Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSXV:BCM

We Think Bear Creek Mining (CVE:BCM) Can Afford To Drive Business Growth

Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

Given this risk, we thought we'd take a look at whether Bear Creek Mining (CVE:BCM) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

View our latest analysis for Bear Creek Mining

Does Bear Creek Mining Have A Long Cash Runway?

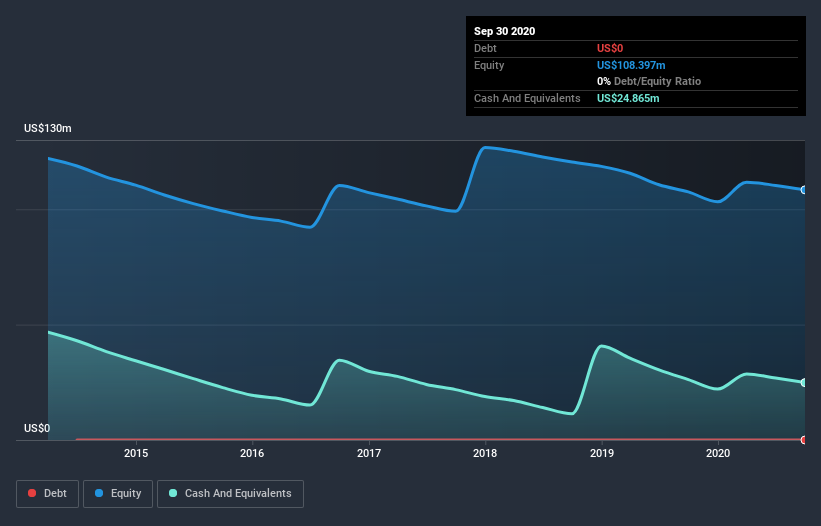

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. In September 2020, Bear Creek Mining had US$25m in cash, and was debt-free. In the last year, its cash burn was US$13m. That means it had a cash runway of around 23 months as of September 2020. While that cash runway isn't too concerning, sensible holders would be peering into the distance, and considering what happens if the company runs out of cash. The image below shows how its cash balance has been changing over the last few years.

How Easily Can Bear Creek Mining Raise Cash?

Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Since it has a market capitalisation of US$265m, Bear Creek Mining's US$13m in cash burn equates to about 4.9% of its market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Bear Creek Mining's Cash Burn A Worry?

Given it's an early stage company, we don't have a lot of data with which to judge Bear Creek Mining's cash burn. We would undoubtedly be more comfortable if it had reported some operating revenue. However, it is fair to say that its cash burn relative to its market cap gave us comfort. To put it simply, we think its cash burn situation is totally fine given it is still developing its business. Taking a deeper dive, we've spotted 3 warning signs for Bear Creek Mining you should be aware of, and 2 of them can't be ignored.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Bear Creek Mining, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether Bear Creek Mining is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:BCM

Bear Creek Mining

Engages in the acquisition, exploration, and development of precious and base metal properties in Peru and Mexico.

Fair value with weak fundamentals.