- Canada

- /

- Metals and Mining

- /

- TSXV:CKG

American Pacific Mining And 2 Other TSX Penny Stocks To Watch

Reviewed by Simply Wall St

The Canadian market has shown resilience, with a surprising jobs report in October that added 66,000 positions and reduced the unemployment rate to 6.9%, even as global markets experience volatility due to AI valuation concerns. In such fluctuating times, identifying stocks with solid financials and growth potential becomes crucial for investors seeking stability and opportunity. Although the term "penny stocks" may seem outdated, these smaller or newer companies can still offer significant value; we will explore three examples that stand out for their financial strength and potential for long-term gains.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.15 | CA$57.39M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.03 | CA$212.58M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.45 | CA$3.43M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.17 | CA$765.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.09 | CA$21.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.25 | CA$958.27M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.93 | CA$142.11M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.14 | CA$201.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.77 | CA$9.58M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 411 stocks from our TSX Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

American Pacific Mining (CNSX:USGD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: American Pacific Mining Corp. focuses on the exploration and development of precious and base metals in the Western United States, with a market cap of CA$44.91 million.

Operations: American Pacific Mining Corp. has not reported any revenue segments.

Market Cap: CA$44.91M

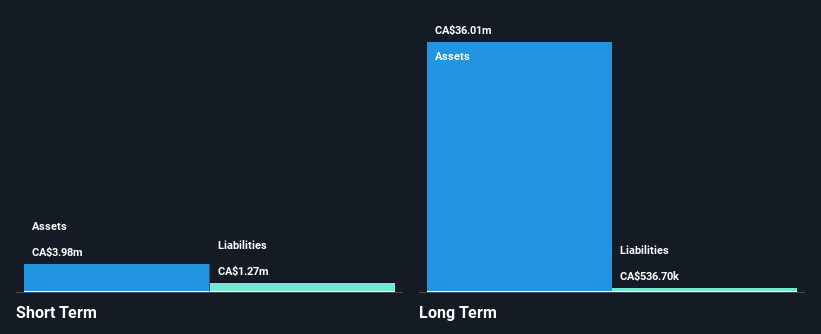

American Pacific Mining Corp., with a market cap of CA$44.91 million, is a pre-revenue company engaged in exploring precious and base metals in the Western U.S. The strategic focus on its Palmer VMS Project highlights its potential role in addressing the U.S.'s barite supply deficit, crucial for oil and gas drilling. Recent developments include Phase II drill targets at the Madison Copper-Gold Project, aiming to expand high-grade copper-gold skarn mineralization. Despite reporting net losses, American Pacific remains debt-free with short-term assets exceeding liabilities, providing some financial stability as exploration efforts continue.

- Get an in-depth perspective on American Pacific Mining's performance by reading our balance sheet health report here.

- Review our historical performance report to gain insights into American Pacific Mining's track record.

Chesapeake Gold (TSXV:CKG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Chesapeake Gold Corp. is a mineral exploration and evaluation company that focuses on acquiring, evaluating, and developing precious metal deposits in North and Central America, with a market cap of CA$173.03 million.

Operations: Chesapeake Gold Corp. has not reported any revenue segments.

Market Cap: CA$173.03M

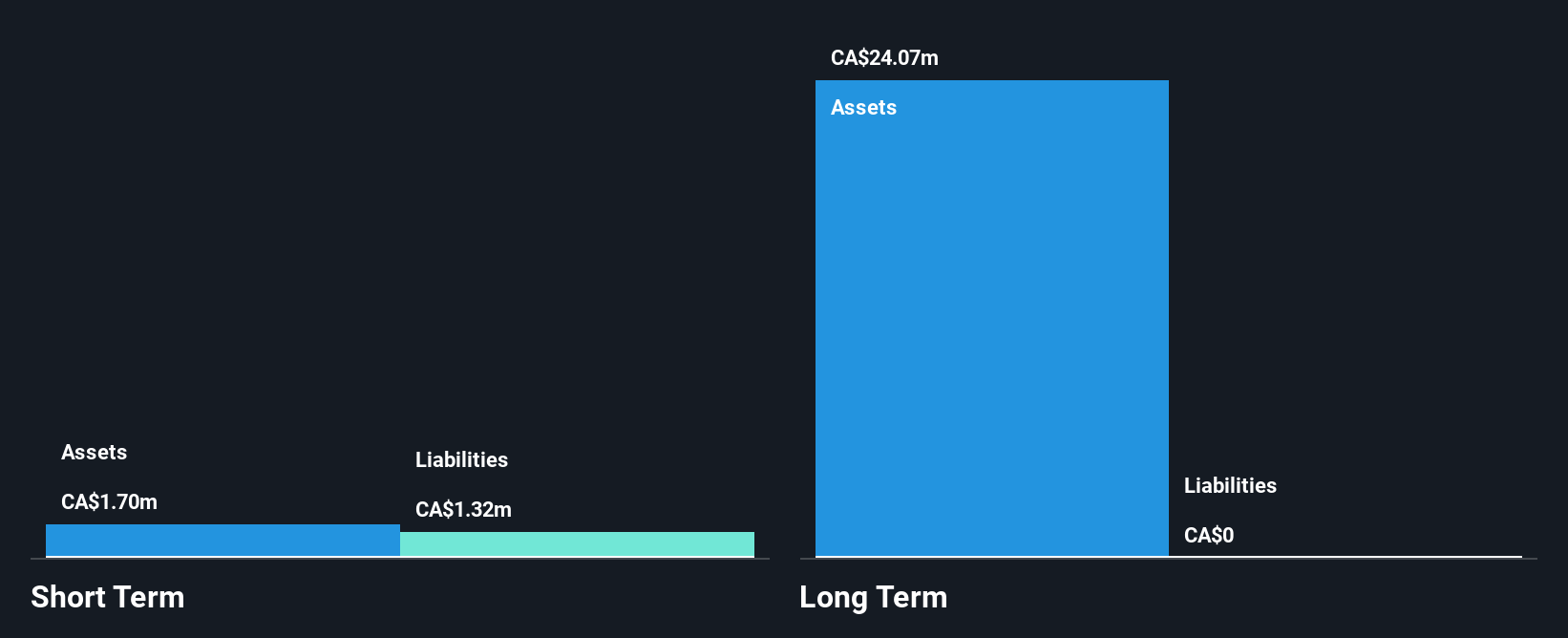

Chesapeake Gold Corp., with a market cap of CA$173.03 million, is pre-revenue and focuses on developing precious metal deposits in North and Central America. Recent developments include an extended exploration agreement for the Metates property in Mexico until 2030, highlighting its commitment to long-term growth. The company is advancing proprietary sulphide leach technology with promising test results that could enhance value generation. Despite being unprofitable, Chesapeake remains debt-free with sufficient cash runway for over a year. Its short-term assets exceed liabilities, providing some financial stability amidst high share price volatility and industry challenges.

- Take a closer look at Chesapeake Gold's potential here in our financial health report.

- Learn about Chesapeake Gold's historical performance here.

Namibia Critical Metals (TSXV:NMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Namibia Critical Metals Inc. is involved in the acquisition, exploration, development, and evaluation of critical metals properties in Namibia, with a market cap of CA$53.27 million.

Operations: No revenue segments are reported for the company.

Market Cap: CA$53.27M

Namibia Critical Metals Inc., with a market cap of CA$53.27 million, is pre-revenue and focused on critical metals exploration in Namibia. The company has no long-term liabilities and remains debt-free, which can be appealing to risk-tolerant investors seeking exposure to the mining sector. Despite being unprofitable, it has reduced losses by 16.7% annually over five years and maintains a cash runway for more than a year if free cash flow growth persists. Recent earnings reports show increased net losses compared to last year, while its share price remains highly volatile over recent months.

- Unlock comprehensive insights into our analysis of Namibia Critical Metals stock in this financial health report.

- Gain insights into Namibia Critical Metals' historical outcomes by reviewing our past performance report.

Summing It All Up

- Navigate through the entire inventory of 411 TSX Penny Stocks here.

- Ready For A Different Approach? AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CKG

Chesapeake Gold

A mineral exploration and evaluation company, focuses on acquisition, evaluation, and development of precious metal deposits in North and Central America.

Flawless balance sheet with low risk.

Market Insights

Community Narratives