- Canada

- /

- Metals and Mining

- /

- TSXV:ATY

It's Unlikely That Atico Mining Corporation's (CVE:ATY) CEO Will See A Huge Pay Rise This Year

CEO Fernando Ganoza has done a decent job of delivering relatively good performance at Atico Mining Corporation (CVE:ATY) recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 15 June 2021. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Atico Mining

Comparing Atico Mining Corporation's CEO Compensation With the industry

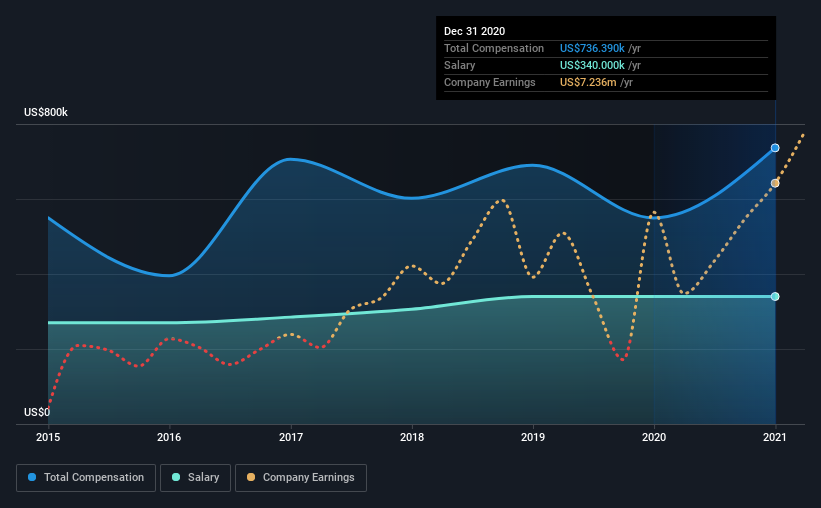

According to our data, Atico Mining Corporation has a market capitalization of CA$80m, and paid its CEO total annual compensation worth US$736k over the year to December 2020. That's a notable increase of 34% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at US$340k.

In comparison with other companies in the industry with market capitalizations under CA$242m, the reported median total CEO compensation was US$124k. Hence, we can conclude that Fernando Ganoza is remunerated higher than the industry median. Furthermore, Fernando Ganoza directly owns CA$1.2m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$340k | US$340k | 46% |

| Other | US$396k | US$209k | 54% |

| Total Compensation | US$736k | US$549k | 100% |

Talking in terms of the industry, salary represented approximately 93% of total compensation out of all the companies we analyzed, while other remuneration made up 7% of the pie. Atico Mining sets aside a smaller share of compensation for salary, in comparison to the overall industry. If total compensation is slanted towards non-salary benefits, it indicates that CEO pay is linked to company performance.

Atico Mining Corporation's Growth

Atico Mining Corporation's earnings per share (EPS) grew 46% per year over the last three years. It achieved revenue growth of 49% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Atico Mining Corporation Been A Good Investment?

Atico Mining Corporation has generated a total shareholder return of 16% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. We've identified 2 warning signs for Atico Mining that investors should be aware of in a dynamic business environment.

Switching gears from Atico Mining, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:ATY

Atico Mining

Engages in the acquisition, exploration, and development of copper and gold projects in Latin America.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives