- Canada

- /

- Metals and Mining

- /

- TSXV:BCM

Little Excitement Around Bear Creek Mining Corporation's (CVE:BCM) Revenues As Shares Take 32% Pounding

The Bear Creek Mining Corporation (CVE:BCM) share price has fared very poorly over the last month, falling by a substantial 32%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 53% loss during that time.

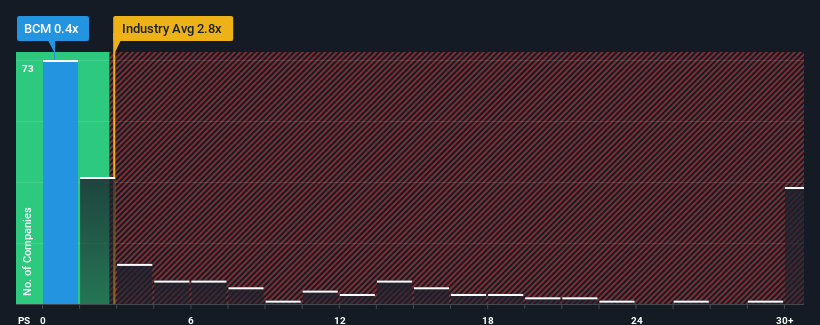

Since its price has dipped substantially, Bear Creek Mining may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 2.8x and even P/S higher than 17x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Bear Creek Mining

What Does Bear Creek Mining's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Bear Creek Mining has been relatively sluggish. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Bear Creek Mining will help you uncover what's on the horizon.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Bear Creek Mining's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 8.3%. However, due to its less than impressive performance prior to this period, revenue growth is practically non-existent over the last three years overall. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 5.5% per year as estimated by the only analyst watching the company. That's shaping up to be materially lower than the 25% per year growth forecast for the broader industry.

With this in consideration, its clear as to why Bear Creek Mining's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Bear Creek Mining's P/S

Bear Creek Mining's P/S looks about as weak as its stock price lately. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Bear Creek Mining maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

You should always think about risks. Case in point, we've spotted 5 warning signs for Bear Creek Mining you should be aware of, and 1 of them doesn't sit too well with us.

If you're unsure about the strength of Bear Creek Mining's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Bear Creek Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:BCM

Bear Creek Mining

Engages in the acquisition, exploration, and development of precious and base metal properties in Peru and Mexico.

Medium-low risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives