The Canadian market has been closely monitoring the evolving business models of mega-cap tech companies, particularly their shift towards more asset-heavy investments in data centers and AI infrastructure. While these trends are noteworthy, investors might find value in diversifying their portfolios to include sectors beyond technology. Penny stocks, though a somewhat outdated term, continue to offer intriguing opportunities for growth by focusing on smaller or newer companies with strong balance sheets and solid fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.10 | CA$51.82M | ✅ 3 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.73 | CA$176.31M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.26M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.33 | CA$48.82M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.19 | CA$765.09M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$0.94 | CA$22.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.20 | CA$945.72M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.85 | CA$145.67M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.20 | CA$207.39M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$10.23M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 412 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Kingsmen Resources (TSXV:KNG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kingsmen Resources Ltd. is a junior mineral exploration company focused on acquiring and exploring mineral properties, with a market cap of CA$42.65 million.

Operations: Currently, there are no reported revenue segments for Kingsmen Resources Ltd.

Market Cap: CA$42.65M

Kingsmen Resources Ltd., with a market cap of CA$42.65 million, is a pre-revenue junior mineral exploration company focusing on projects in Mexico's Parral mining district. Recent activities include completing a 12-hole drill program at the Las Coloradas silver project, revealing promising mineralization with significant silver and gold values. The company's acquisition of the Almoloya Gold/Silver project enhances its exploration potential by consolidating historically fragmented claims into a single package. A recent private placement raised CA$3 million to support these initiatives. Despite no debt and experienced management, Kingsmen remains unprofitable with increasing losses over five years.

- Get an in-depth perspective on Kingsmen Resources' performance by reading our balance sheet health report here.

- Assess Kingsmen Resources' previous results with our detailed historical performance reports.

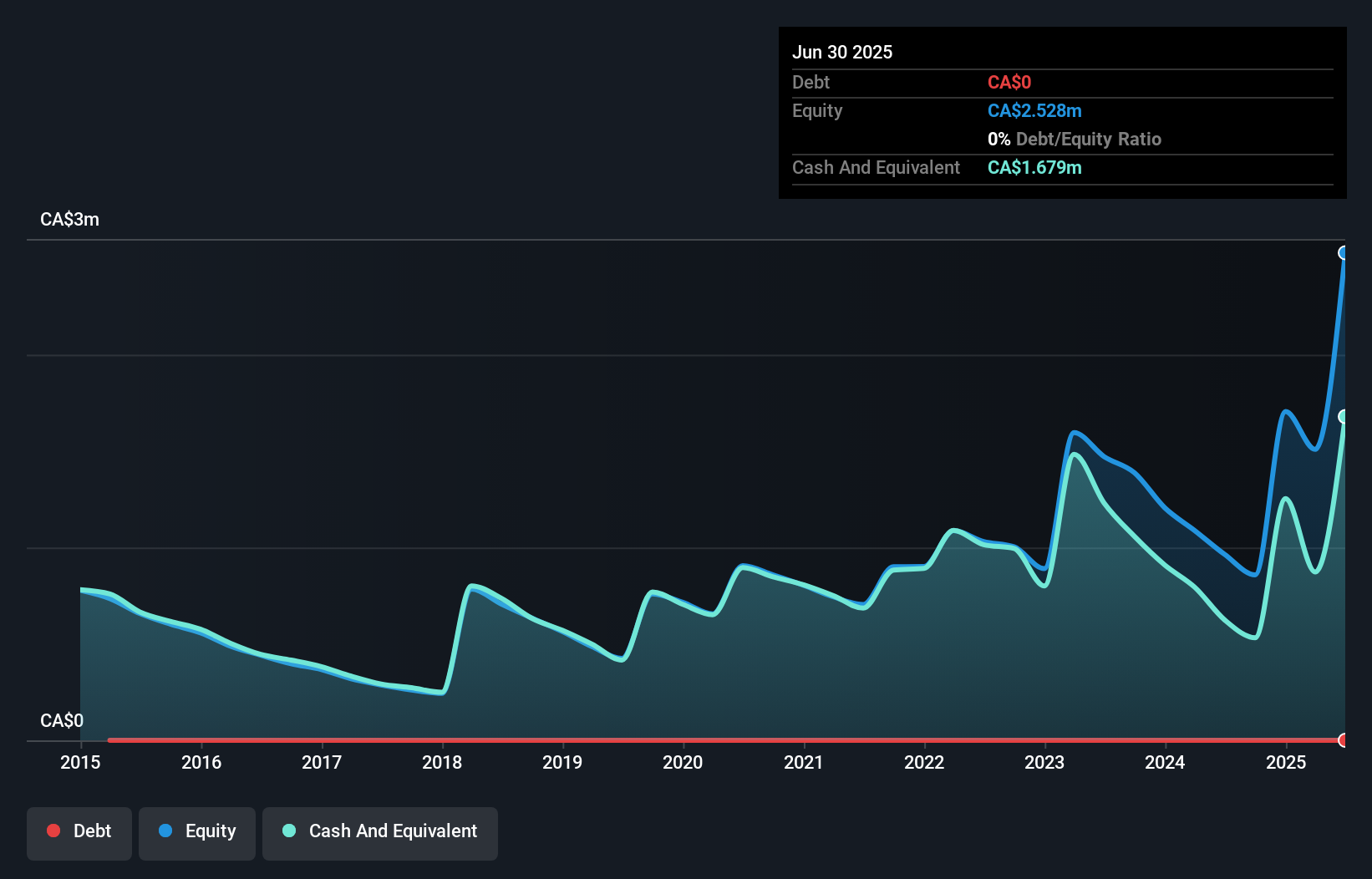

NexgenRx (TSXV:NXG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NexgenRx Inc. operates in Canada, providing administration, adjudication, and payment services for drug, dental, and other extended health-care claims for beneficiaries of health benefit plans underwritten by its customers, with a market cap of CA$28.45 million.

Operations: The company generates revenue from benefits administration services amounting to CA$17.17 million.

Market Cap: CA$28.45M

NexgenRx Inc., with a market cap of CA$28.45 million, has recently achieved profitability after years of declining earnings, marking a significant turnaround. The company is debt-free, with short-term assets comfortably exceeding both its short and long-term liabilities. Despite having a low return on equity at 12.4%, NexgenRx benefits from high-quality earnings and an experienced management team averaging 6.5 years in tenure. While the dividend track record remains unstable, the absence of shareholder dilution over the past year adds stability to its financial profile amidst fluctuating profit growth rates in the insurance industry context.

- Navigate through the intricacies of NexgenRx with our comprehensive balance sheet health report here.

- Learn about NexgenRx's historical performance here.

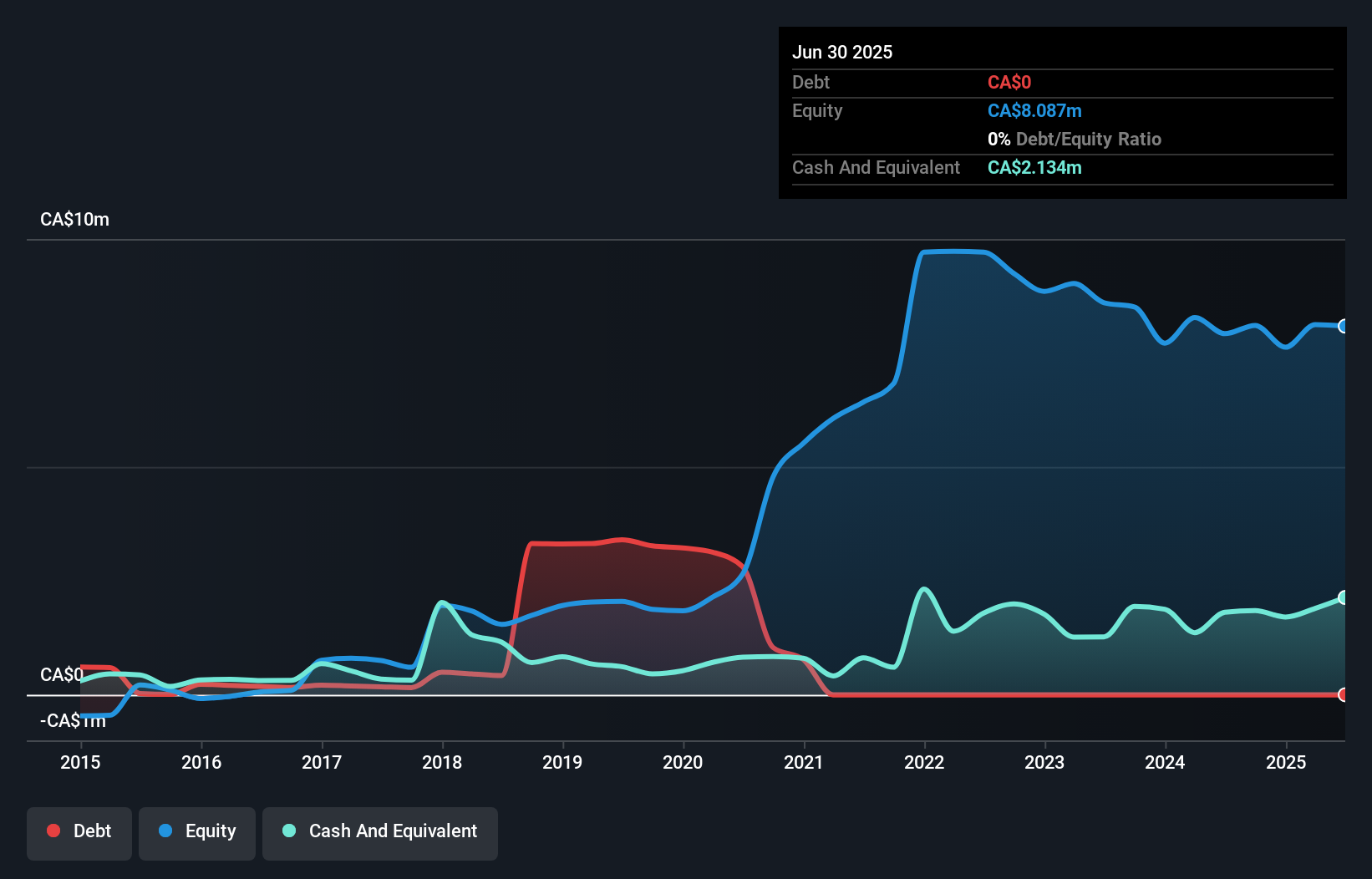

ROK Resources (TSXV:ROK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ROK Resources Inc. is an independent oil and gas company operating in Canada with a market cap of CA$48.99 million.

Operations: ROK Resources Inc. has not reported any specific revenue segments.

Market Cap: CA$49M

ROK Resources Inc., with a market cap of CA$48.99 million, is navigating challenges as it transitions through financial turbulence. Despite being unprofitable and experiencing increased losses over the past five years, ROK maintains a debt-free status and has a cash runway exceeding three years due to positive free cash flow. Recent earnings reveal declining revenue and net losses compared to last year, highlighting operational hurdles. However, an acquisition agreement by Blue Alaska Oil Trading LLC for CA$52 million could reshape its trajectory, pending regulatory and shareholder approvals expected by Q1 2026. The seasoned management team bolsters strategic direction amid these developments.

- Click to explore a detailed breakdown of our findings in ROK Resources' financial health report.

- Learn about ROK Resources' future growth trajectory here.

Taking Advantage

- Take a closer look at our TSX Penny Stocks list of 412 companies by clicking here.

- Contemplating Other Strategies? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NexgenRx might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:NXG

NexgenRx

NexgenRx Inc. administers, adjudicates, and pays drug, dental, and other extended health-care claims for the beneficiaries of health benefit plans underwritten by its customers in Canada.

Flawless balance sheet second-rate dividend payer.

Market Insights

Community Narratives