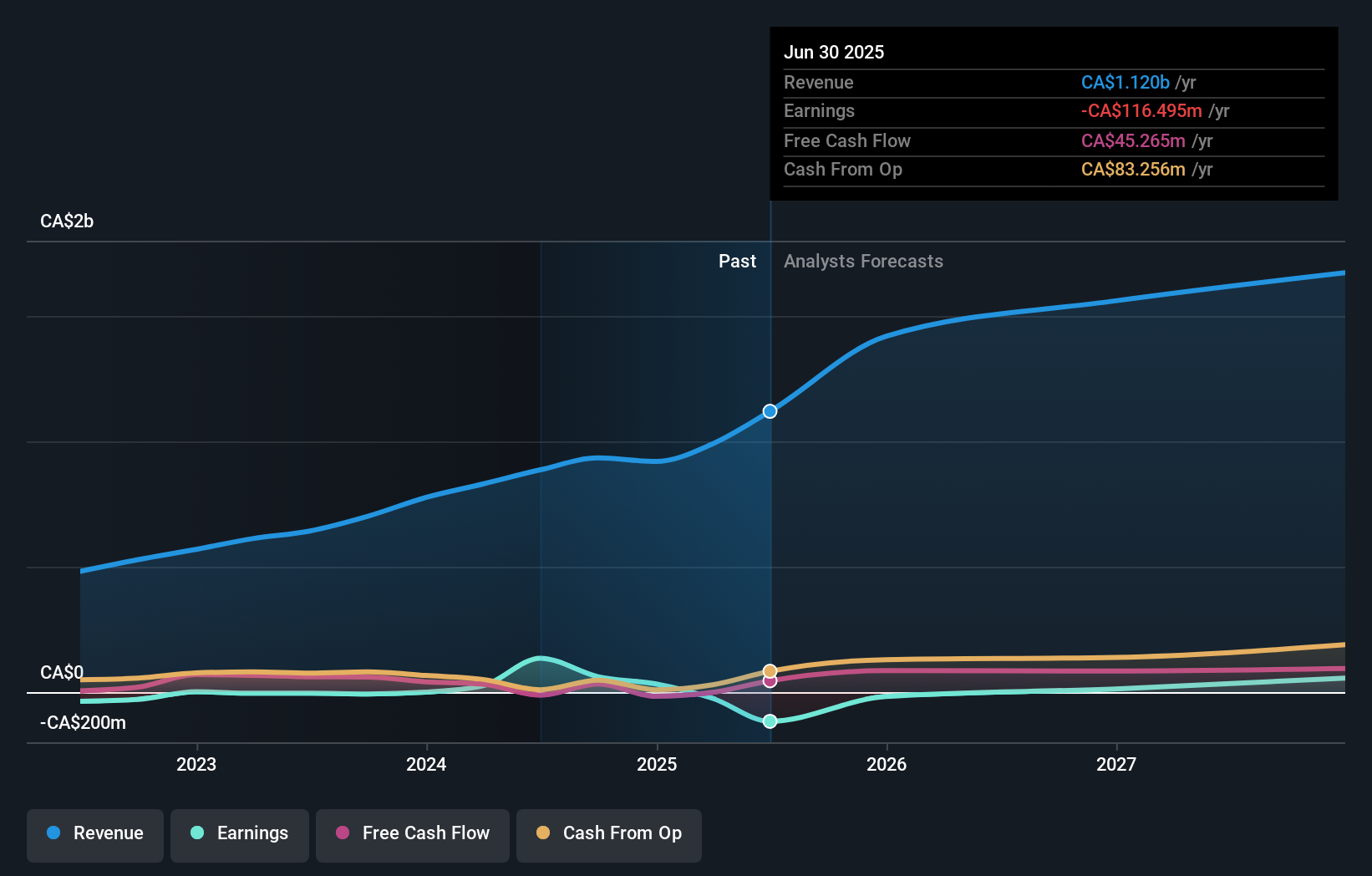

Overview: WELL Health Technologies Corp. is a digital healthcare company focused on serving practitioners in Canada, the United States, and internationally, with a market cap of approximately CA$992.68 million.

Operations: The company's revenue segments include CA$85.16 million from SaaS and Technology Services, CA$253.13 million from Canadian Patient Services - Primary WMC, CA$160.98 million from Canadian Patient Services - Specialized WDC, CA$116.57 million from WELL Health USA Patient Services - Primary WISP, CA$126.10 million from WELL Health USA Patient Services - Primary Circle Medical, and CA$250.86 million and CA$190.80 million respectively from WELL Health USA Patient Services - Specialized CRH Medical and Provider Staffing.

Insider Ownership: 22.6%

Revenue Growth Forecast: 11.6% p.a.

WELL Health Technologies shows strong growth potential, with revenue forecast to grow faster than the Canadian market at 11.6% annually. Insiders have increased their holdings recently, and the company trades at a substantial discount to its estimated fair value. WELL is expected to achieve profitability within three years, supported by strategic alliances like the recent partnership with HEALWELL AI Inc., which enhances clinical research capabilities and focuses on high-growth AI initiatives in healthcare.

- Navigate through the intricacies of WELL Health Technologies with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that WELL Health Technologies is trading behind its estimated value.

Where To Now?

- Click through to start exploring the rest of the 42 Fast Growing TSX Companies With High Insider Ownership now.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kits Eyecare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KITS

Kits Eyecare

Operates a digital eyecare platform in the United States and Canada.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives