Stock Analysis

- Canada

- /

- Metals and Mining

- /

- TSXV:MJS

Discover 3 TSX Penny Stocks With Market Caps Under CA$90M

Reviewed by Simply Wall St

The Canadian market has shown a promising upward trend, rising 1.2% over the last week and 28% in the past year, with earnings expected to grow by 16% annually. In this context, identifying stocks with strong financials becomes crucial, especially for those looking at smaller or newer companies that may offer unique growth opportunities. While penny stocks might seem like an outdated term, they remain a relevant investment area; we will explore three such stocks that combine financial strength with potential for long-term success.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.68 | CA$611.71M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.15 | CA$5.18M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.35 | CA$313.96M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.34 | CA$116.65M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.75 | CA$298.44M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.31 | CA$233.67M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.035 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$29.82M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Li-Metal (CNSX:LIM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Li-Metal Corp. is involved in the development, production, and sale of metallic lithium metal and anode materials, with a market cap of CA$9.87 million.

Operations: The company's revenue comes entirely from its Batteries / Battery Systems segment, amounting to CA$0.16 million.

Market Cap: CA$9.87M

Li-Metal Corp., a pre-revenue company with a market cap of CA$9.87 million, has been facing challenges typical of penny stocks. The firm reported minimal sales of CA$0.03 million for the recent quarter, down from CA$0.18 million the previous year, and continues to operate at a net loss. Despite having short-term assets exceeding both its short and long-term liabilities, Li-Metal's cash runway is less than one year, indicating potential liquidity issues if current cash flow trends persist. Recent executive changes include appointing Keshav Kochhar as CEO following his successful sale of lithium technology assets to Arcadium Lithium plc.

- Jump into the full analysis health report here for a deeper understanding of Li-Metal.

- Review our historical performance report to gain insights into Li-Metal's track record.

Azimut Exploration (TSXV:AZM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Azimut Exploration Inc. is involved in the acquisition, exploration, and evaluation of mineral properties in Canada and has a market cap of CA$53.07 million.

Operations: The company's revenue segment is focused on the acquisition, exploration, and evaluation of exploration properties, generating CA$0.32 million.

Market Cap: CA$53.07M

Azimut Exploration Inc., with a market cap of CA$53.07 million, is a pre-revenue company focused on mineral exploration in Canada. Recent metallurgical tests on its Galinée Property have shown promising lithium recovery rates, with spodumene concentrates exceeding chemical-grade quality for hydrometallurgical processing. Despite being pre-revenue, Azimut's financial stability is supported by short-term assets surpassing liabilities and no debt burden. The company's strategic joint ventures and successful exploration initiatives highlight its potential within the emerging lithium district in Quebec's Eeyou Istchee James Bay region, although it remains subject to the inherent risks associated with early-stage mining ventures.

- Dive into the specifics of Azimut Exploration here with our thorough balance sheet health report.

- Explore historical data to track Azimut Exploration's performance over time in our past results report.

Majestic Gold (TSXV:MJS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Majestic Gold Corp. is a mining company engaged in the exploration, development, and operation of mining properties in China, Australia, and Canada with a market cap of CA$83.41 million.

Operations: The company's revenue is derived from its activities in exploration, development, and operation of mining properties, amounting to $60.08 million.

Market Cap: CA$83.41M

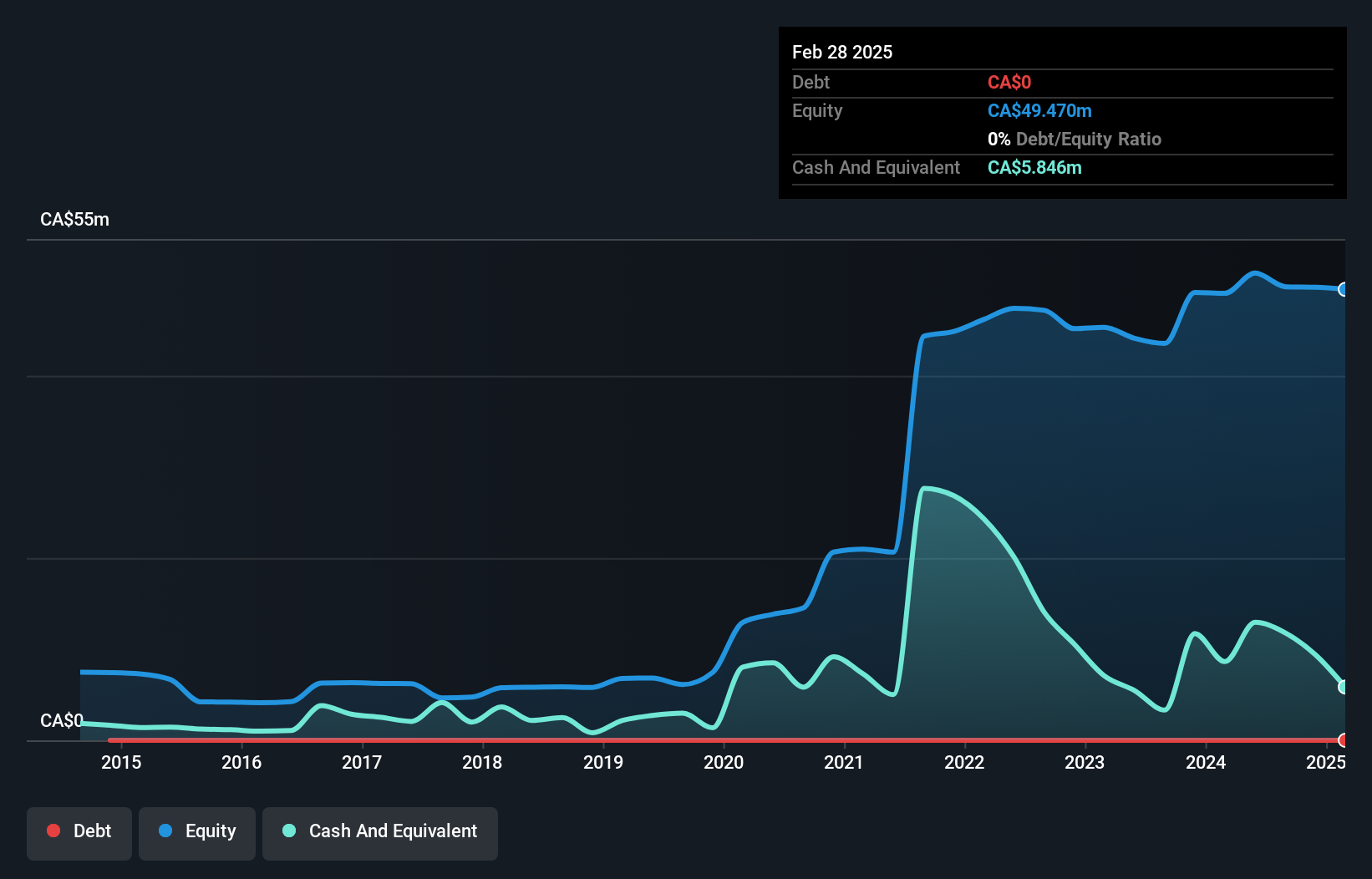

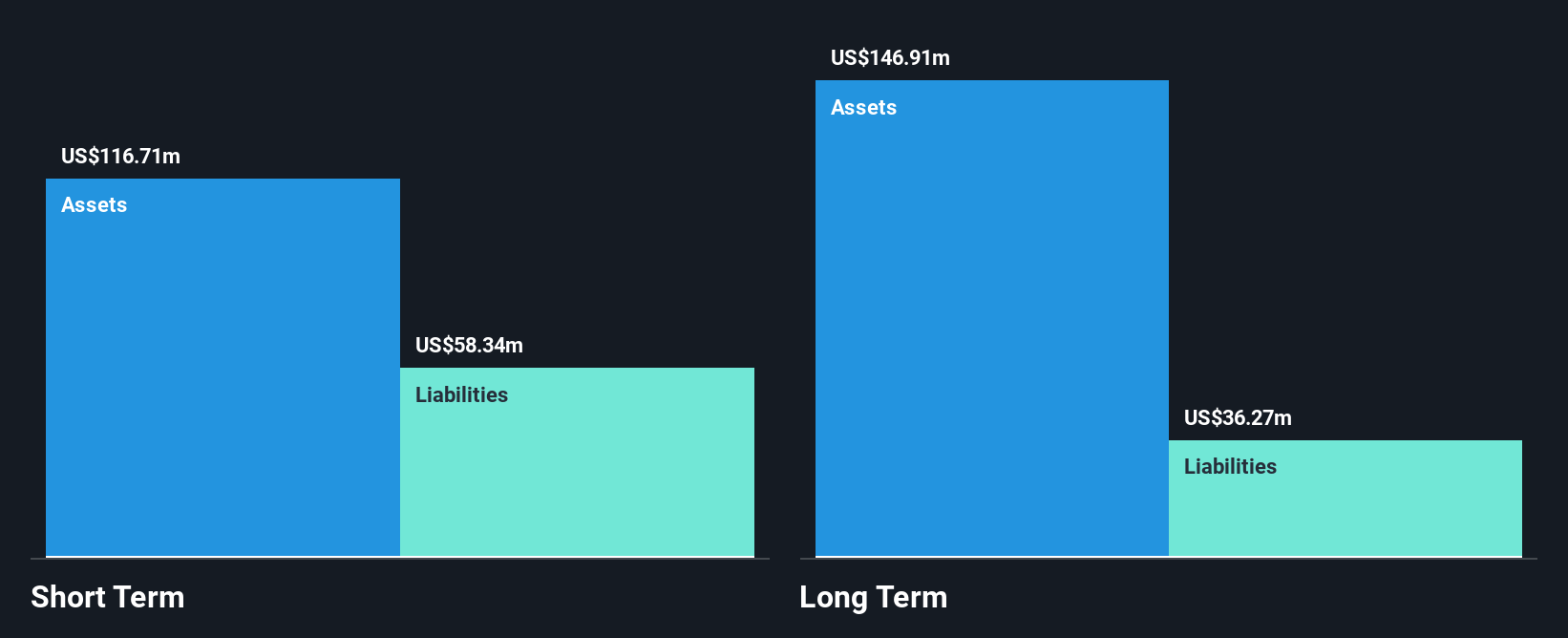

Majestic Gold Corp., with a market cap of CA$83.41 million, shows a solid financial position with short-term assets significantly exceeding liabilities and more cash than total debt. The company has maintained stable earnings growth over the past five years at 14% per annum, though recent growth was modest at 1.2%. Despite lower profit margins compared to last year, Majestic's net income improved in the latest quarter alongside increased sales. Its inclusion in the S&P/TSX Venture Composite Index marks a positive development, while consistent production guidance and dividend announcements reflect operational stability and shareholder returns focus.

- Click here and access our complete financial health analysis report to understand the dynamics of Majestic Gold.

- Assess Majestic Gold's previous results with our detailed historical performance reports.

Taking Advantage

- Click here to access our complete index of 947 TSX Penny Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:MJS

Majestic Gold

A mining company, focuses on exploration, development, and operation of mining properties in China, Australia, and Canada.