- Canada

- /

- Metals and Mining

- /

- TSXV:AHR

TSX Penny Stocks Under CA$800M Market Cap: 3 Hidden Opportunities

Reviewed by Simply Wall St

As October closed with markets near record highs, investors are navigating a landscape shaped by central banks' cautious rate cuts and easing trade tensions between major economies. Amid these developments, penny stocks remain a compelling area of interest for those seeking opportunities beyond the mainstream market indices. Despite their somewhat outdated name, penny stocks often represent smaller or newer companies that can offer significant growth potential when backed by strong financials.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.59 | CA$65.48M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$22.73M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.37 | CA$238.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.40 | CA$3.34M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.375 | CA$56.33M | ✅ 2 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.06 | CA$705.22M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.13 | CA$22.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.94 | CA$149.22M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.13 | CA$201.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.75 | CA$9.33M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our TSX Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Amarc Resources (TSXV:AHR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Amarc Resources Ltd. focuses on the acquisition, exploration, and development of mineral properties in Canada and has a market cap of CA$250.11 million.

Operations: Amarc Resources Ltd. does not report specific revenue segments, as it primarily engages in the acquisition, exploration, and development of mineral properties in Canada.

Market Cap: CA$250.11M

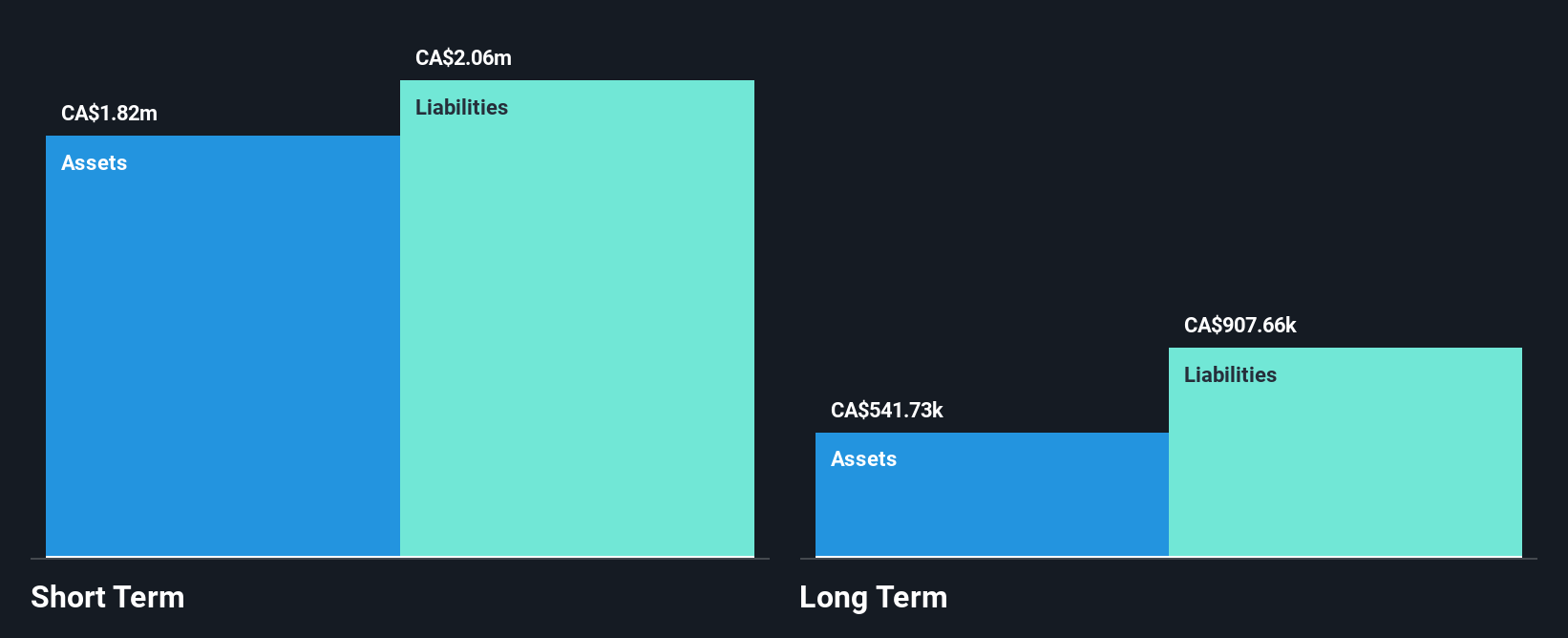

Amarc Resources Ltd. is pre-revenue, with less than US$1m in revenue, and has shown recent positive earnings for the second quarter of 2025, reporting a net income of CA$0.65 million compared to a loss last year. Despite being unprofitable over the past five years with losses increasing at 48.4% annually, Amarc's financial position has improved from negative shareholder equity to positive. The company benefits from sufficient cash runway for over three years and no long-term liabilities. Recent successful drilling at its JOY District highlights potential expansion opportunities funded by Freeport-McMoRan Mineral Properties Canada Inc., enhancing its exploration prospects.

- Jump into the full analysis health report here for a deeper understanding of Amarc Resources.

- Gain insights into Amarc Resources' historical outcomes by reviewing our past performance report.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Colonial Coal International Corp. focuses on acquiring, exploring, and developing coal properties in Canada with a market cap of CA$268.93 million.

Operations: Colonial Coal International Corp. has not reported any revenue segments.

Market Cap: CA$268.93M

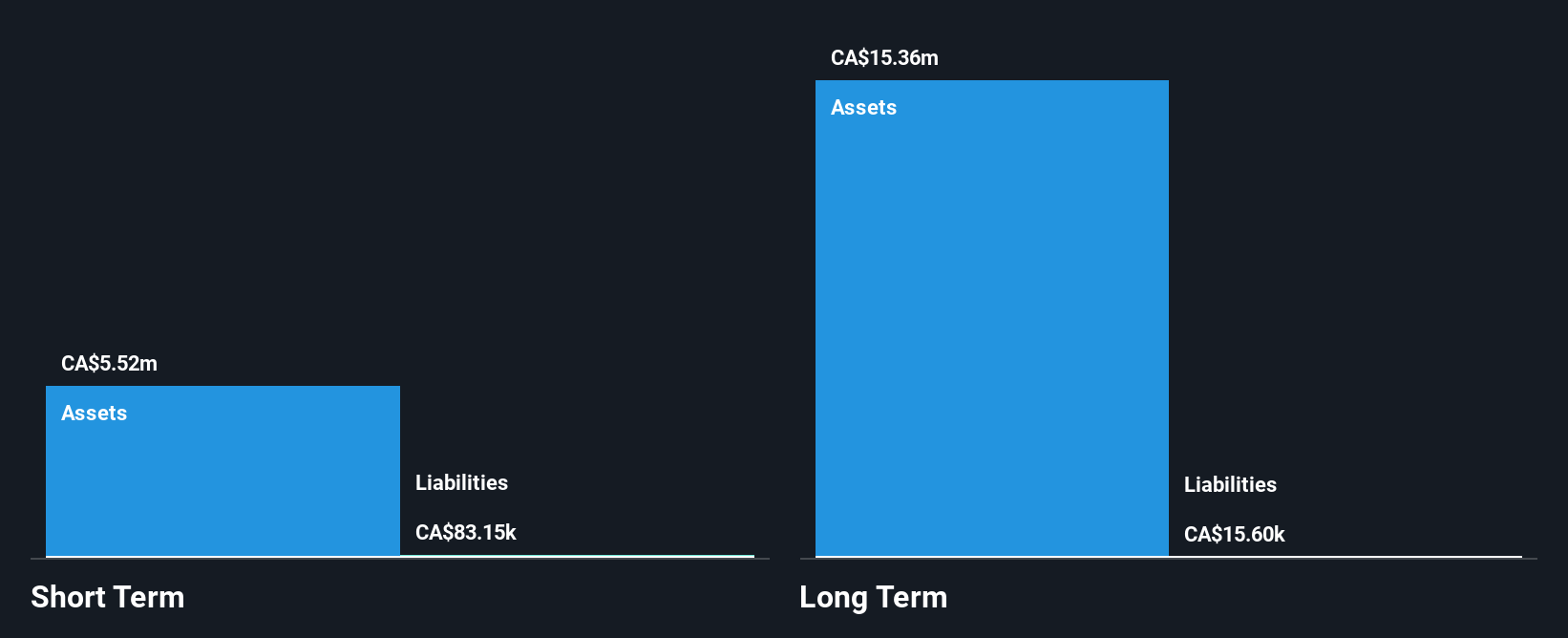

Colonial Coal International Corp. is pre-revenue, with less than US$1m in revenue, and reported a net loss of CA$7.12 million for the full year ending July 31, 2025, an increase from the previous year's CA$5.57 million loss. The company benefits from a seasoned management team and board of directors with average tenures of over 12 years. Despite being debt-free and having no long-term liabilities, Colonial Coal's earnings have declined by 22.2% annually over the past five years. However, it maintains sufficient cash runway for more than a year based on current free cash flow levels without significant shareholder dilution recently observed.

- Dive into the specifics of Colonial Coal International here with our thorough balance sheet health report.

- Examine Colonial Coal International's past performance report to understand how it has performed in prior years.

Santacruz Silver Mining (TSXV:SCZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Santacruz Silver Mining Ltd. is involved in the acquisition, exploration, development, production, and operation of mineral properties in Latin America and has a market cap of CA$727.12 million.

Operations: The company's revenue is derived from its operations at Porco ($40.12 million), Bolivar ($82.69 million), Zimapan ($90.00 million), SAN Lucas ($88.04 million), and the Caballo Blanco Group ($73.94 million).

Market Cap: CA$727.12M

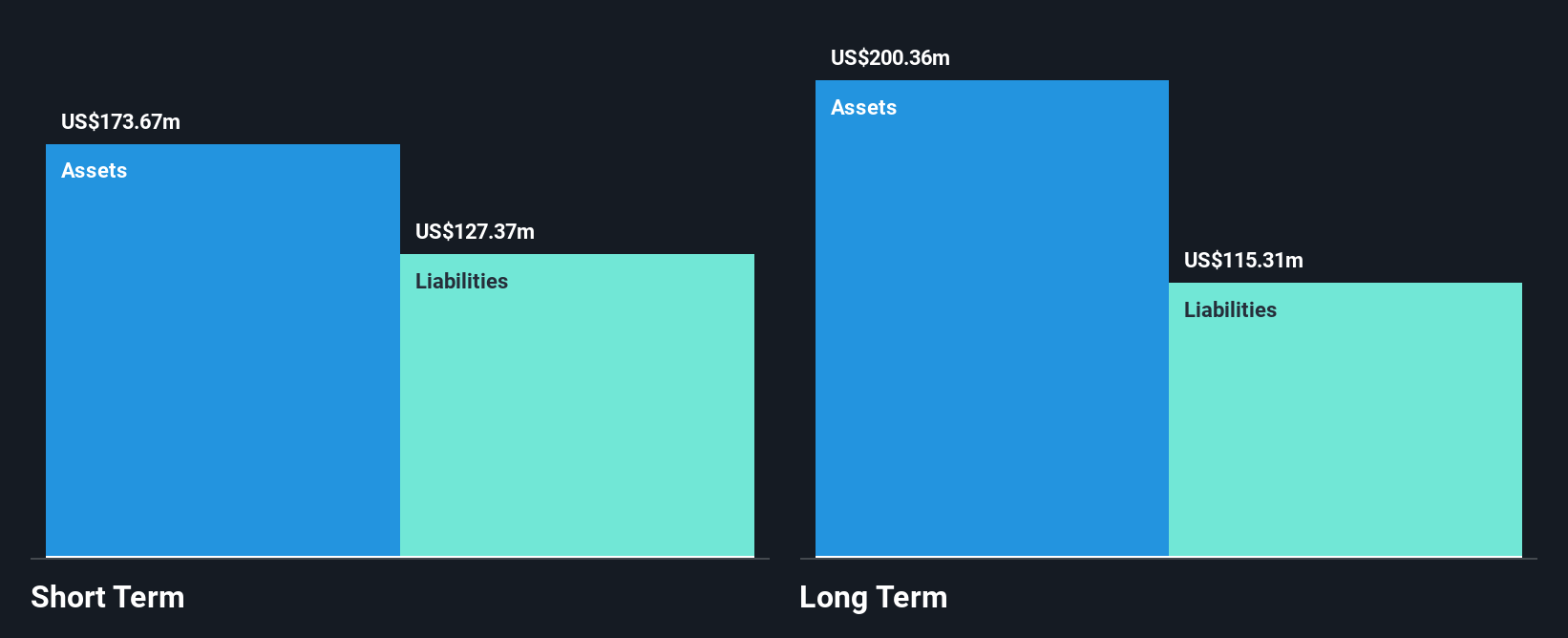

Santacruz Silver Mining Ltd. has demonstrated positive financial performance, with a net income of US$20.98 million for Q2 2025, up from US$1.45 million the previous year, and revenue growth to US$73.3 million in the same period. The company is advancing its Soracaya Project in Bolivia toward full production permitting, a strategic move to enhance its production base. Despite recent insider selling and negative earnings growth over the past year, Santacruz maintains strong liquidity with short-term assets exceeding liabilities and cash surpassing total debt levels, supported by high-quality earnings and robust interest coverage from EBIT at 72.9 times interest payments.

- Navigate through the intricacies of Santacruz Silver Mining with our comprehensive balance sheet health report here.

- Review our growth performance report to gain insights into Santacruz Silver Mining's future.

Seize The Opportunity

- Gain an insight into the universe of 410 TSX Penny Stocks by clicking here.

- Ready For A Different Approach? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:AHR

Amarc Resources

Engages in the acquisition, exploration, and development of mineral properties in Canada.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives