- Canada

- /

- Metals and Mining

- /

- TSXV:NAM

Discover June 2025's TSX Penny Stock Highlights

Reviewed by Simply Wall St

The Canadian market has been navigating a complex landscape, with recent trade negotiations and economic indicators creating both opportunities and challenges for investors. In this context, penny stocks—often representing smaller or newer companies—can offer intriguing possibilities due to their affordability and growth potential. While the term "penny stocks" may seem outdated, these investments remain relevant as they can combine financial strength with the chance for significant returns.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.60 | CA$60.69M | ✅ 3 ⚠️ 3 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.67 | CA$612.77M | ✅ 3 ⚠️ 4 View Analysis > |

| illumin Holdings (TSX:ILLM) | CA$1.82 | CA$93.91M | ✅ 4 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.025 | CA$2M | ✅ 2 ⚠️ 3 View Analysis > |

| Findev (TSXV:FDI) | CA$0.425 | CA$12.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.76 | CA$505.63M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.00 | CA$19.82M | ✅ 2 ⚠️ 4 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.10 | CA$157.34M | ✅ 1 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.85 | CA$177.41M | ✅ 3 ⚠️ 1 View Analysis > |

| McChip Resources (TSXV:MCS) | CA$1.10 | CA$6.28M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 455 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Critical Elements Lithium (TSXV:CRE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Critical Elements Lithium Corporation focuses on acquiring, exploring, and developing mining properties in Canada, with a market cap of CA$83.87 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$83.87M

Critical Elements Lithium Corporation, with a market cap of CA$83.87 million, is pre-revenue but has recently turned profitable, reporting a net income of CA$7.79 million for Q2 2025. The company completed a significant VTEM survey on its Nemaska Belt properties to identify high-priority drill targets for potential Nickel-Copper-PGE and lithium mineralization. With no debt and short-term assets exceeding liabilities, the financial position is stable. The management team is experienced with an average tenure of over eight years, and the stock trades at a favorable price-to-earnings ratio compared to the Canadian market.

- Take a closer look at Critical Elements Lithium's potential here in our financial health report.

- Evaluate Critical Elements Lithium's prospects by accessing our earnings growth report.

New Age Metals (TSXV:NAM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: New Age Metals Inc. is a mineral exploration company focused on acquiring, exploring, and developing platinum group metals, precious, and base metals properties in Canada and the United States with a market cap of CA$15.56 million.

Operations: New Age Metals Inc. has not reported any revenue segments.

Market Cap: CA$15.56M

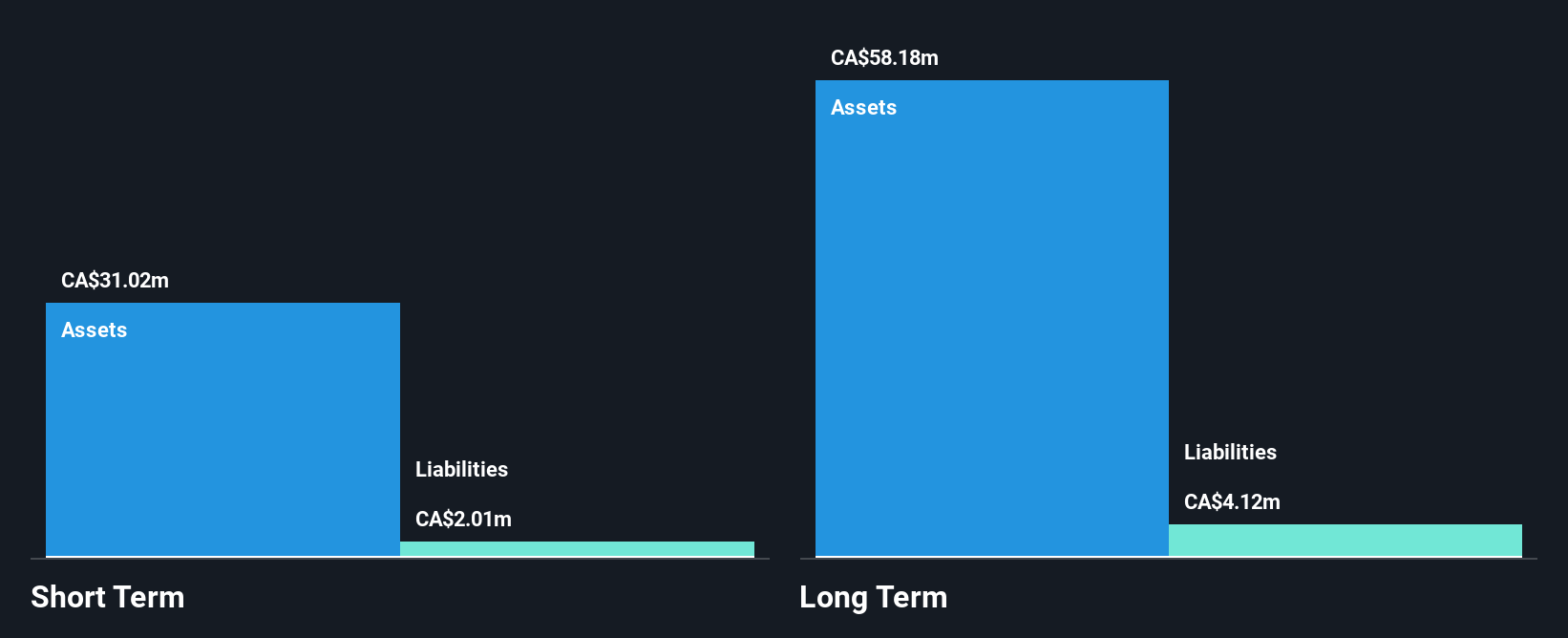

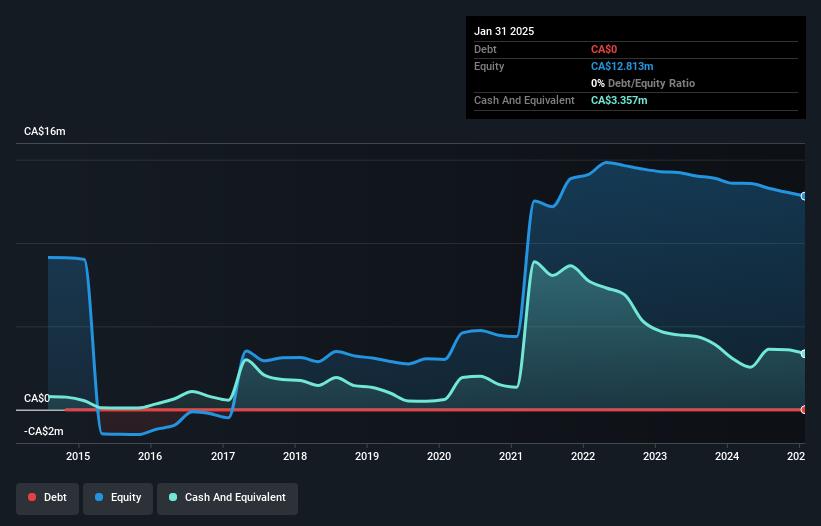

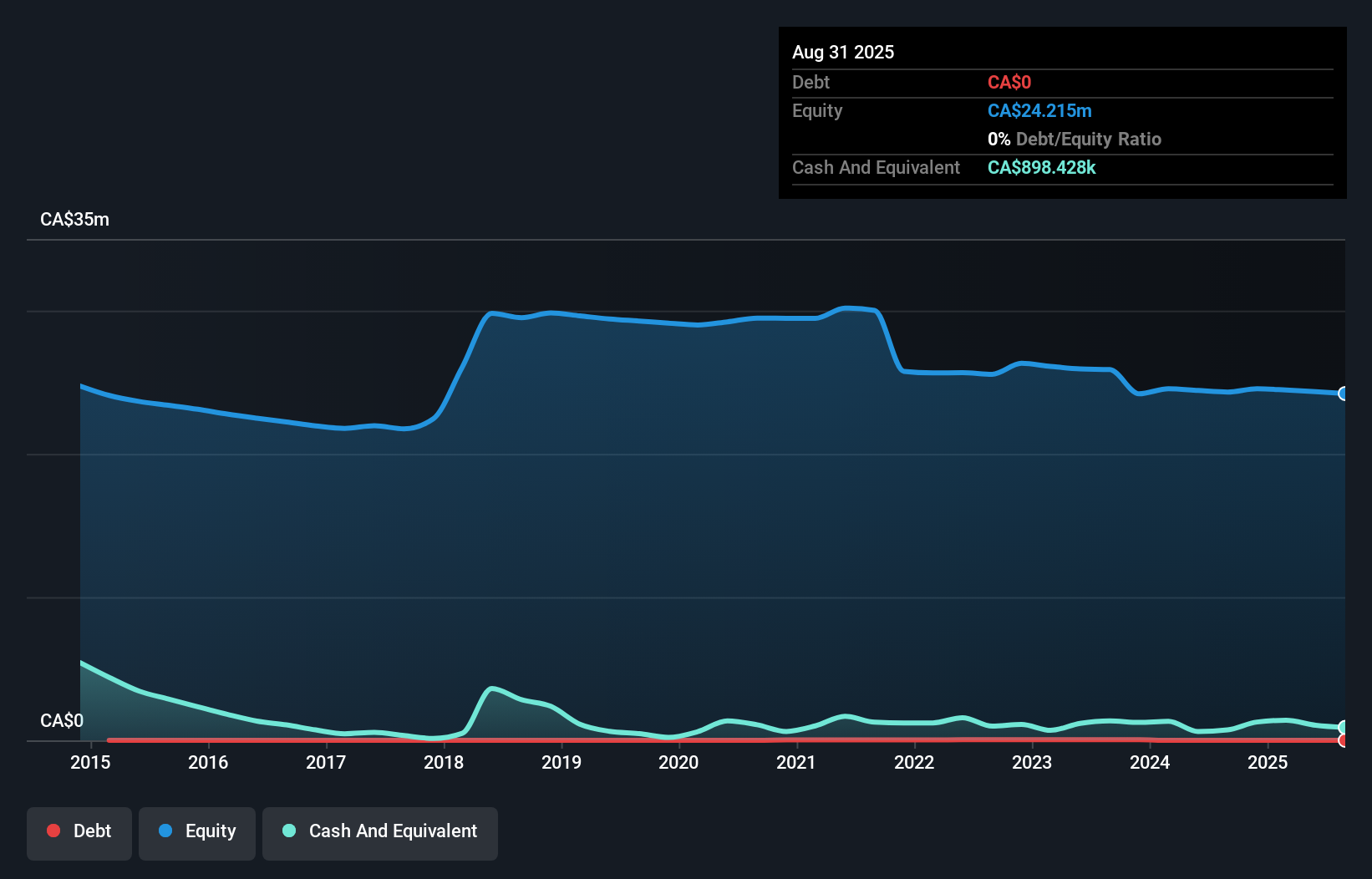

New Age Metals Inc., with a market cap of CA$15.56 million, is pre-revenue and focuses on mineral exploration in Canada and the U.S. The company has initiated its 2025 exploration program on gold-antimony properties in Newfoundland, supported by a Letter of Acceptance from the local government. This two-phase program involves initial prospecting followed by detailed sampling and drilling activities. NAM's financial stability is bolstered by sufficient cash runway for over three years without debt, though it remains unprofitable with increased losses over five years. The management team is seasoned, averaging 8.6 years in tenure.

- Navigate through the intricacies of New Age Metals with our comprehensive balance sheet health report here.

- Gain insights into New Age Metals' past trends and performance with our report on the company's historical track record.

Namibia Critical Metals (TSXV:NMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Namibia Critical Metals Inc. focuses on acquiring, exploring, developing, and evaluating a diverse range of critical metals properties in Namibia, with a market cap of CA$16.34 million.

Operations: No revenue segments are reported for the company.

Market Cap: CA$16.34M

Namibia Critical Metals Inc., with a market cap of CA$16.34 million, is pre-revenue and focuses on critical metals in Namibia. The company reported a reduced net loss for Q1 2025 compared to the previous year, indicating some progress in managing expenses despite ongoing unprofitability. Its financial position is supported by short-term assets exceeding liabilities and no long-term debt, providing a stable cash runway for over three years based on current free cash flow. While its share price remains highly volatile, management and board experience contribute positively to strategic direction without recent shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in Namibia Critical Metals' financial health report.

- Gain insights into Namibia Critical Metals' historical outcomes by reviewing our past performance report.

Make It Happen

- Click here to access our complete index of 455 TSX Penny Stocks.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Age Metals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NAM

New Age Metals

Acquires, explores, and develops platinum group metals (PGMs), precious metals, base metals, and green metals lithium in Canada and the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives